Analysis of trades and tips for trading GBP

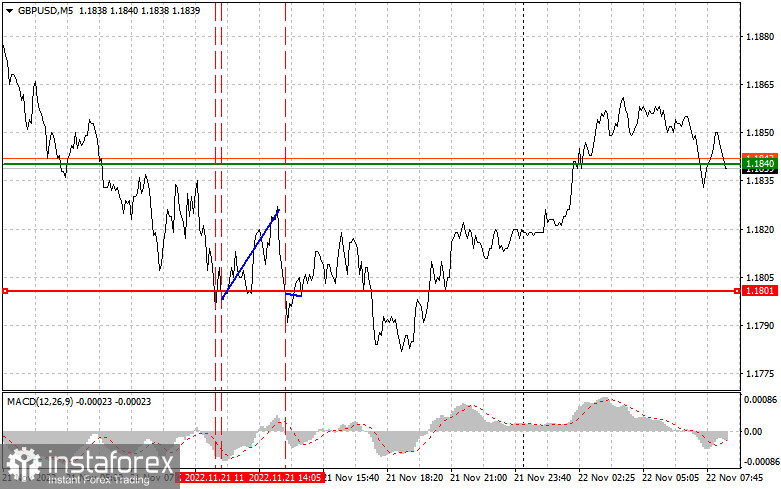

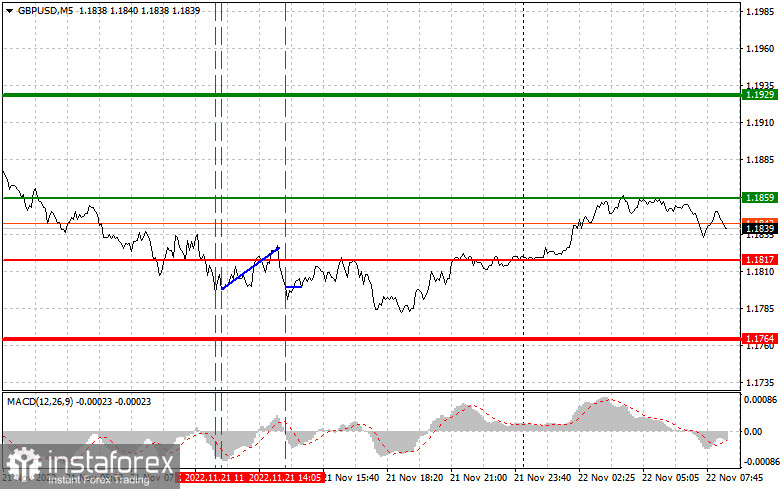

A test of 1.1801 occurred at a time when the MACD indicator declined significantly from the zero level. In my opinion, it limited the downward movement of the pair. For this reason, the implementation of scenario No. 2 for long positions looked more likely. Another test of 1.1801 after a short period of time, which was important for confirming the signal, took place at a time when the MACD already escaped the oversold zone. It could have led to an upward correction of the pair. Thus, I opened long positions on the pound sterling. Shortly after, it grew by about 35 pips.

BoE Deputy Governor of the Financial Stability Jon Cunliffe delivered a speech yesterday. However, it has no impact on market sentiment. The pair remained stuck in the sideways channel. It is expected to move in the same range today. In the morning, public sector net borrowing data was revealed. This report will hardly affect the trajectory of the pair as well as data on the UK public finances. In the afternoon, there will also be several economic reports, namely the Redbook Index and the Richmond Fed Manufacturing Index. However, traders are likely to ignore them as they are anticipating the speeches of Fed policymakers Loretta Mester and James Bullard. Not long ago, other Fed members said that it is time to consider a pause in monetary tightening. They fear that further tightening could push the economy into a recession. If Mester and Bullard also hint at a possible slowdown in rate hikes, the pound sterling will definitely rise against the US dollar.

Buy signal

Scenario No.1: we could buy the pound sterling today if the price reaches 1.1859 plotted by the green line on the chart with the target at 1.1929 (thicker green line on the chart). I would recommend leaving the market at 1.1929 and then selling the pound sterling in the opposite direction, bearing in mind a 30-35 pip downward move from the market entry point. The pair is likely to rise as bears are still unable to push it to the lows of last week. Important! Before opening long positions, make sure that MACD is above the zero mark and it has just started to climb from it.

Scenario No.2: it is also possible to buy the pound sterling today if the price approaches 1.1817. At this moment the MACD indicator should be in the oversold area. It could limit the downward potential of the pair. It may also trigger an upward reversal of the market. The pair is expected to grow to the opposite levels of 1.1859 and 1.1929.

Sell signal

Scenario No.1: We could sell the pound sterling if the price hits 1.0228 plotted by the red line on the chart. If so, there might be a sharp drop. The 1.0183 level could serve as the target where I recommend leaving the market and buying the pound sterling in the opposite direction, bearing in mind a 20-25 pip upward move. The pressure on the pair could return only due to negative economic reports. Important! Before opening short positions, make sure that MACD is below the zero line and it has just started beginning to decline from it.

Scenario No.2: it is also possible to sell the pound sterling today if the price decreases to 1.1859. At this moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It could also lead to a downward reversal of the market. The pair is projected to decline to the opposite levels of 1.1817 and 1.1764.

What's on the chart

A thin green line is a key level where you can place long positions on GBP/USD.

A thick green line is the target price as the quote is unlikely to move above it.

A thin red line is a level where you can place short positions on GBP/USD.

A thick red line is the target price as the quote is unlikely to move below it.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place Stop Loss orders to minimize losses. Without placing Stop Loss orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română