M5 chart of EUR/USD

On Friday, EUR/USD tried to rise further, but eventually collapsed near 1.0579, which it failed to surpass earlier. Thus, a new round of local correction began, but its strength and depth still leave much to be desired, we are still waiting for a more serious bearish correction. There were no important reports or events in the eurozone, and in the US there was the PPI, which helped the dollar to grow a little bit, and the Consumer Sentiment Index from the University of Michigan, which was ignored. Basically, last week the pair was moving quite logically according to the macro data, however, the quote's recent movement can hardly be logically explained. I still believe that the euro has grown too much and it is time for it to go down. This week there will be plenty of macro data and fundamental events to implement that plan.

Speaking of trading signals, everything was pretty good as well, though not ideal. At the beginning of the European session, two sell signals around 1.0579 appeared, afterwards the pair fell to 1.0514, where the Kijun-Sen was. A rebound from this line followed, so it was time to close the short positions and try to open the long ones. However, longs did not bring any profit, and by the end of the day there were no other signals, so the deal could be manually closed at zero. The profit was about 25 points on the first deal.

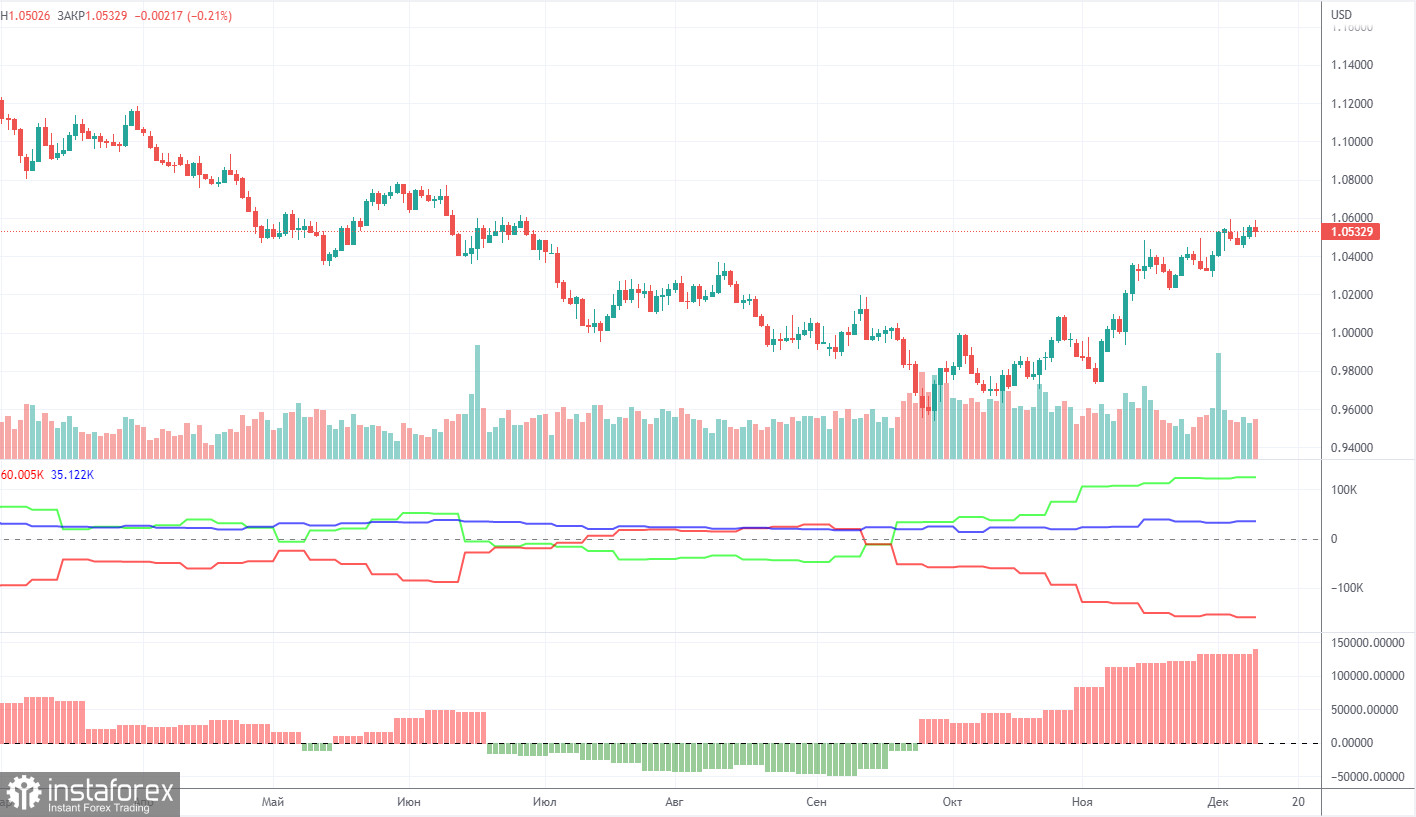

COT report

COT reports on EUR/USD have puzzled traders through most of 2022. Half of the year, COT reports indicated clear-cut bullish sentiment among large market makers while the single European currency was extending its weakness. For a few months, the reports showed a bearish sentiment and the euro was also trading lower. Currently, the net position of non-commercial traders is again bullish and increasing. Although the euro is rising, a rather high value of the net position allows us to assume an early completion of the uptrend. During the reporting week, the number of long positions held by non-commercial traders increased by 3,900 and that of short positions grew by 1,300. Accordingly, the net position grew by about 2,600 contracts. The green and red lines of the first indicator moved far away from each other, which could mean the end of the uptrend (!!!) (which, in fact, never happened). The number of long positions exceeds that of short positions by 125,000. Therefore, the net position of non-commercial traders may continue to rise further but without triggering a similar rise in the euro. When it comes to the total number of longs and shorts across all categories of traders, there are now 35,000 more short positions (661,000 vs 626,000).

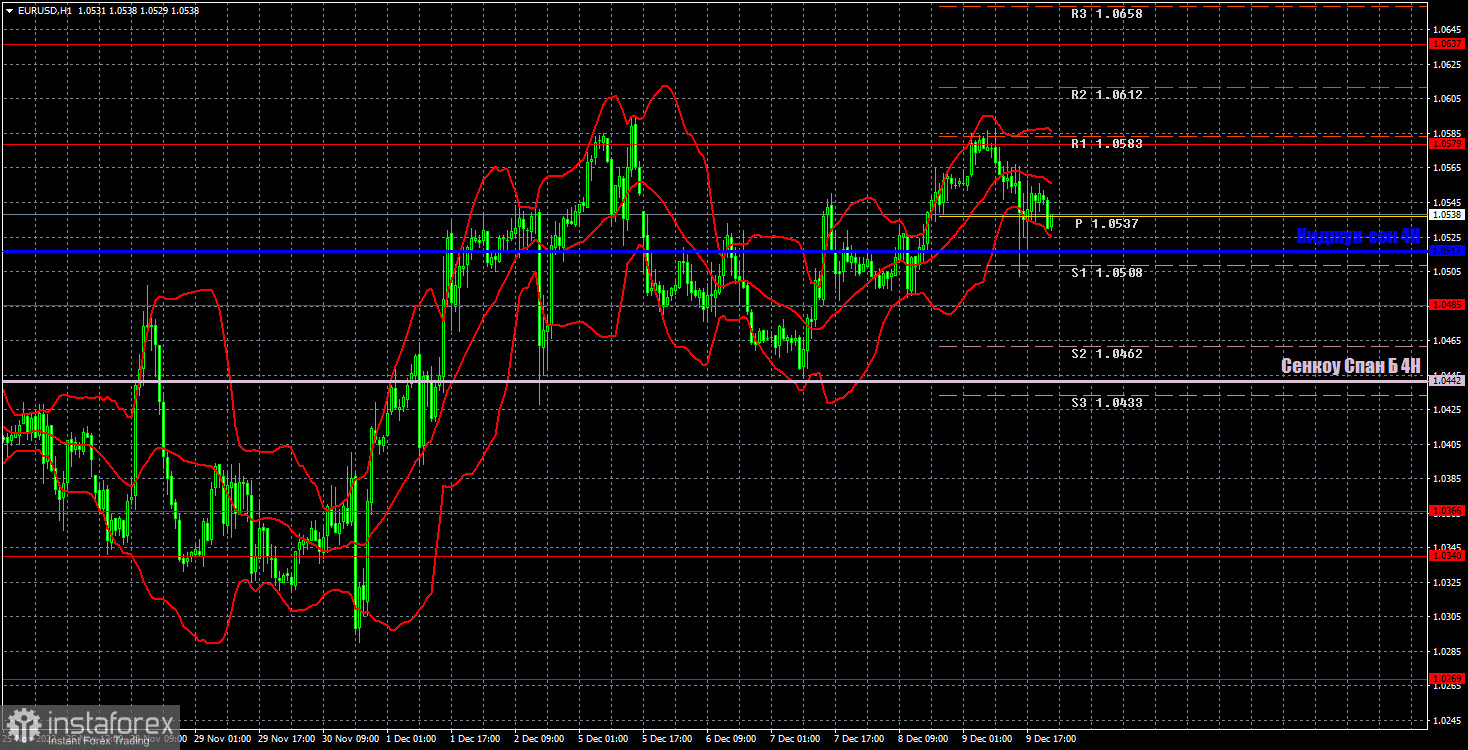

H1 chart of EUR/USD

On the one-hour chart, EUR/USD continues to remain near its local highs, but this week traders will have so many events and reports that they can use so it is impossible to say which direction the price may move and where it will end the current week. I'm still waiting for a strong bearish correction and I believe it could happen this week. On Monday, the pair may trade at the following levels: 1.0195, 1.0269, 1.0340-1.0366, 1.0485, 1.0579, 1.0637, as well as Senkou Span B (1.0442) and Kijun Sen (1.0517). Lines of the Ichimoku indicator may move during the day, which should be taken into account when determining trading signals. There are also support and resistance levels, but signals are not formed near these levels. Bounces and breakouts of the extreme levels and lines could act as signals. Don't forget about stop-loss orders, if the price covers 15 pips in the right direction. This will prevent you from losses in case of a false signal. On December 12, there are no important reports or events in the EU and the US, but the most interesting ones are yet to come. In particular, the Federal Reserve and European Central Bank meetings and the inflation report. The market may just start processing all these data beforehand, starting from Monday, so volatility could be high this week.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română