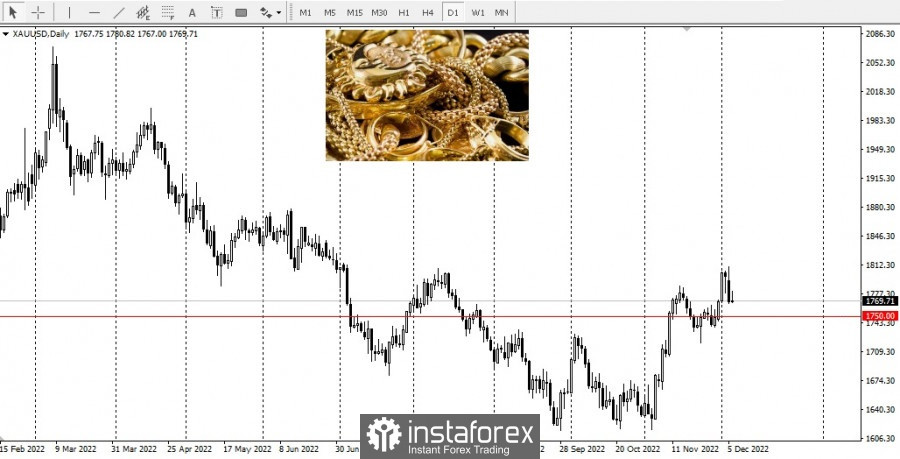

The gold market, which marked a solid breakout of last month's two-year lows, seems comfortable around $1,780 an ounce. However, gold prices have risen nearly $200 since early November as markets reacted to the Federal Reserve's plan to slow down rate hikes starting in December.

Thus, the end of the rate hike cycle is approaching. Ahead of this, bond yields dropped markedly, and the US dollar again lost some of its previous gains. Consequently, the headwind that gold faced on that side was replaced by a tailwind.

While gold has benefited from these shifting expectations, the slowdown does not necessarily mean the Fed is ready for a reversal. In the current conditions, it is difficult for gold prices to maintain a steady growth above $1,800 an ounce. Interest rates are likely to stay elevated.

With Federal Reserve monetary policy set for next week, gold investors should pay attention to the expected final rate more than future rate hikes.

According to CME's FedWatch tool, the US central bank will raise the federal funds rate to a peak between 5.00% and 5.25%.

If interest rate expectations rise further after the upcoming Fed meeting because the Fed sees a need for a higher rate, gold could come under pressure.

The same will happen if the US dollar appreciates again.

Then gold prices will retest support at $1,750 an ounce.

However, as soon as the first Fed rate cut becomes known, this can be expected in the second half of next year, gold should start to rise again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română