Last week it nearly closed at the opening level. The price did not approach the MACD line on the weekly chart, and the MACD line moved lower, settling in the area where support is at 1.0410.

The price has lost a major thing - momentum. Now it will be harder to overcome the MACD line. Being able to do so will open the target level at 1.0205 (high on September 12). Anyway, the weekly candlestick is already moving above the MACD line, and the only thing that can stop the price from going up is the outcome of the Federal Reserve meeting.

On the daily chart, the divergence and its angle are still unclear. Either the divergence has formed, or the price will reach the target range at 1.0615/42, and the divergence will form along the less steep slope.

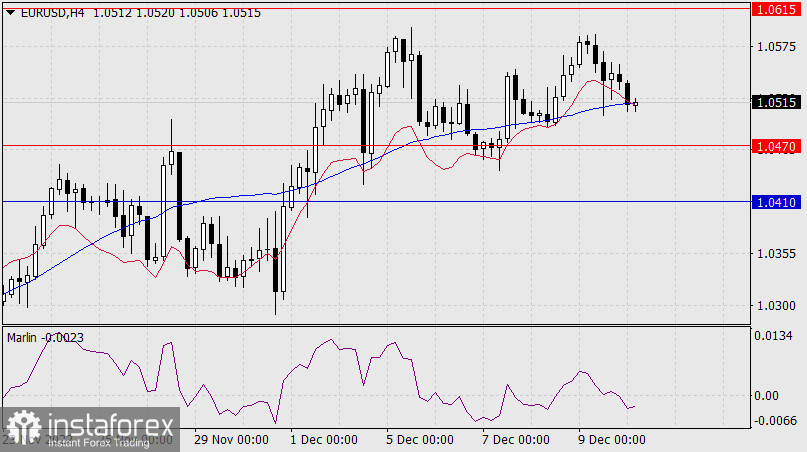

On the four-hour chart, the Marlin oscillator has penetrated into the bears' area. The price has crossed the area under the support of the MACD line and under the balance line (red sliding line). There is a high probability of a downward movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română