Even though neither the US nor the UK released any significant macroeconomic publications on Friday, the GBP/USD currency pair managed to increase at the end despite the lack of movement. Thus, the pound price has once again increased almost out of nowhere, which has even stopped surprising in recent weeks. The moving average, linear regression channels, and the Ichimoku indicator's lines on the 24-hour TF point upward. Technically speaking, the situation is clear-cut: there is an upward trend. But just as with the euro, we've been wondering for a while now: On what basis is the pound sterling increasing? Yes, there are many technical reasons, but what about the macroeconomic and fundamental ones? The response is the same as it was for the euro: essentially none. Although it has increased the rate for eight straight meetings, it might slow down in December, even though the current inflation rate does not favor this. In the UK, the consumer price index has long exceeded 10% and so far doesn't appear to be slowing down.

As a result, the BA and the ECB have no reason to slow down the rate hike pace. We are talking about tightening monetary policy by 5 to 5.5 percent in the United States to combat inflation. However, a more drastic tightening in Britain may be required because of Brexit and the pandemic, and the British economy does not feel as secure as the American one. As a result, there is a deadlock: The Bank of England cannot raise the interest rate continuously or by any amount.

There is a lot of "foundation" this week.

Reports on the UK's GDP and industrial production will be released to start a new week. Although these reports are not all that significant, a response might come as a result. The market might be distracted this week by central bank meetings and inflation reports, which are of higher priority. Because there will be no other events on Monday, the market may focus on these figures.

Tuesday will be a fascinating day as well. Data on unemployment and wages will be released in the UK, and the US will release its November inflation report, which may show another slowdown in consumer price growth to 7.3–7.6% y/y. When Britain releases its November inflation report on Wednesday, we can, at best, anticipate a slowdown of 0.1-0.2%. To 10.9–11.0 percent from the current 11.1%. As we can see, even if such a reduction occurs, it will not be sufficient to begin reducing the rate at which the key rate is increasing. The Fed meeting's outcomes and a press conference with Jerome Powell will be presented in the evening.

Results of the Bank of England meeting, at which the rate may also increase by 0.5% to 3.5%, will be announced on Thursday. Retail sales, unemployment benefit claims, and industrial production are all examples of American activity. Retail sales and business activity indices for the manufacturing and service sectors were released Friday in Britain and the US, respectively. As you can see, this week is expected to be very volatile and trending because we anticipate a sufficient number of events and important events each day. However, the market's response to particularly significant events can be unpredictable.

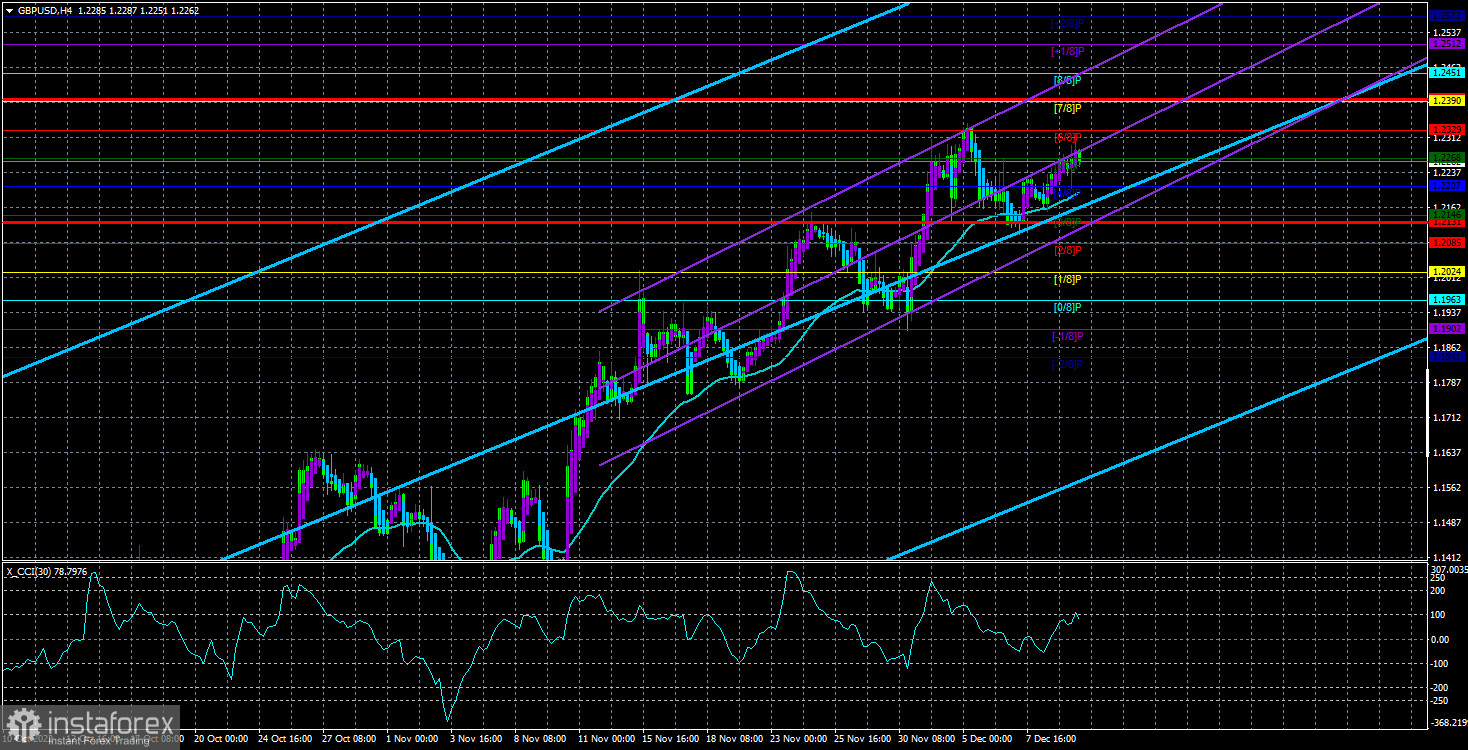

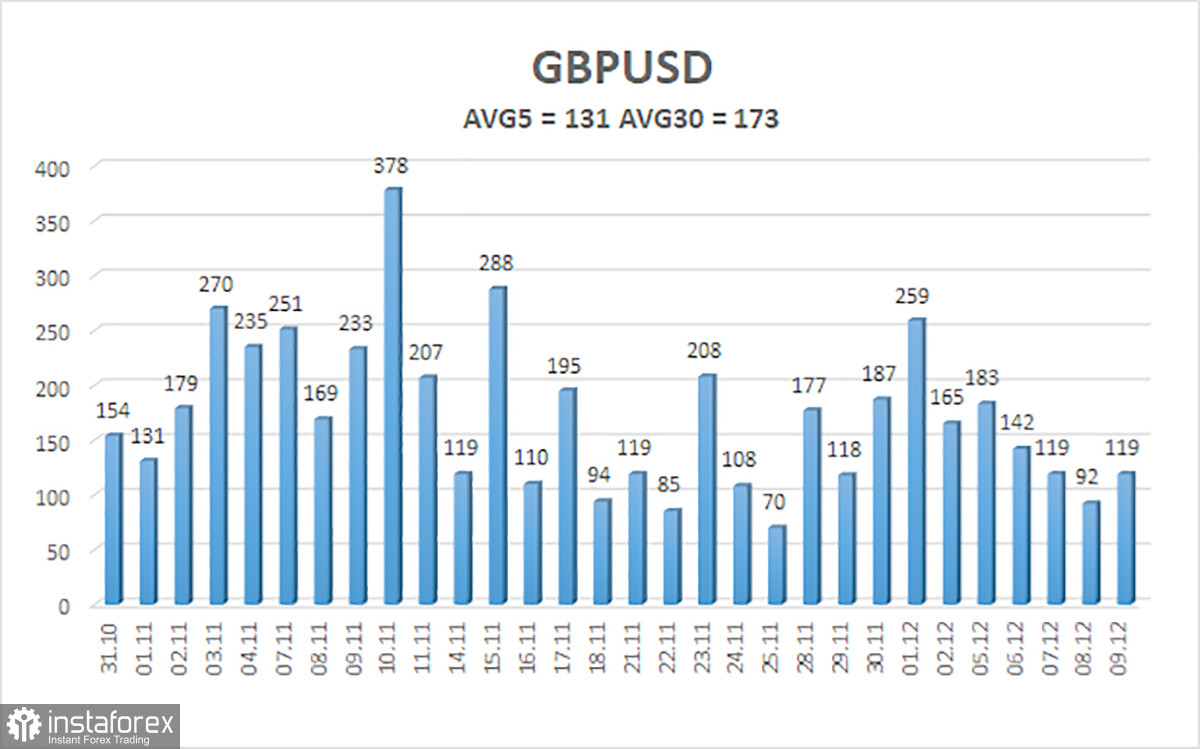

Over the previous five trading days, the GBP/USD pair has averaged 131 points of volatility. This value for the dollar/pound exchange rate is "very high." So, on Monday, December 12, we anticipate movement within the channel and are constrained by the levels of 1.2131 and 1.2393. The downward reversal of the Heiken Ashi indicator indicates that the pair is attempting to correct.

Nearest levels of support

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest levels of resistance

R1 – 1.2268

R2 – 1.2329

R3 – 1.2390

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair attempts to move upward. Therefore, until the Heiken Ashi indicator turns down, you should maintain buy orders with targets of 1.2329 and 1.2390. With targets of 1.2131 and 1.2085, open sell orders should be fixed below the moving average.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română