Everyone is talking about the onset of recession in the eurozone and that a recession in the U.S. is just around the corner. However, the U.S. labor market and business activity in the service sector are giving some pleasant surprises. The European statistics do not lag behind. The GDP of the currency bloc expanded faster in the third quarter than previously expected, and the actual data on German industrial production exceeded Bloomberg experts' forecasts. All this contributed to EURUSD's return above 1.05, although it failed to gain a foothold there at the first attempt.

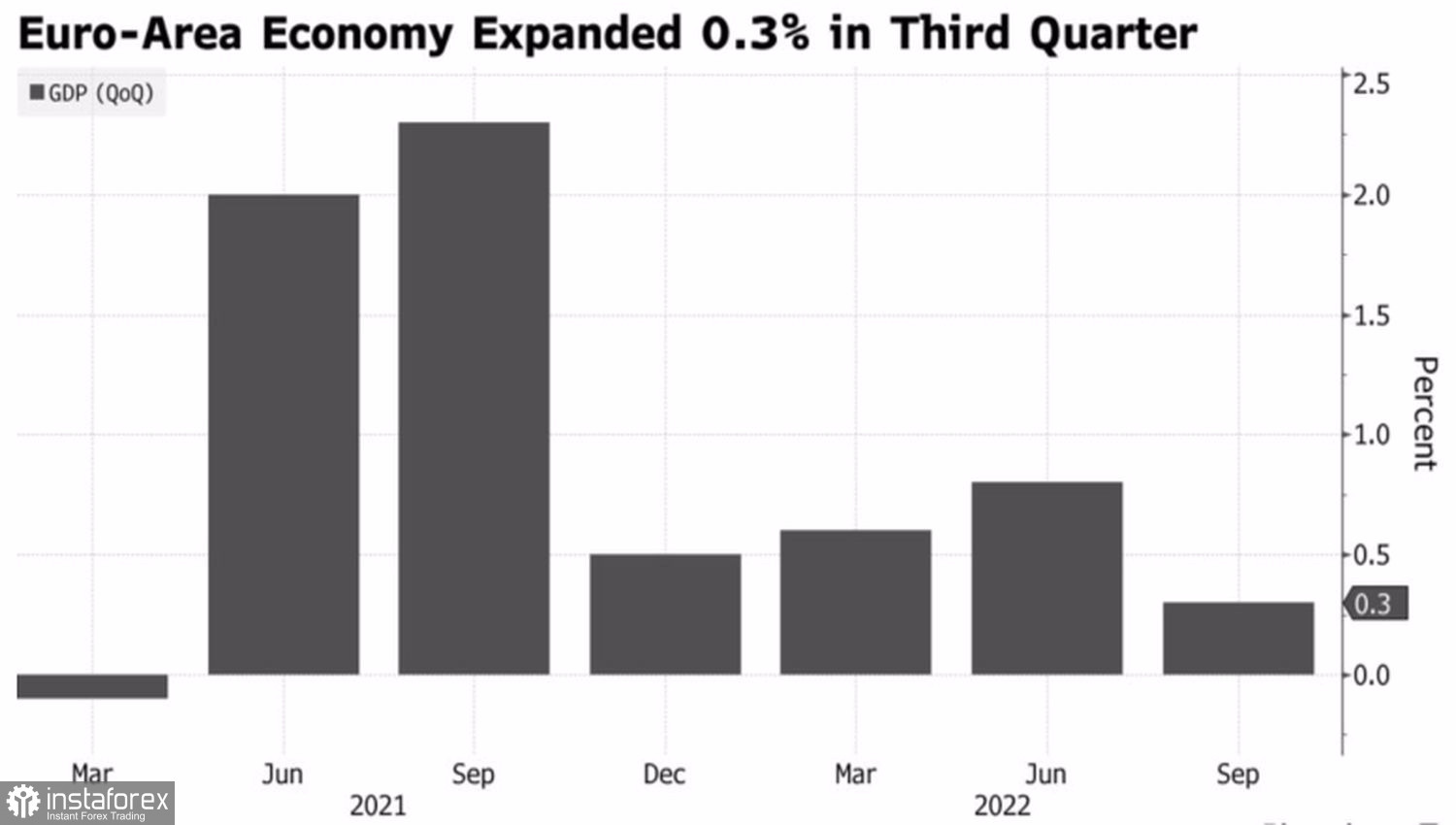

The eurozone economy grew by 0.3% in July–September, surpassing the preliminary estimate of 0.2% QoQ. On an annualized basis, the indicator grew by 2.3% due to consumer demand and investment in fixed assets.

Eurozone GDP dynamics

The stronger-than-expected data increases the chances that the currency bloc will be able to weather the energy crisis. That is, the recession at the turn of 2022–2023 will be shallow and short-lived. This is good news for the euro, which tried to spread its wings on the strong statistics on the European GDP and German industrial production. However, rising gas prices in the euro area clipped EURUSD's wings.

Despite the high occupancy of blue fuel storage facilities, the cold snap and the opening of China can quickly deplete them. It's one thing when China sits in lockdowns and everything is fine with the weather. Another when temperatures in Asia begin to fall, and Beijing moves away from the zero-COVID policy. Competition is a good thing, but when it comes to competition between the EU and China for LNG, this results in higher gas prices and growing risks of a deep recession in the eurozone.

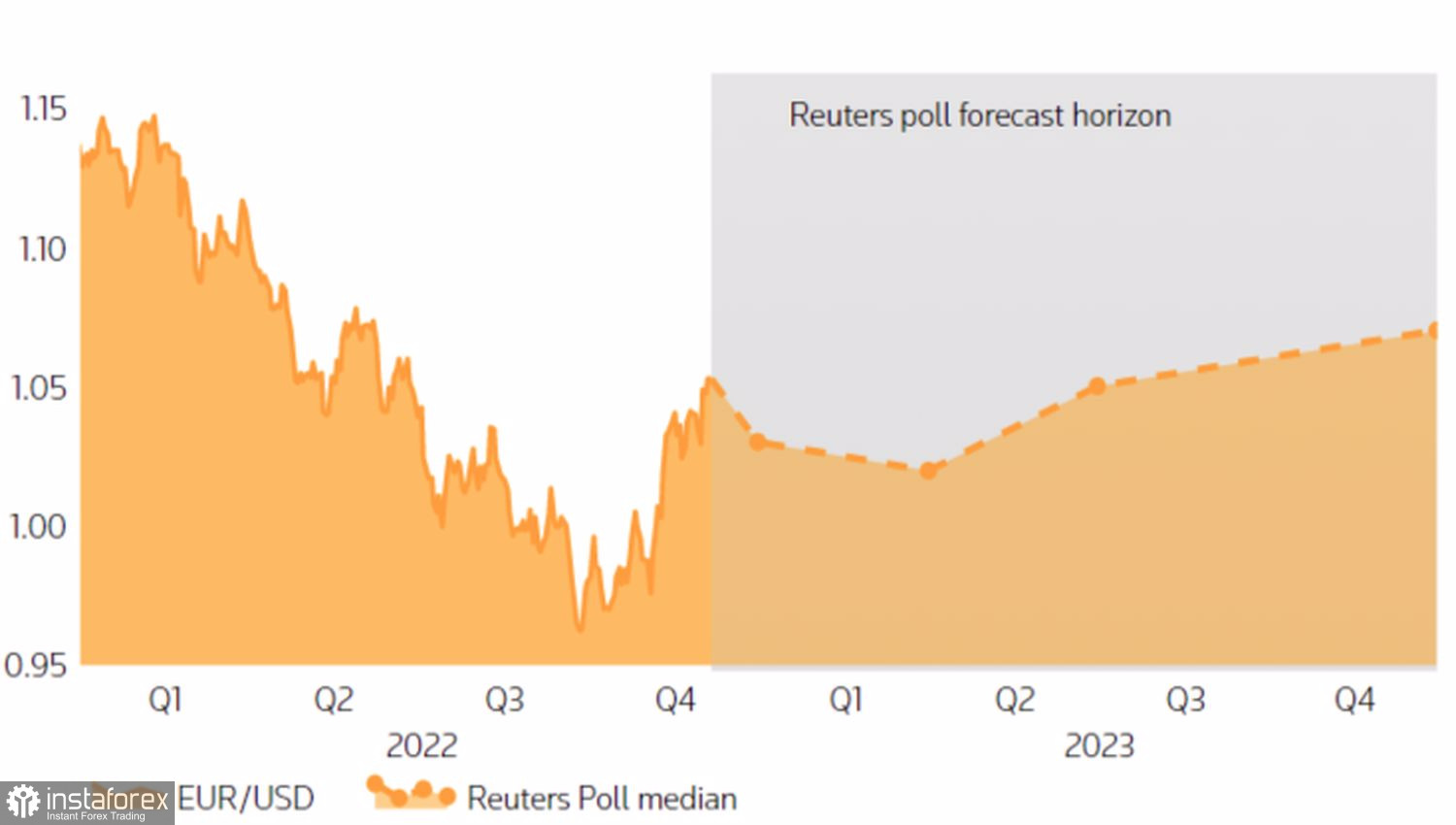

It seems the euro needs to survive the first quarter, and then things will go smoothly. The Fed will end the cycle of tightening monetary policy, China will defeat COVID-19, Europe will survive the cold winter, and the recession will end. In the U.S., it will still be on the radar. This is the basic scenario for the development of events, allowing Reuters experts to predict the fall of EURUSD to 1.02 in three months and the rise to 1.07 in 12 months.

Expected dynamics of EURUSD

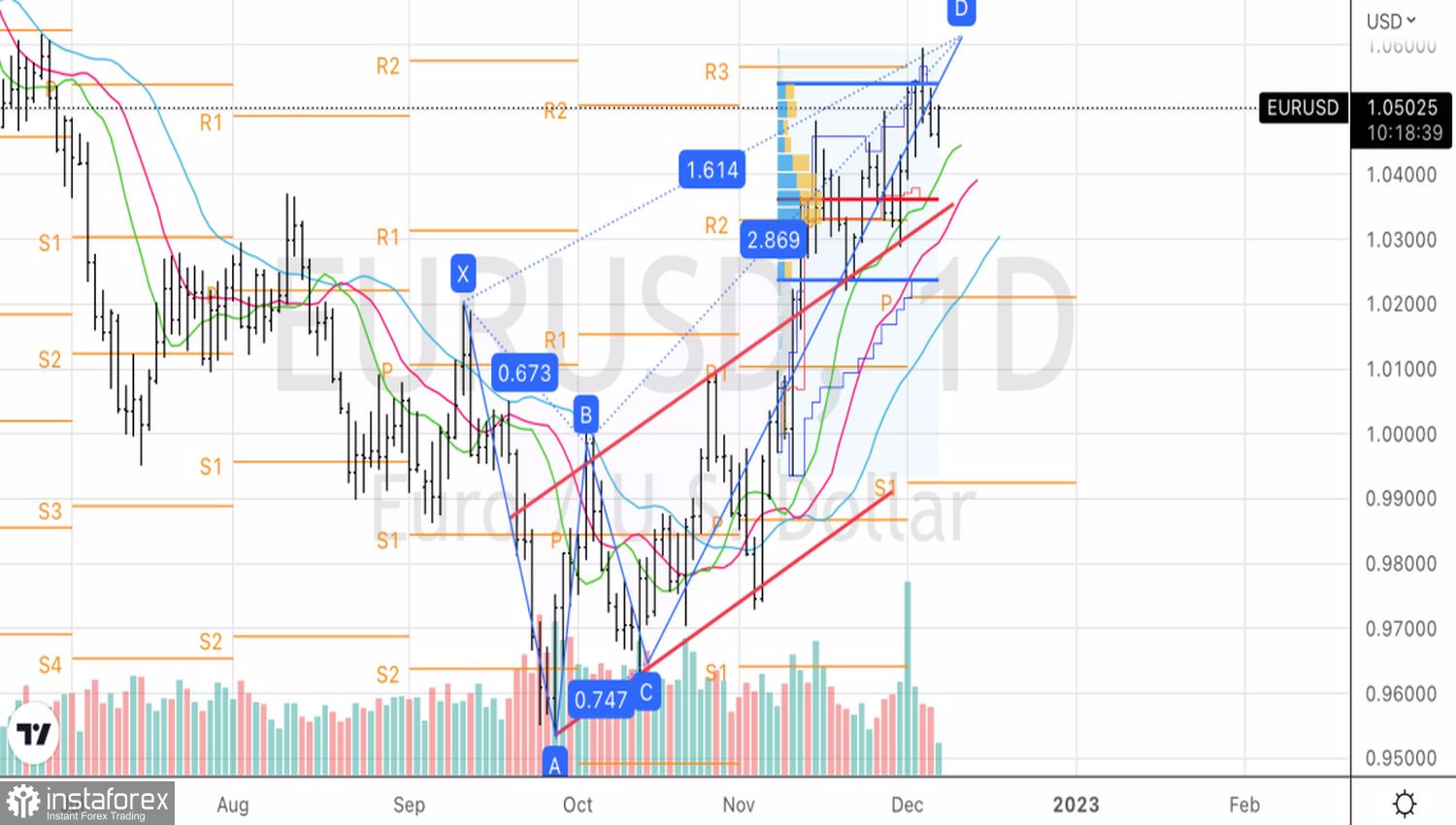

A logical question arises: has the euro climbed too high if the eurozone is already facing a recession, and the U.S. has not yet? It is quite possible, Danske Bank believes, and advocates the development of a pullback to a rally in EURUSD in the event of an increase in inflation expectations in the report of the University of Michigan on December 9 and an unpleasant surprise from the US CPI on December 13. We are talking about an unexpected acceleration of inflation against the background of forecasts of its further slowdown.

Technically, without overcoming resistance in the form of the 1.0505 pivot point and the upper limit of the fair value range of 1.024–1.054, EURUSD bulls will not be able to restore the upward trend. A rebound from these marks will provide an opportunity to sell the euro.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română