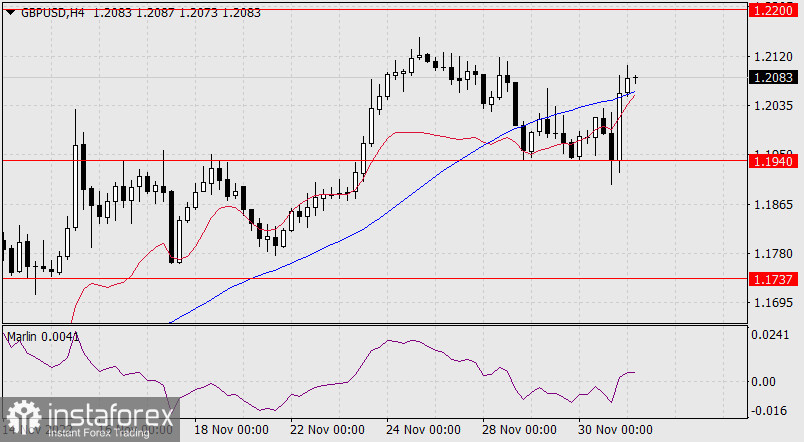

The British pound gained 110 pips on Wednesday, but failed to break through the support at 1.1940. Price divergence with the Marlin oscillator takes the form of the usual sideways movement, and this is the first sign of potential growth in the medium-term.

First of all the price should cross the resistance of the first target level at 1.2200. Settling above it will open the prospect of further growth to 1.2410, which is a support on April 28 and resistance on June 16. We will consider the reversal conditions on the lower timeframe.

On the four-hour chart, the price has settled above the MACD indicator line, and Marlin has entered the positive area. Obviously, in order to change the trend, the price and the oscillator should go back under these lines, which have now become supports. In order to confirm the reversal, the price needs to go below 1.1940. Right now we do not expect the price to rise above 1.2200 - the markets behave too impulsively lately, ignoring the global economic trends.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română