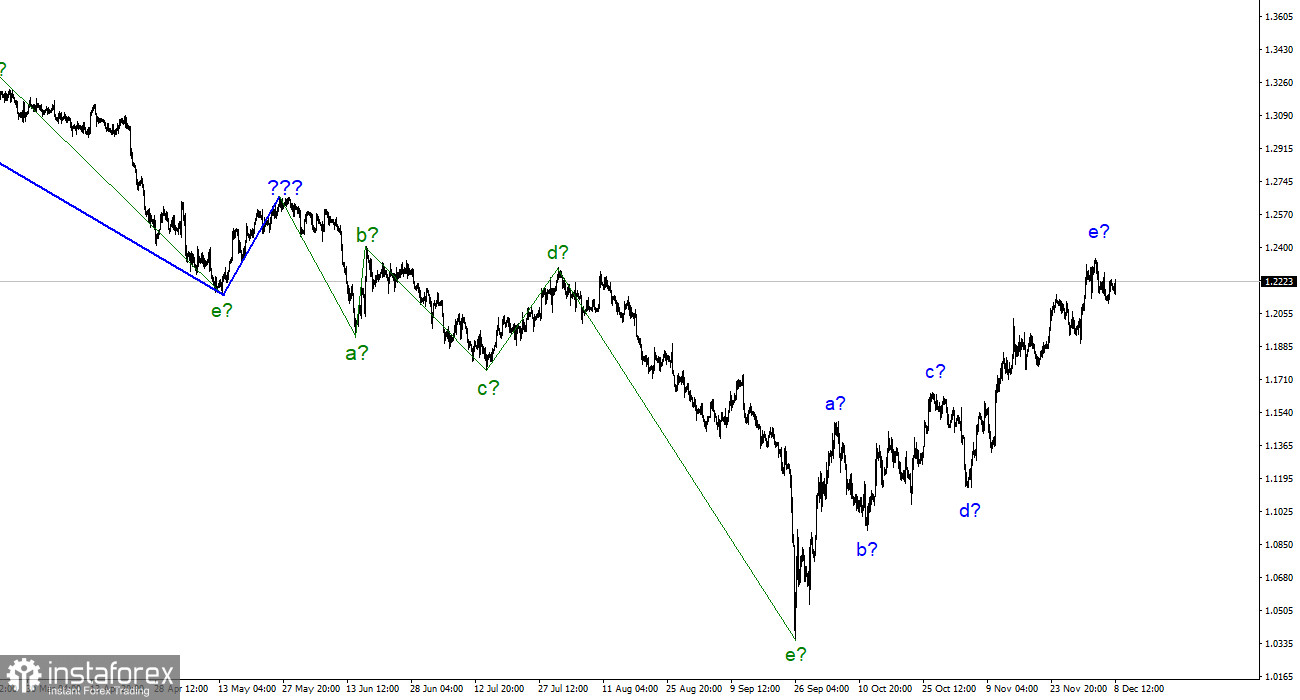

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still needs to be clarified. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. As a result, the instrument's price increase may last for a while. Both instruments are still forming an upward trend segment that will eventually lead to a mutual decline. Recently, the British pound's news background has been so varied that it is challenging to sum it up in one word. The British pound had more than enough reasons to rise and fall. As you can see, it primarily chose the first option and still does so today. The internal wave structure of wave e became more complicated due to the rise in quotes the week before last, and it became even more complicated the following week. However, as of this week's first day, the British pound still feels great and has no desire to create a corrective wave. I am currently waiting for the decline of both instruments. Still, these trend sections may take an even longer form because the wave marking on both instruments allows the ascending section to be built up to completion at any time.

The UK currency is still in high demand.

The pound/dollar exchange rate on Thursday increased by ten basis points. Additionally, while this is an improvement over yesterday's instrument, it has no value for the current wave markup. In other words, a change of 50 or 100 points has no bearing on the instrument because it is just market noise. I still need to figure out whether the upward trend section's construction is complete once the quotes have moved past the 150-point peaks. We can anticipate the continuation of the upward trend in quotes and the start of a downward trend in the current environment. This week, there is no background news in the UK, and in the USA, the market is already aware of all the most intriguing reports. The consumer sentiment index and the report on unemployment benefit applications cannot alter the market's stance toward trading. As a result, I don't anticipate any significant changes this week either. The important thing is that these adjustments can be made before the Bank of England and Fed meetings.

Additionally, I don't link upcoming price changes to the Fed and Bank of England meetings. The market has already experienced the rate changes from December several times. As a result, although the amplitude may increase significantly on the days of the announcement of the outcomes of the meetings of both central banks, it is unlikely that this will mark the beginning of a new downward trend segment. Alternately, the current ascending one will get trickier. The market must now determine whether any factors drive demand for the euro or pound to rise. I can't personally see them. We will still witness the development of at least a three-wave correction section of the trend if the market accepts this conclusion.

Conclusions in general

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. Since the wave marking permits the construction of a downward trend section, I cannot advise purchasing the instrument. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer shape.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română