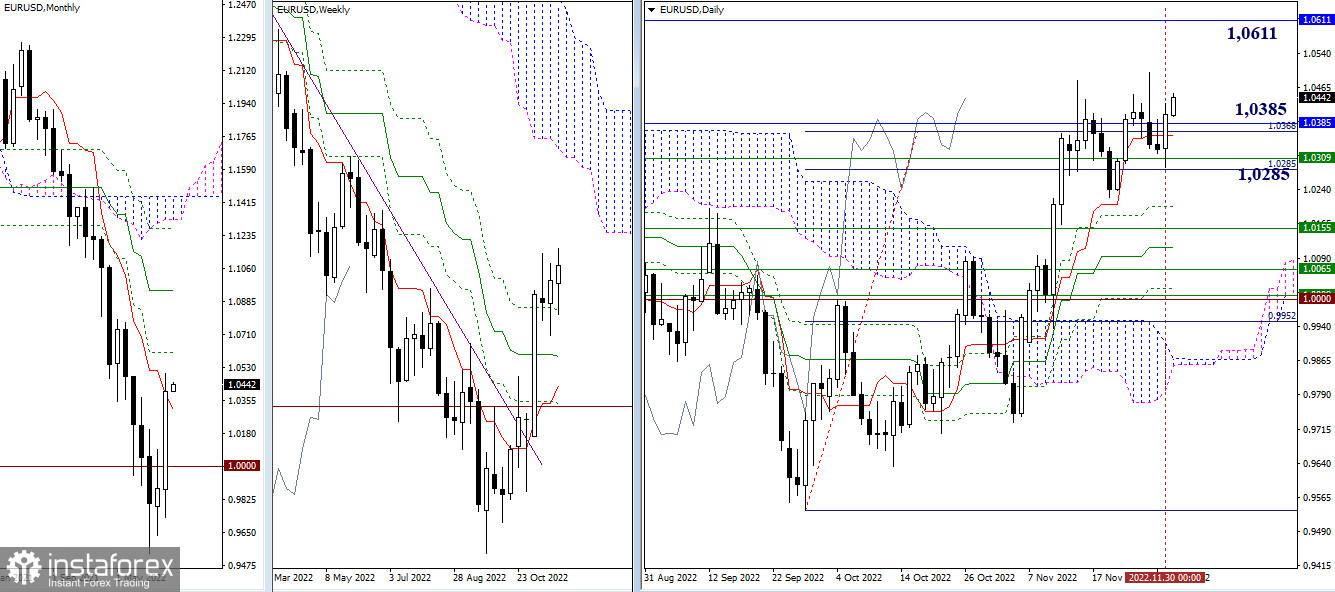

EUR/USD

Larger timeframes

The bulls enabled EUR/USD to close yesterday above the current support area of 1.0385 to 1.0285. If the instrument continues its rise and sustains enough bullish momentum, the next level to be tested is seen at 1.0611 which corresponds to a one-month Fibo Kijun. The currency pair closed November with a bullish candlestick. The euro bulls followed the way until a one-month short-term trend. After it had been tested, EUR/USD closed the month above it.

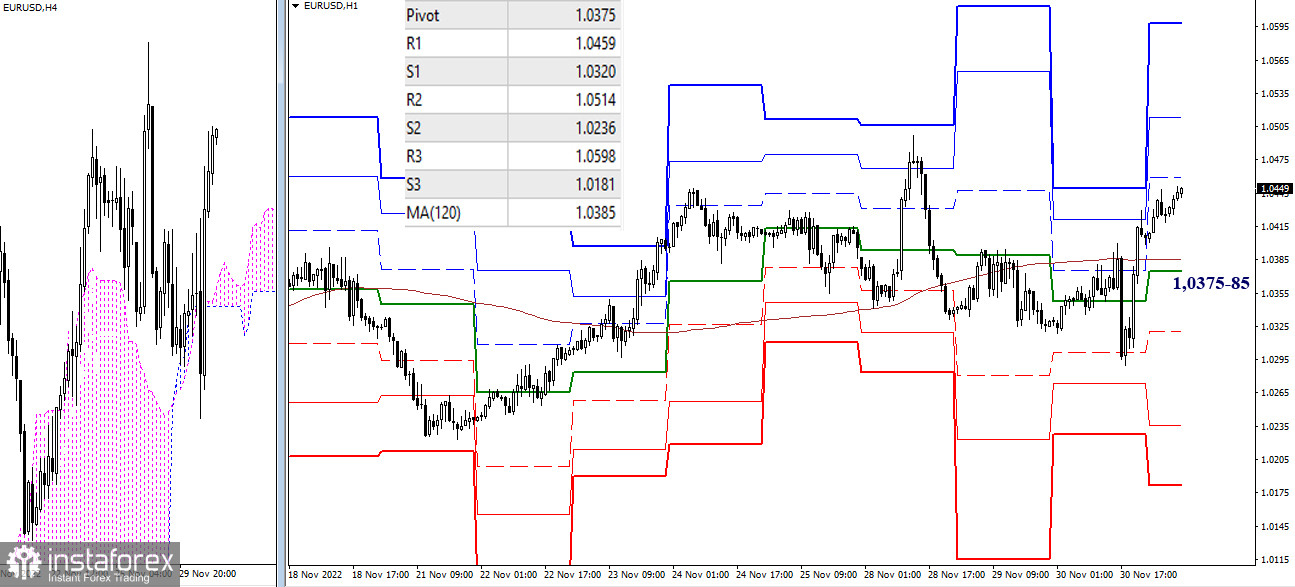

H4 – H1

The currency pair has been stuck for long between the borders of the wide support area at larger timeframes. At the same time, the price settles either above or below the key levels on smaller timeframes. If the price settles below the key levels, the bears take advantage of the situation. Otherwise, if the pair is traded above the key levels like it is happing now, the bulls are taking the lead. The upward intraday targets coincide with the resistance of classical pivot levels, namely 1.0459 – 1.0514 – 1.0598. Alternatively, if the price retreats below the key levels of 1.0375-85 (the central pivot level + a one-week long-term trend), this price action will again change the current balance of trading forces on smaller timeframes. The support levels of classical pivot points such as 1.0320 – 1.0236 – 1.0181 serve as target levels.

***

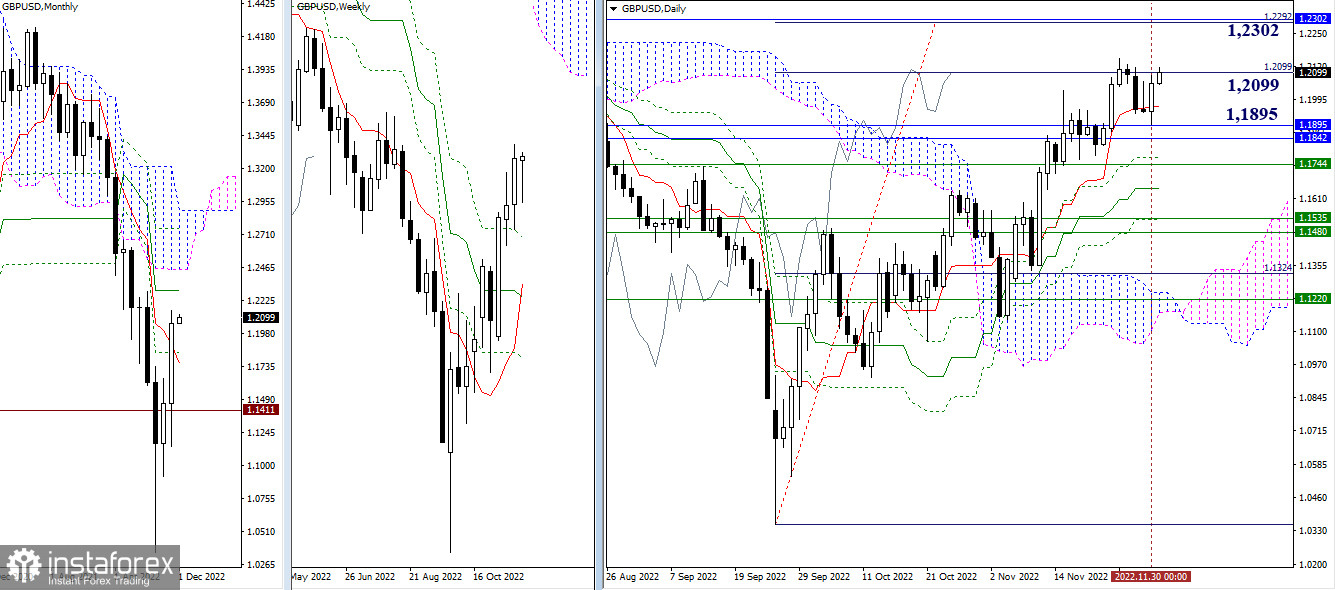

GBP/USD

Larger timeframes

The bulls closed the month on an optimistic note. At the moment, they are using the current support levels of 1.0895 – 1.0965 with the aim of testing the first intraday target level. The bulls intend to break the Ishimoku cloud at 1.2099. If GBP/USD settles above it, the door will be open for hitting the intraday target at 1.2292. Besides, traders predict the price growth to a one-month medium-term trend line at 1.2302.

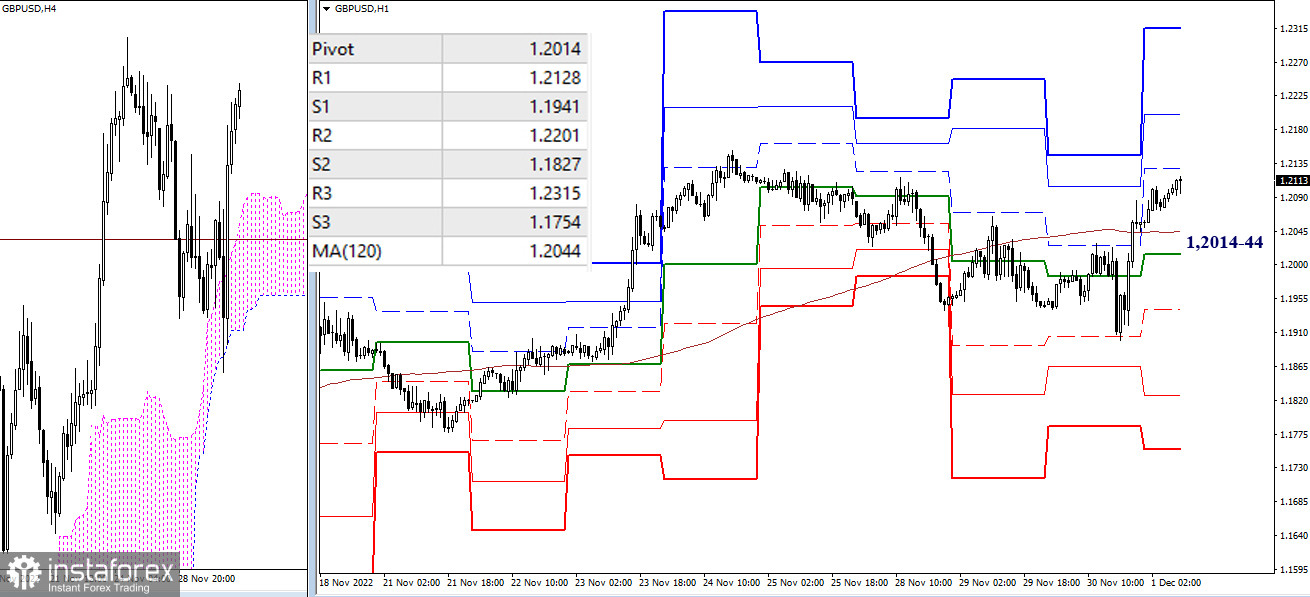

H4 – H1

The bulls managed to take over the key levels. As a result, the bulls are again setting the tone for GBP/USD. Their dominance is seen on smaller timeframes. Higher intraday targets match the classical resistance pivot levels at 1.2128 – 1.2201 – 1.2315. If the bears return to the market again in the near time and they manage to settle the price below the key levels of 1.2014-44 (central pivot intraday level + a weekly long-term trend line), this will change the current balance of forces and the downward target levels will be recognized at classical support levels of 1.1941 – 1.1827 – 1.1754.

***

Technical analysis is based on the following ideas.

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun

H1 – classical Pivot Points + Moving Average 120 (weekly long-term trend line)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română