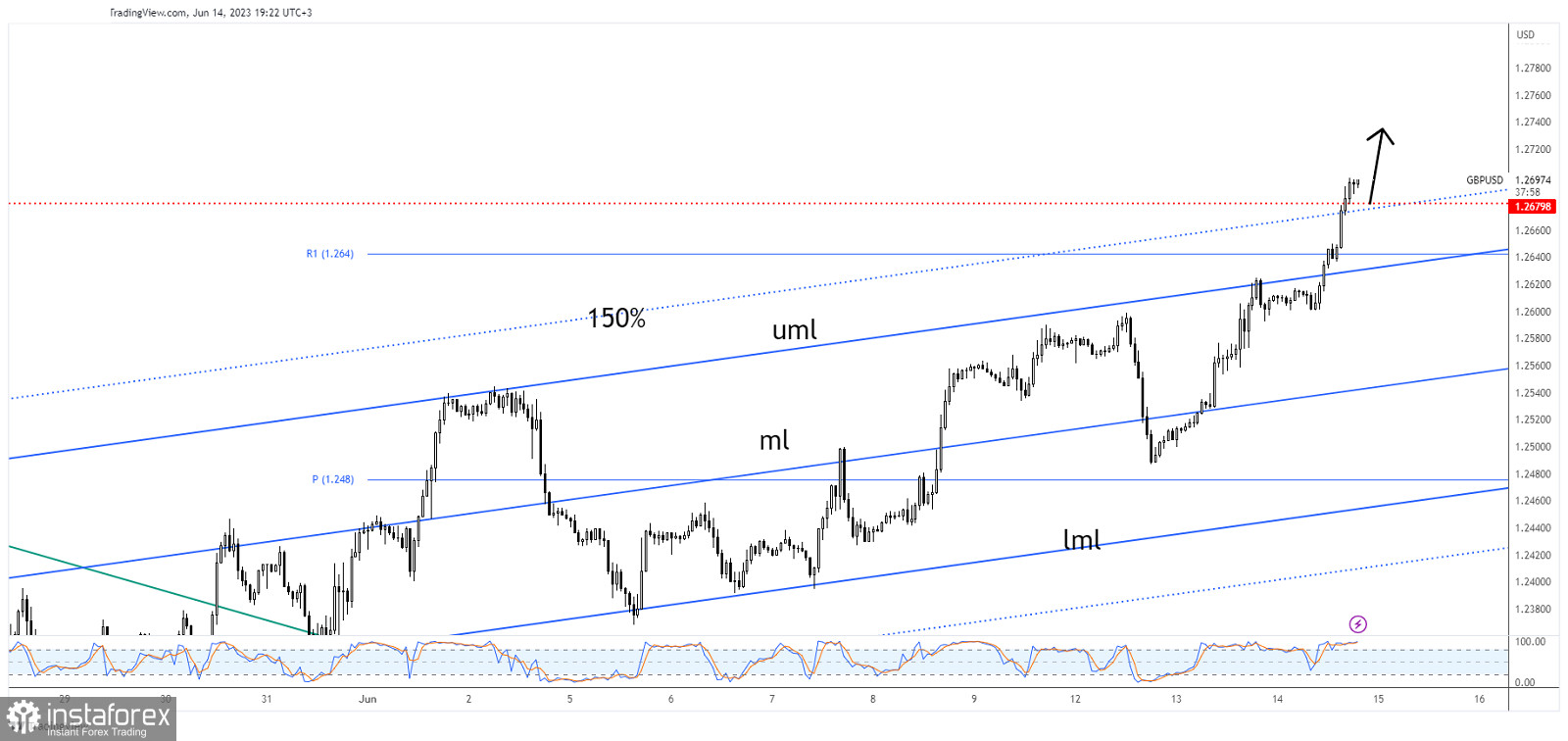

The GBP/USD pair rallied in the short term as the USD weakened by sell-offs. The bias is bullish, so further growth is natural despite temporary retreats. It's trading at 1.2692 at the time of writing.

Fundamentally, the current rally was expected after the US reported lower inflation in the last trading session. The CPI m/m increased only by 0.1% versus the 0.2% growth estimated, while CPI y/y came in at 4.0%, less versus the 4.1% growth forecasted. Earlier today, the USD took a hit from the US PPI which reported a 0.3% drop versus the 0.1% drop estimated. In the short term, the USD depreciated versus its rivals also because the FED is expected to keep the Federal Funds Rate at 5.25% tonight.

GBP/USD Strong Buyers!

Technically, the GBP/USD pair ignored the resistance levels signaling strong buyers and an upside continuation. Now, it has taken out the 1.2679 historical level and the 150% Fibonacci line (dynamic resistance).

Still, after its amazing growth, we cannot exclude a temporary drop. The rate could come back to test and retest the broken levels before jumping higher.

GBP/USD Forecast!

The bias is bullish, but don't forget that the FOMC should bring sharp movements later. Consolidating above the 1.2679 and above the 150% line, testing and retesting these levels could be seen as a new buying opportunity.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română