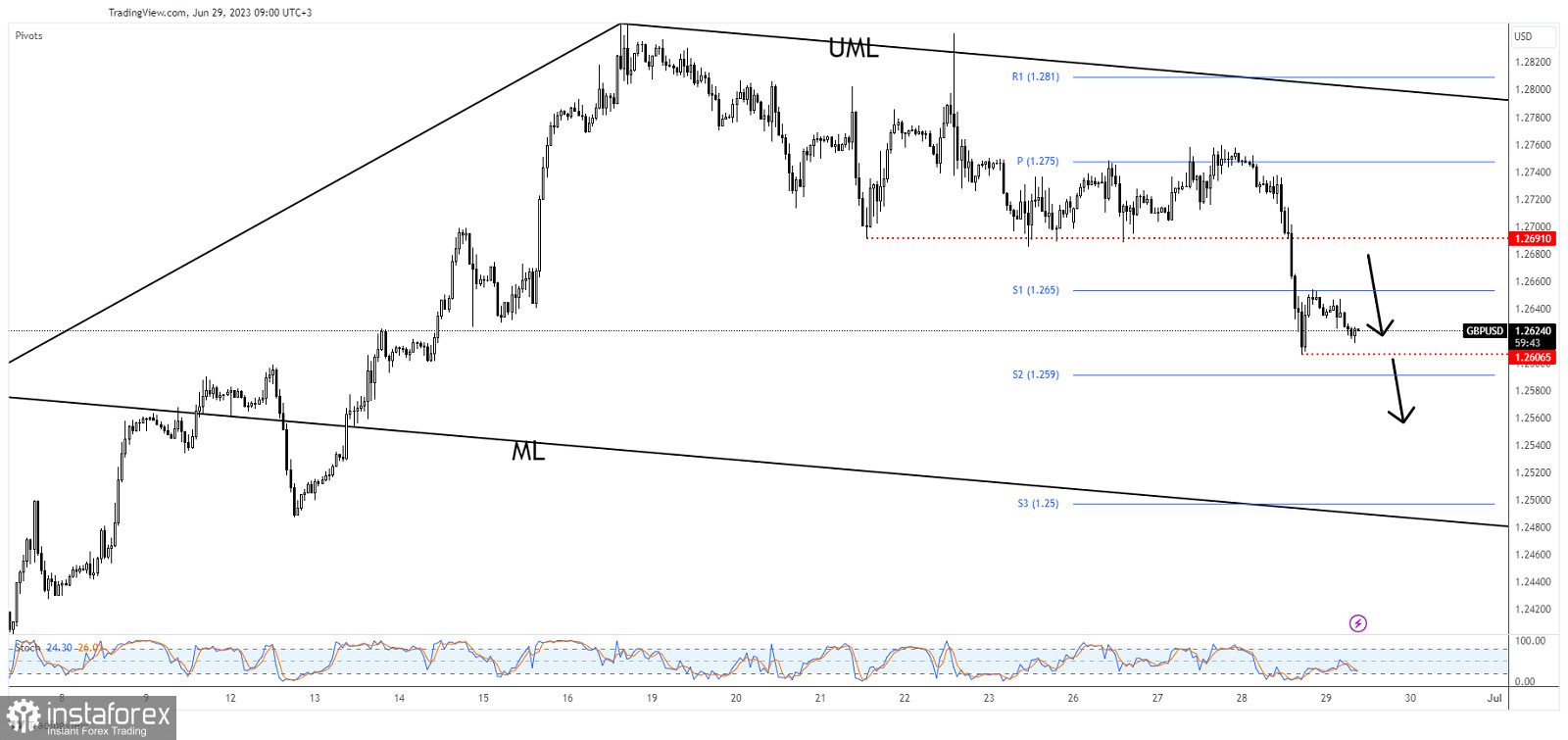

The GBP/USD pair dropped as much as 1.2606 in the last trading session, registering a new lower low. In the short term, the price tried to rebound but the downside pressure remains high, so a deeper drop is natural. DXY's upside continuation should force the greenback to appreciate versus its rivals.

The currency pair crashed as the US reported positive economic data in the last two days. Today, the Uk is to release M4 Money Supply, Mortgage Approvals, and Net Lending to Individuals. Still, only the US data could really shake the markets today. The Final GDP and Unemployment Claims are seen as high-impact events. In addition, Final GDP Price Index and Pending Home Sales data will be released as well. Better than expected US figures should lift the USD.

GBP/USD Temporary Rebounds!

Technically, GBP/USD found support at 1.2606. It has rebounded but the bounce back was stopped by the weekly S1 (1.2650). This represents a static resistance, 1.2691 is seen as an upside obstacle as well.

After its massive sell-off, a rebound was natural, but don't forget that temporary bounce backs could bring us new short opportunities.

GBP/USD Forecast!

A new lower low, a valid breakdown below 1.2606 is seen as a selling signal. The median line (ML) of the descending pitchfork represents a major downside target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română