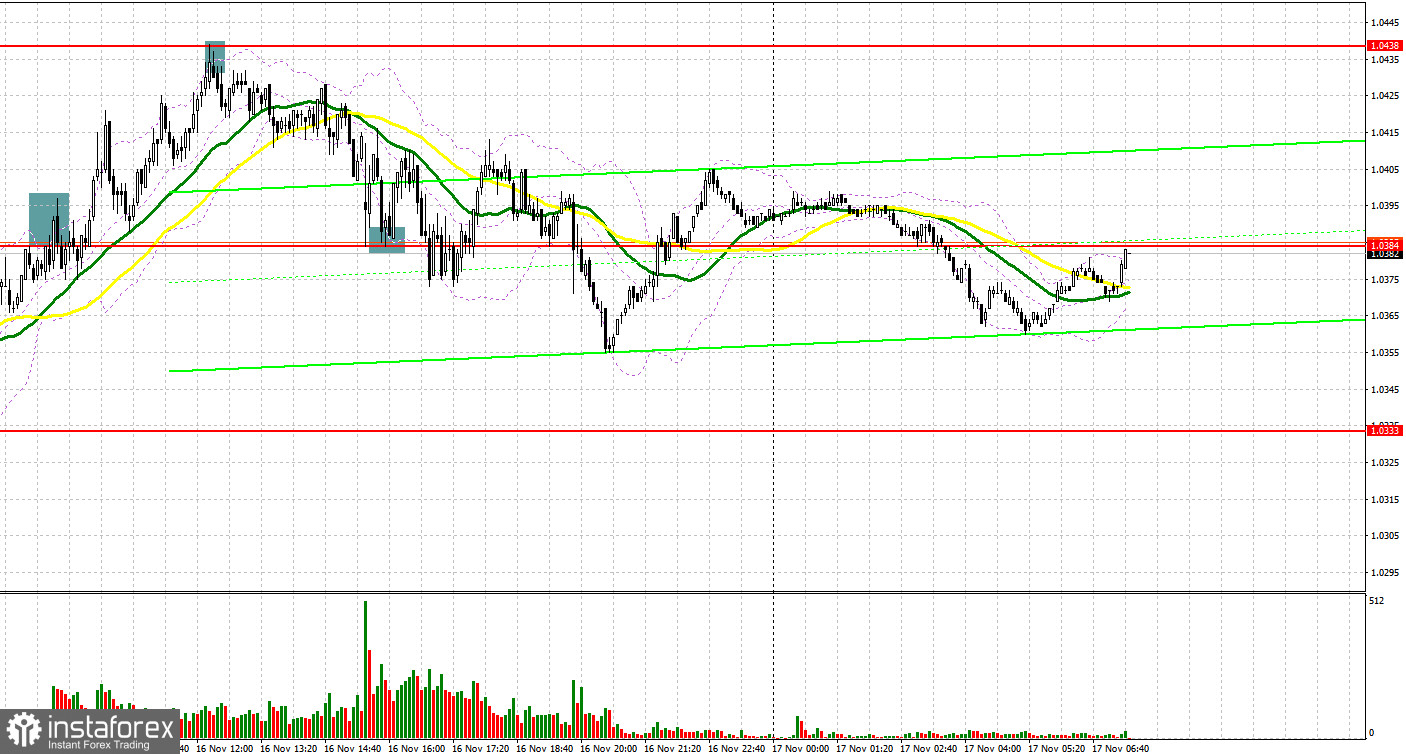

There were several entry signals yesterday. Let us look at the 5-minute chart and figure out what happened. In my morning review, I highlighted the level of 1.0384 and recommended making decisions with this level in mind. The pair quickly rose to this level in the first half of the day. Bulls retreated afterwards, resulting in the pair performing a false breakout and creating a sell signal. However, EUR/USD did not come under pressure afterwards and surged towards 1.0438, triggering Stop Loss orders of bearish traders. The false breakout of 1.0438 was a great opportunity to sell the euro at a favorable price. The pair retraced to 1.0384, and traders gained about 50 pips. Bulls opened some long positions during a false breakout below 1.0384. However, EUR/USD reversed downwards after moving up by 15 pips, forcing traders to close these positions to break even.

When to open long positions on EUR/USD:

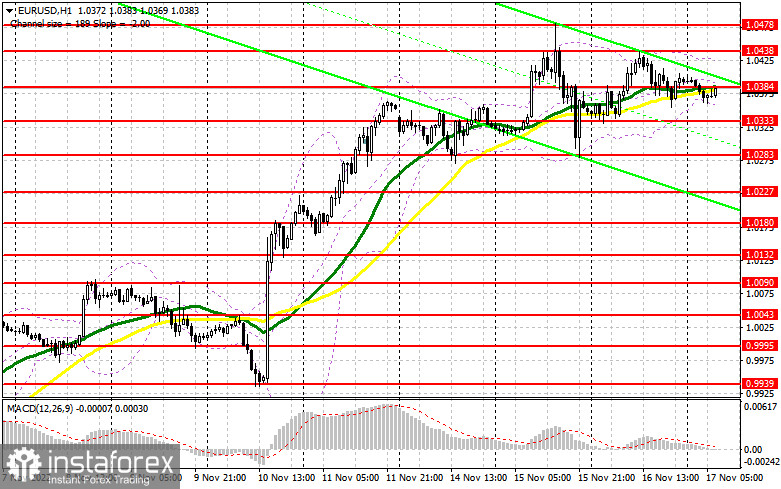

Strong US retail sales data have likely influenced traders and the US dollar's prospects. This report clearly signalled that inflation continues to rise in the US and that the Federal Reserve will have to put great effort into bringing it under control, even if it means slowing down the economy with rate hikes. Today, the CPI data will be released in the EU. It is forecasted to remain at 10.7%, which would be a good sign for the European Central Bank as it actively fights soaring prices. If inflation continues to rise, it would be another case in favor of interest rate increases, making euro purchases attractive. If EUR/USD slumps after the data is released, traders are recommended to open long positions if the pair performs a false breakout near the closest support level of 1.0333. The false breakout will help ensure that major bullish players are in the market and will return the pair to 1.0384, where the pair is currently trading. If EUR/USD breaks through this level and performs a downward test, I would expect it to rise towards the high of 1.0438 once again. Many traders sold EUR at that level yesterday. Above this range lies the monthly high of 1.0478. If EUR/USD breaks through this level as well, it will trigger Stop Loss orders of bears and create an additional buy signal. The pair may jump towards into the 1.0525 area, which will extend the bullish trend at the end of the week. On the other hand, if EUR/USD slides down and bulls are inactive at 1.0333, pressure on the euro will increase slightly. This will push the euro down towards the next support level of 1.0283. This level is the lower boundary of the horizontal channel that might form soon. Long positions in this area should only be opened during false breakouts. You can buy EUR/USD immediately if it bounces from 1.0227 or 1.0180 keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Bears are putting pressure on the euro and obviously do not want the pair to hit monthly highs. The eurozone inflation data will be significant for the pair today. It is unlikely that anything will change drastically in the market before the CPI data is published. Personally, I expect inflation to increase, which will create some problems for euro bears. The only thing that bearish traders can expect is the formation of a false breakdown in the nearest resistance zone at 1.0384. This will create an entry signal and will allow the pair to go down to the support at 1.0333. EUR/USD will consolidate below this range only if ECB President Christine Lagarde, who is scheduled to speak this afternoon, makes a very dovish statement. An upward retest of 1.0333 will allow selling EUR/USD, which will trigger Stop Loss orders of bulls and send the pair into a larger decline to the 1.0283 area. Euro buyers will become active again in this area and will begin to take advantage of the drop. The farthest target will be at 1.0227, where I recommend taking profits. If EUR/USD moves up during the European session, and bears are idle at 1.0384, the demand for the pair will increase, which may extend the bull market. Then the pair may hit 1.0438. In this case, I advise you not to rush with going short on EUR/USD and open short positions there only if a false breakout is formed. You can sell the pair immediately if it rebounds from the high of 1.0478 or from 1.0525, keeping in mind a downward intraday correction of 30-35 pips.

COT report:

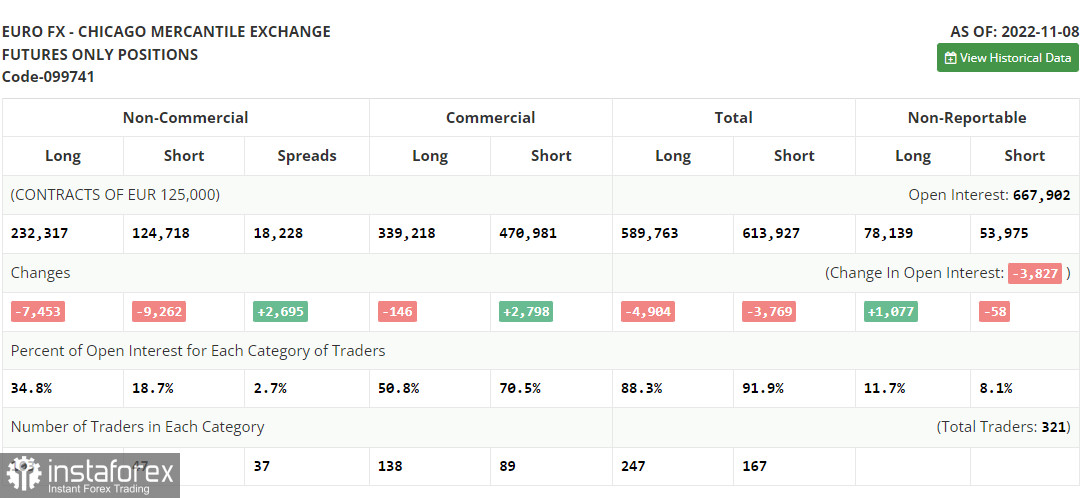

According to the Commitment of Traders (COT) report for November 8, both short and long positions increased. These data do not take into account the market situation after the release of US inflation data, so you should not trust the current COT data much. Price growth merely slowed down – it did not decrease. Even though US inflation slowed down to a larger degree than previously anticipated, the Federal Reserve will continue to follow its policy and raise interest rates. The Fed funds rate is expected to be increased by 0.5%-0.75% in December. As for the euro, the demand for risky assets has indeed grown slightly. However, besides the Fed potentially slowing down monetary tightening, another key factor is the further increase in interest rates in the eurozone. More European politicians have stated recently that interest rates should be hiked further to deal with rising inflation. However, if the EU economy continues to contract at a rapid pace, aggressive rate hikes can be halted, which will limit the upward potential of the pair in the medium term. The COT report indicated that long non-commercial positions decreased by 7,453 to 232,317, while short non-commercial positions fell by 9,262 to 124,718. At the end of the week, the total non-commercial net position remained positive and stood at 107,599 against 105,790 a week ago. This indicates that investors continue to take advantage of the situation and buy cheap euro even above parity. They also accumulate long positions, expecting the crisis to end and the pair to recover in the long term. The weekly closing price increased to 1.0104 from 0.9918.

Indicators' signals:

Moving averages

Trading is carried out near 30-day and 50-day moving averages, which indicates that market participants are uncertain.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD moves up, the indicator's upper border at 1.0430 will serve as support. If the pair slides down, the lower border at 1.0360 will serve as support.

Description of indicators

Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart. Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart. MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9 Bollinger Bands (Bollinger Bands). Period 20 Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. Total non-commercial net position is the difference between the short and long positions of non-commercial traders. English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română