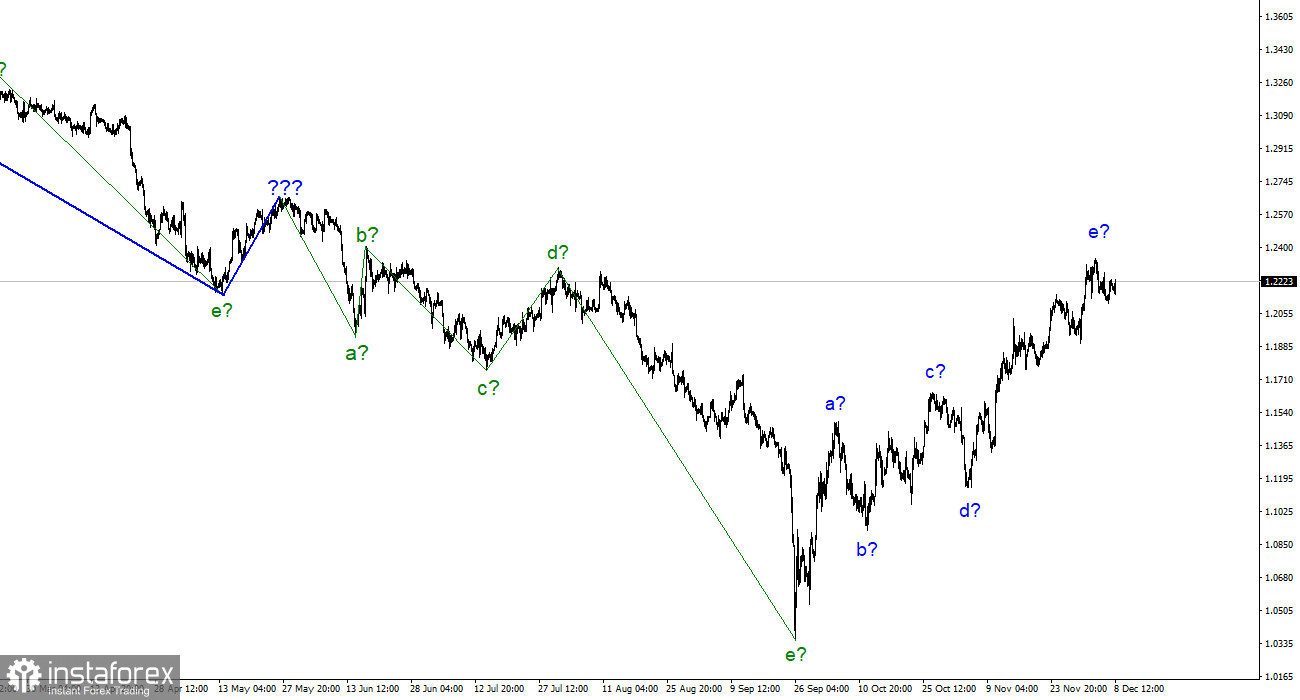

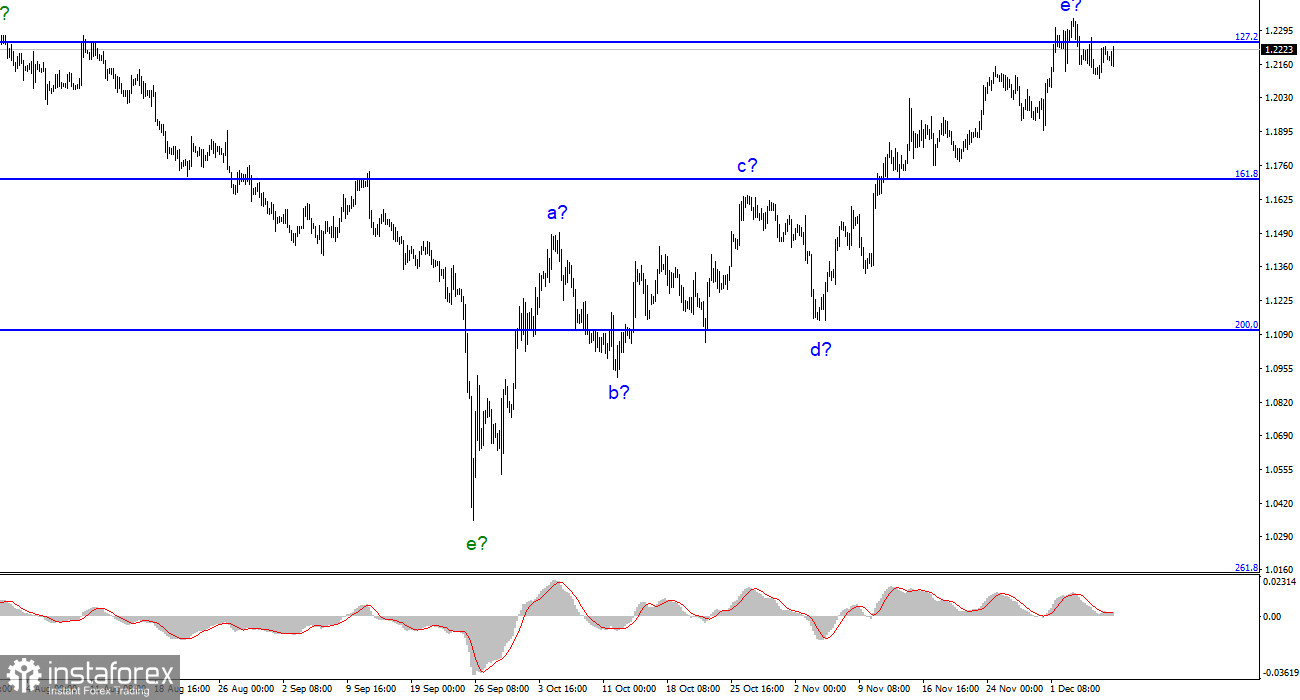

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still needs to be clarified. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. As a result, the instrument's price increase may last for a while. Both instruments are still forming an upward trend segment that will eventually lead to a mutual decline. Recently, the British pound's news background has been so varied that it is challenging to sum it up in one word. The British pound had more than enough reasons to rise and fall. As you can see, it primarily chose the first option and still does so today. The internal wave structure of wave e became more complicated due to the rise in quotes the week before last, and it became even more complicated the following week. However, as of this week's first day, the British pound still feels great and has no desire to create a corrective wave. I am currently waiting for the decline of both instruments. Still, these trend sections may take an even longer form because the wave marking on both instruments allows the ascending section to be built up to completion at any time.

The UK currency continues to be in high demand.

The pound/dollar exchange rate on Friday increased by 30 basis points. Even on Friday, when the euro at least slightly lost value, there was still room for the pound to gain some value. Since all the day's news came from America, the news background for the euro/dollar and pound/dollar instruments coincided 100%. However, the European and British were traded in the market in very different ways yesterday, but overall, both instruments continue to move very similarly. Now almost identical wave patterns point to the formation of a descending set of waves. However, neither this factor nor the fact that there are no other factors for the new growth of the euro and pound is taken into account by the market. Because of this, the demand for US currency still needs to rise, both instruments' quotes are fixed, and the downward trend sections I've been hoping for are not developing. Nothing noteworthy occurred this week in the UK, the USA, or the European Union.

So, all that is left to do is wait. It's also challenging to predict what we should all anticipate. The start of central bank meetings next week will undoubtedly aid the market in making a decision, but let me remind you that we require an increase in the US currency, not the reverse. Wave e may continue to develop since it is currently impossible to say whether the upward trend section's construction is finished. However, it will only help traders a little because, in this scenario, this wave can keep building for as long as it likes, and the entire trend section will grow much longer. Things might start to get better next week.

Conclusions in general

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. Since the wave marking now makes it possible to start building a downward trend section immediately, I can no longer recommend purchasing the instrument. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer shape.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română