Since the US dollar is extremely oversold, the market urgently needs a correction. On Monday, there were prerequisites for this. However, the market returned to its previous quite high levels. This proves that the market needs at least a minor reason to start a correction. However, Germany's macroeconomic reports are unlikely to alter the market picture.

Meanwhile, preliminary estimates on business activity, which will be disclosed today, will have a considerable influence on the market. Judging by the forecast, the expected data may cause a partial correction. In the UK, forecasts are quite gloomy. Thus, the manufacturing PMI may decline to 45.6 points from 46.2 points. The services PMI is likely to drop to 47.6 points from 48.8 points. As a result, the composite PMI may slide to 47.5 points from 48.2 points, thus causing a decrease in the pound sterling.

UK Composite PMI

In the US, forecasts are more positive. Although the manufacturing PMI is expected to slide to 50.1 points from 50.4 points, the services PMI may increase to 49.3 points from 47.8 points. Thus, the composite PMI may rise to 49.5 points from 48.2 points.

US Composite PMI

However, the greenback's appreciation is likely to be capped by the unemployment claims report. The overall number of claims may increase by 13,000. The number of initial claims may rise by 6,000, whereas the number of continuing claims is likely to add 7,000. The data will be published today since tomorrow, the US will celebrate Thanksgiving Day.

US Continuing Claims

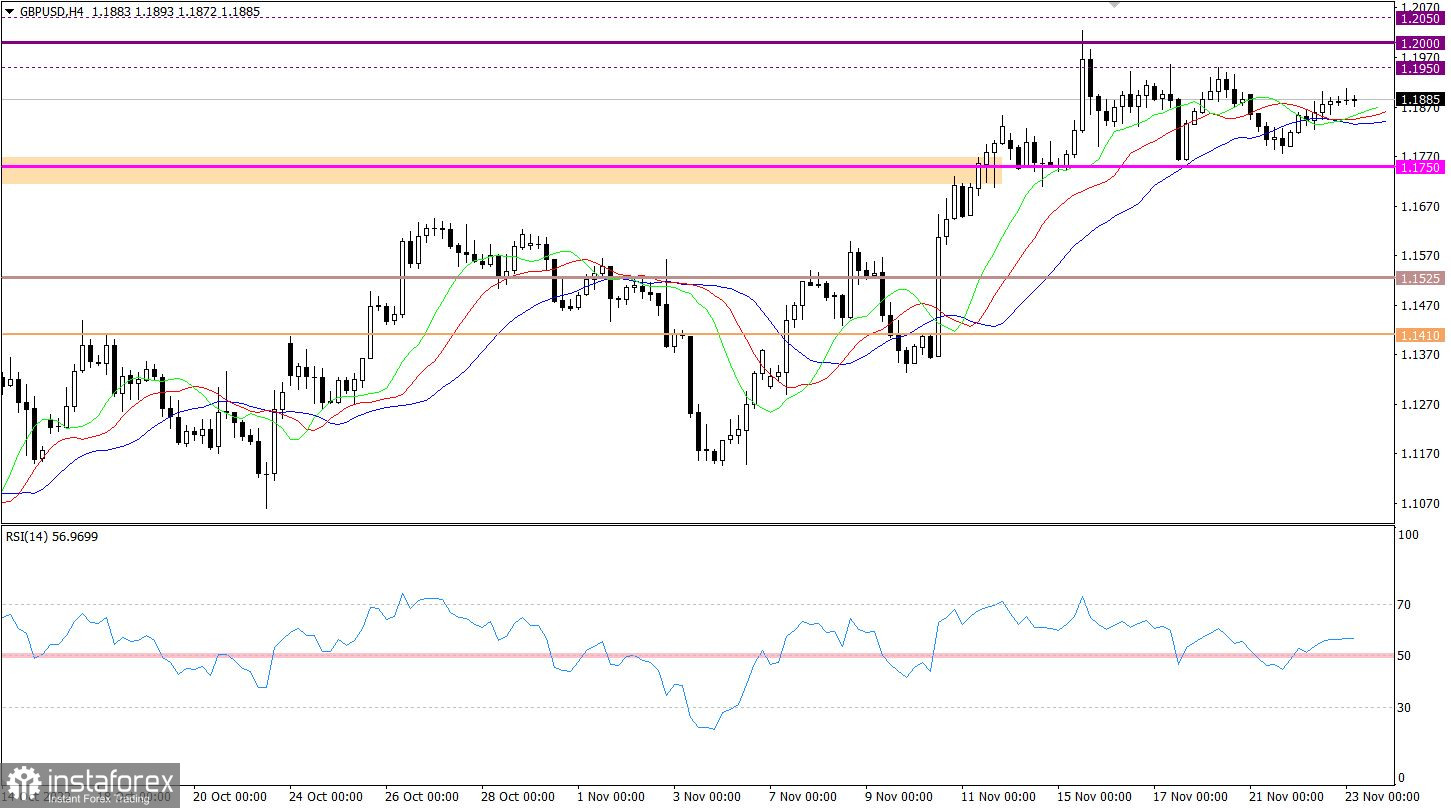

The pound/dollar pair has been hovering within the sideways channel of 1.1750/1.1950 for a week already. Although the range is wide, the pair remains stagnant. The range was formed when the pair was rising from the low of the downtrend.

On the four-hour chart, the RSI technical indicator is hovering along the mid line 50, which proves stagnation. On the daily chart, the indicator is in the upper area of 50/70, which points to an upward cycle.

On the four-hour chart, the Alligator's MAs are intersecting each other, which corresponds to the sideways movement. On the daily chart, the indicator is ignoring the flat movement. That is why MAs are headed upward.

Outlook

Under the current conditions, traders should remain focused on the limits of the range. It means that the price rebound from either limit is a temporary strategy. The breakout approach is still the main one as it may indicate a further movement of the quote.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, the indicators are providing mixed signals. In the mid-term period, indicators are pointing to an upward cycle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română