A new report by Coingecko released on Monday outlines the reasons for the collapse of FTX.

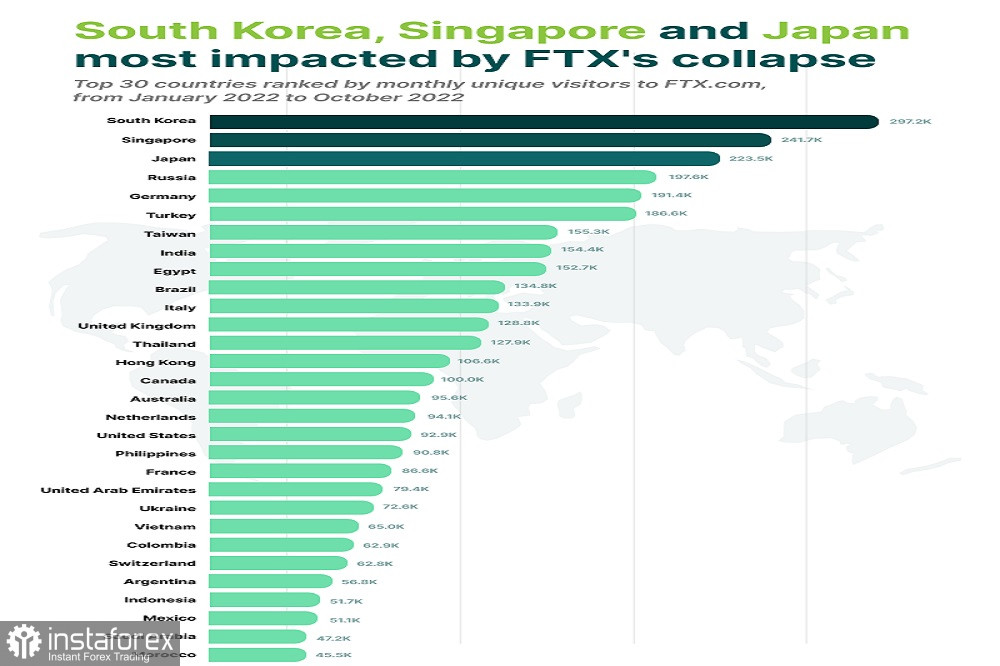

The report compiled the total number of monthly visits to FTX.com by users from 30 countries between January and October 2022. It became clear that users from East Asia were among the most numerous and active users of the platform: 297,200 visits per month from South Korea, 241,700 from Singapore and 223,500 from Japan, accounting for almost 16% of the exchange traffic.

Russian users took fourth place with almost 200,000 visits per month, while Turkey and Germany approached 190,000, rounding out the top six.

Users from the UK visited the exchange an average of 129,000 times a month, which put them in 12th place. Canadians visited the site 100,000 times a month, which translates to 15th place, while Australians ranked 16th with 96,000 visits.

The US was in 18th place, and their number of user visits per month may seem low at 93,000, but US clients were encouraged to use FTX.US for their trading, so the vast majority of US user traffic is not included in the report.

South Korea, a country of 52 million people accounting for 6.1% of total traffic, was the hardest hit by the collapse of FTX. The exchange's bankruptcy led the South Korean government to accelerate the country's new Digital Asset Base Act (DABA), a comprehensive regulatory framework drafted in June 2022 following the collapse of cryptocurrency firm Terra in May.

"As the market fell due to global austerity, Terra-Luna, Celsius and FTX failed one after another, making it a year of declining trust," Lee Myung-soon, senior vice president of the Financial Supervisory Service (FSS), said last week.

Kim So-Young, vice chairman of South Korea's Financial Services Commission (FSC), also confirmed that due to the urgency of protecting users, it would be better for the country to quickly introduce minimum regulatory standards and add them later, rather than wait for international standards to be agreed upon. DABA is expected to be completed in 2023.

Singapore is recognized as a major cryptocurrency hub in Asia and accounts for 5% of FTX.com's global traffic despite having a population of only 5.5 million. When Binance shut down in the island nation in December 2021, many of its users switched to FTX.

Late last week, Singapore-based state holding company Temasek wrote off its entire $275 million stake in FTX after it said their eight-month due diligence process on the firm raised no red flags.

Japanese users represented 4.6% of FTX.com's global traffic.

On November 15, Japanese investment giant SoftBank announced that it would write off all of its $100 million investment in FTX they made earlier this year.

On the same day, Japanese crypto exchange Liquid also suspended withdrawals from its platform. FTX bought Liquid in February 2022 to support FTX's latest entry into the Japanese market, as the deal meant the exchange gained access to Liquid's type 1 financial instrument business license.

On November 10, the Japan Financial Services Agency issued an order to FTX Japan to cease business operations and hold assets.

Since the FTX.com exchange went out of business and is under bankruptcy protection, the biggest beneficiaries of user traffic have been rival platforms Binance and OKX. As of November 13, Binance has increased its market share by 7% to a dominant 64% of the total among the top 10 cryptocurrency exchanges. The market share of OKX increased by 1.1% over the same period, from 11.9% to 13%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română