The Bank of England raised its key rate by 49bp to 4.90% - a sharper move than analysts who had made their forecasts earlier in the week had expected.

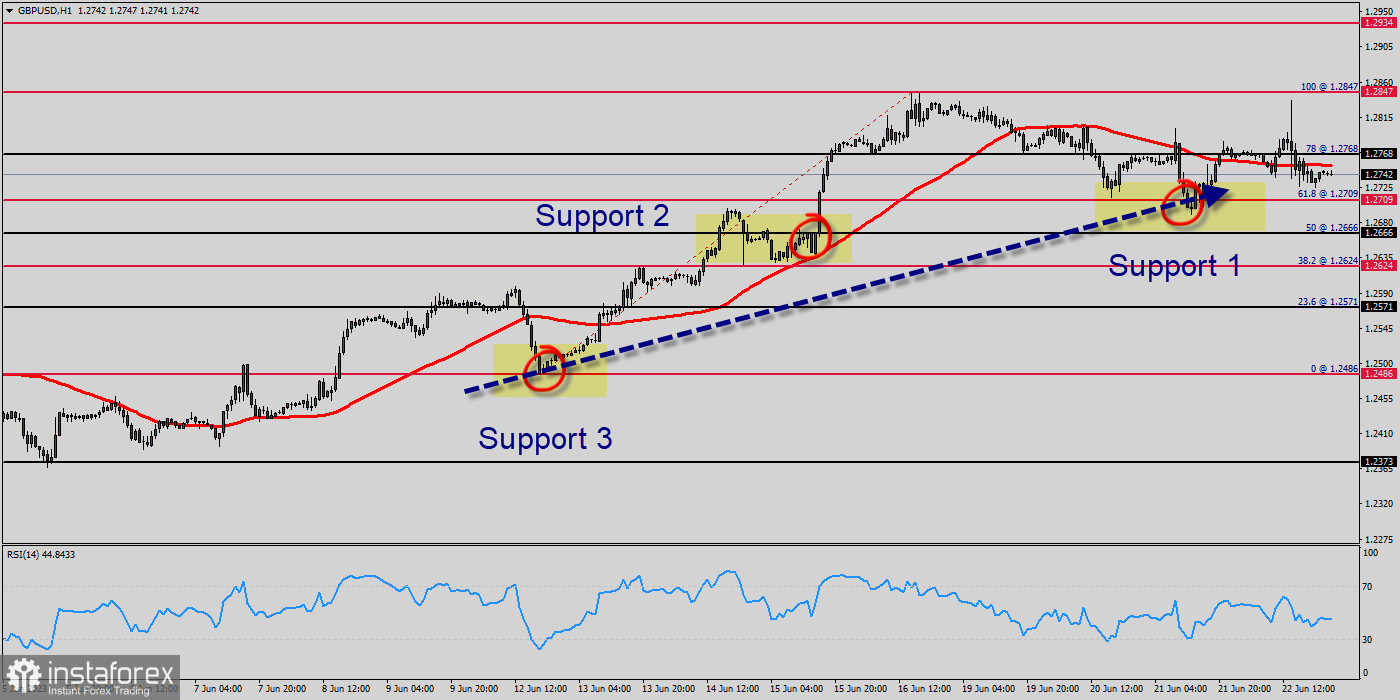

The GBP/USD's long-term target was reported in May and updated in July at 1.2709, and 1.2847 traded today at 1.2742. The GBP/USD pair formed a double bottom on today's hourly chart at 1.2709. The GBP/USD pair for July traded from 1.2486 to 1.2847 then broke 1.2624 in July to trade at the 1.2742 level.

The market reaction to the rate surprise deserves a separate mention. The GBPUSD pair jumped 60 pips up to 1.2840 and fell 100 pips down to 1.2740 within 10 minutes of the decision being published.

However, it's a logical move, given that the latest inflation data from the previous day exceeded both market expectations and the Bank's forecasts.

It should have expected a tougher stance from the central bank, given the persistently high inflation in the UK.

The GBP/USD pair will continue rising from the level of 1.2624 in the long term. It should be noted that the support is established at the level of 1.2624 which represents the daily pivot point on the H1 chart.

The price is likely to form a double bottom in the same time frame. Accordingly, the GBP/USD pair is showing signs of strength following a breakout of the highest level of 1.2624. So, buy above the level of 1.2624 with the first target at 1.2743 in order to test the daily resistance 1.

The level of 1.2847 is a good place to take profits. Moreover, the RSI is still signaling that the trend is upward as it remains strong above the moving average (100).

This suggests that the pair will probably go up in coming hours. If the trend is able to break the level of 1.2847, then the market will call for a strong bullish market towards the objective of 1.2934 today.

This was obviously due to the trading robots working off the news headlines but ran into resistance from the sellers near the highs at last week's close. However, the pound soon stabilised near the day's opening levels, as markets saw the latest decision consistent with the available economic data.

On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.2624, a further decline to 1.2486 can occur. It would indicate a bearish market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română