According to the data published yesterday, inflation in the eurozone has been accelerating. The consumer price index rose by 1.5% in October and by 10.6% year-on-year. Energy products (+4.44%), as well as food, alcohol and tobacco (+2.74%) increased more dramatically. The core HICP index, which excludes volatile prices for food, energy, alcohol and tobacco, was 5% year-on-year in October. Obviously, rising consumer price inflation will reinforce the ECB hawkish rhetoric.

While "the risk of recession has increased," "we expect to raise rates further to the levels needed to ensure that inflation returns to our 2% medium-term target in a timely manner. Inflation in the euro area is far too high," ECB President Christine Lagarde said today, speaking at the European Banking Congress in Frankfurt. "Interest rates are, and will remain, the main tool for adjusting our policy stance," Lagarde concluded.

Judging by these statements, further interest rate hikes in the eurozone are likely. However, it is not clear yet whether this move will lead to further growth of EUR/USD, though in cross currency pairs the euro is likely to strengthen for some time.

Moreover, the weekly data on the US labor market were published yesterday. They turned out to be positive. The number of initial jobless claims rose by 222,000. This is lower than the forecasted 225,000 increase and the previous figure of 226,000. The total number of US citizens receiving unemployment benefits fell from 1.564 million to 1.526 million.

Christopher Waller, a member of the Federal Reserve Board of Governors, recently said that he was considering the possibility of raising the interest rate by 50.0 points at the next meeting, i.e. in December. At the same time, President of the Federal Reserve Bank of St. Louis James Bullard stressed that a lot of work should be done before inflation targets could be met. He believes the Fed's previous moves have not yet resulted in a significant slowdown in inflation.

We discussed the dollar's near-term prospects in today's and recent reviews (DXY: Waiting for a signal. To Buy?).

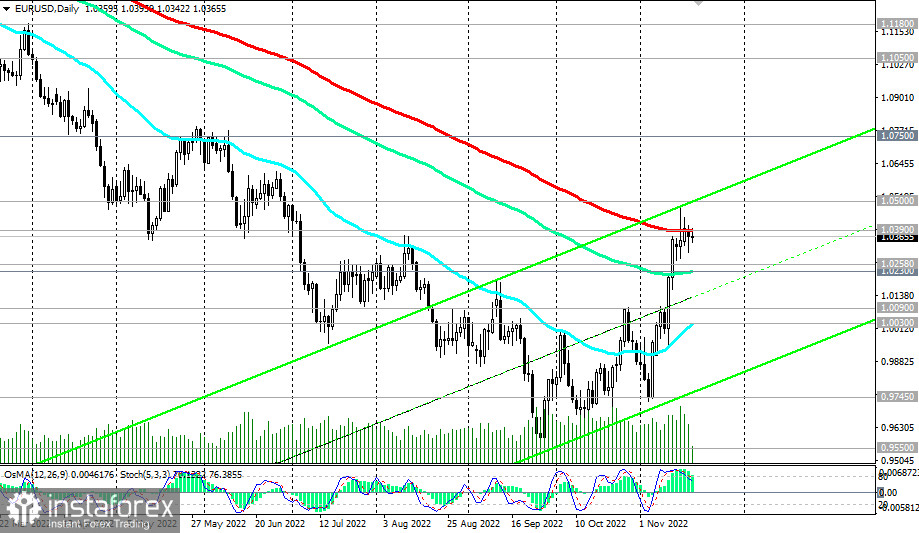

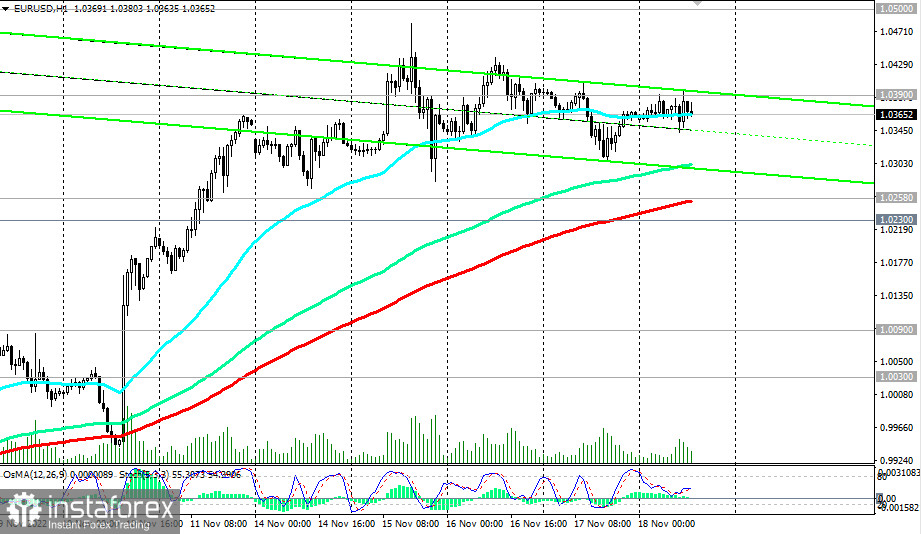

As for the US dollar's major rival on the foreign exchange market, the EUR/USD pair was trading near 1.0365 when this article was published. It failed to overcome the key resistance level of 1.0390 again (EMA200 on the daily chart). The EUR/USD pair remains in a global bear market below this resistance level. However, to resume opening short positions the price should fall below the support levels of 1.0258 (EMA200 on the 1-hour chart), 1.0230 (EMA50 on the daily chart). Short positions are again preferable below these levels (also see our review and tips from yesterday).

Support levels: 1.0258, 1.0230, 1.0090, 1.0020, 1.0000, 0.9745, 0.9700, 0.9600, 0.9535, 0.9500, 0.9400, 0.9300, 0.9200, 0.9000

Resistance levels: 1.0390, 1.0500

*) For the events of the coming week, see the review Weekly major economic events 21.11.2022 - 27.11.2022.

Trading Tips

Sell Stop 1.0290. Stop-Loss 1.0420. Take-Profit 1.0258, 1.0230, 1.0090, 1.0020, 1.0000, 0.9745, 0.9700, 0.9600, 0.9535, 0.9500, 0.9400, 0.9300, 0.9200, 0.9000

Buy Stop 1.0420. Stop-Loss 1.0290. Take-Profit 1.0490, 1.0500

*) Our accounts in the ForexCopy system -> Insta79,Insta211.

**) Links to third-party Live-monitoring system -> Insta79, InstaCopy11.

***) for strategies and training -> https://t.me/fxrealist

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română