Long-term outlook.

During the current week, the EUR/USD currency pair attempted to initiate a downward correction again, but nothing came of it. This week's volatility was extremely low, and trend movements were almost nonexistent since there was no fundamental with a background in macroeconomics. Since there were no significant events during the week, traders were forced to respond to, if not minor, rapidly changing macroeconomic data. For instance, the ISM business activity index for the US services sector was released on Monday, and the third-quarter GDP for the EU was released on Wednesday. Despite these reports, the pair could not demonstrate a discernible movement to the north or south. Thus, the week ended up being utterly dull and uninteresting.

However, the coming week may be both fascinating and eventful. We won't get ahead of ourselves by listing all the activities, but we will still mention that this week there will be three central bank meetings and the release of a significant report on US inflation. Consequently, the volatility over the following five days could be high.

Technically, we still anticipate a significant downward correction, but this week, the pair can move in almost any direction and with any force. Even if the decisions made at a Fed or ECB meeting seem clear-cut, as we have frequently stated, the response to that meeting can be entirely unpredictable. Frequently, the price will change dramatically (or rise sharply) before returning to its initial position. The upward trend is undeniable because all technical indicators are pointing up. However, remember that the pair can sometimes only move in one direction. Over the past month, it has increased by nearly 800 points without experiencing a single pullback.

COT analysis.

The predictions made by COT for the euro in 2022 are paradoxical. They displayed the openly "bullish" attitude of professional traders for the first half of the year, but the value of the euro was steadily declining at the same time. Then they displayed a "bearish" attitude for a while, and the value of the euro also steadily declined. The euro is now increasing, and non-commercial traders' net positions are again "bullish." Still, only a relatively high value of the "net position" enables the impending completion of the upward movement (at least, the correction we expect). The number of buy contracts from the "non-commercial" group increased by 3.9 thousand during the reporting week, while the number of short contracts decreased by 1.3 thousand. The net position consequently increased by about 2.6 thousand contracts. Please note that the first indicator's green and red lines are very far apart, which could signal the end of the ascending trend. There are 125 thousand more buy contracts than sell contracts for non-commercial traders. As a result, although the net position of the "non-commercial" group may continue to increase, the euro may not experience a similar increase. Sales are 35 thousand more if you look at the overall open longs and shorts indicators for all trading categories (661k vs. 626k).

Analysis of fundamental occurrences.

Almost no noteworthy events occurred in the European Union this week. In addition to the GDP report we have already discussed, ECB President Christine Lagarde gave several speeches, but they all contained insignificant information. A report on retail sales was also provided, revealing them to be extremely subpar. The euro experienced a slight decline, but by the end of the week, it had easily and quickly reverted to its highest levels in recent months. Therefore, the general conclusion is unchanged: traders still favor purchasing the euro and the pound, regardless of the macroeconomic and fundamental context. Even though there are compelling reasons to buy the US dollar, it is not increasing. Since the market is already aware of the decisions that will undoubtedly be made after the ECB and Fed meetings, we do not anticipate a significant shift in the market's mood. Both central banks are most likely to increase interest rates by 0.5%. This week, we predict that the euro may lose its only competitive advantage over the dollar. With a high degree of probability, the ECB rate will remain below the Fed rate for a considerable time.

Weekly trading strategy for December 12–16:

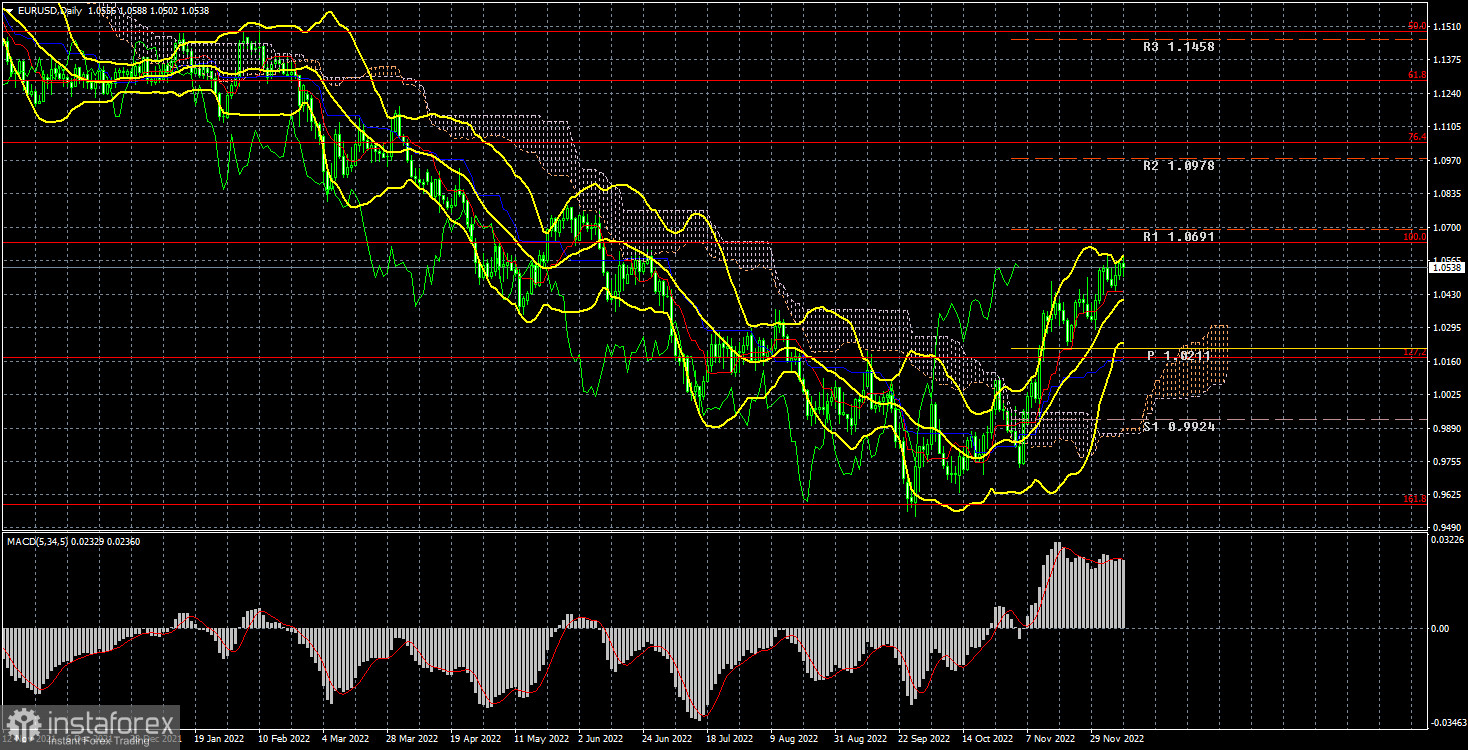

1) The pair is above all of the Ichimoku indicator's lines in the 24-hour time frame, giving it a good chance of continuing to rise. Of course, if geopolitics begins to deteriorate again, these chances could disappear quickly. However, for now, we can expect an upward movement with a target of 1.0636 (100.0% Fibonacci) and higher and should cautiously buy the pair.

2) The euro/dollar pair sales are no longer significant. It would be best to wait for the price to return below the important Ichimoku indicator lines before considering short positions. There are no circumstances in which the US dollar can reverse the current trend. However, in the modern world, anything can happen at any time.

Explanations of the illustrations:

Price levels of support and resistance (resistance and support), Fibonacci levels – targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română