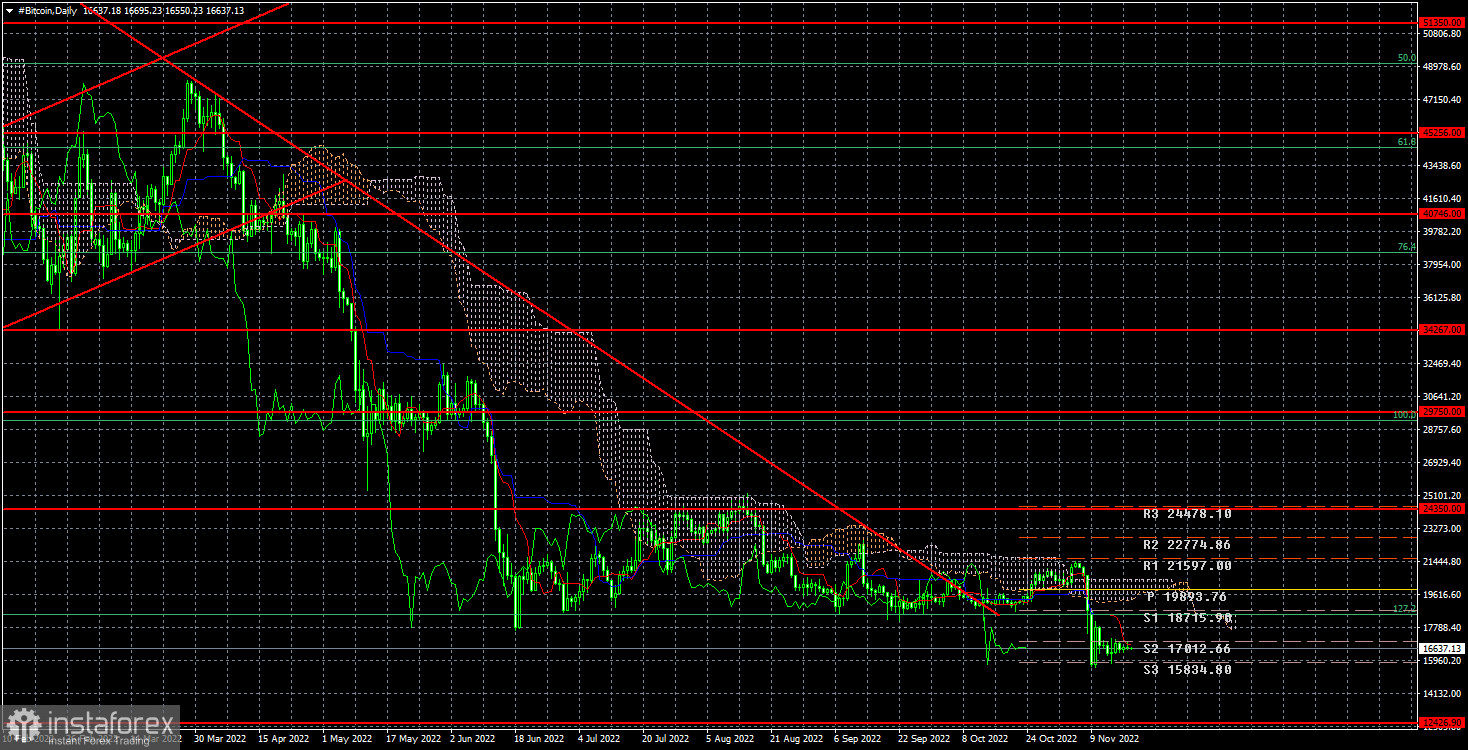

Bitcoin is currently trading at 127.2% Fibonacci, or $18,500. Since this consolidation took place more than a week ago, the quotes have essentially remained stationary at around $ 16,600 per coin. As a result, the narrative we have seen this year is repeated. For several weeks or months, Bitcoin trades in an outright flat, then drops sharply before returning to an outright flat. Therefore, if we wait for at least a few more weeks of flat, we will be surprised. This type of movement, however, has no bearing on the overall forecast for the main cryptocurrency. Bitcoin will continue to decline, and the further it can fall, the longer it stays at its current low price.

As previously stated, the current bitcoin price is less than the production cost. Large mining companies can undoubtedly afford to operate at a loss for a while. Alternatively, do not sell the received "bitcoin" at the current rate. But eventually, the cash reserves that make it possible to survive and keep mining will run out. What comes next? Borrow money? And if bitcoin remains at its current price or drops further? A new bankruptcy wave? We predict that mining activity will gradually decline. As a result, there will be less interest in and demand for bitcoin and other cryptocurrencies. Although they have never indeed been an "alternative to fiat money," many people think that centralization and regulation are not all that bad in times of collapse.

Look at how much the value of the euro has dropped over the last two years - by about 25 cents. But how much are 25 cents? This represents 20% of the euro's value relative to the dollar. Bitcoin has lost 75% of its value in exactly one year, and it may decline further. Is a regulatory body still needed for Bitcoin? Or, if not, everyone should be prepared for the possibility that their asset could decline by as much as 80–90% at any time. And it can occur much more quickly than most people think. The unwavering belief that bitcoin will continue to grow indefinitely results in massive losses for many.

The "bitcoin" quotes finally made a successful attempt to surpass the level of $18,500 for a 24-hour period. Now that we have a target of $12,426, the fall may continue. As we previously stated, since the price was concurrently in a side channel, crossing the downward trend line does not signify the end of the "bearish" trend. The quotes may drop further as the lower channel limit has been reached.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română