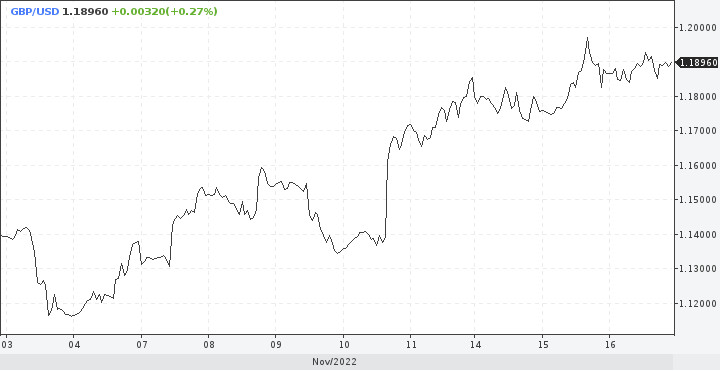

Positions on the pound look attractive, the GBP/USD pair again tested the resistance of 1.1900 on Wednesday. What does this mean and what are the future prospects?

There are doubts about the continuation of the bullish trend, as the fundamental picture for the UK contradicts the current rally. In theory, the sterling should have fallen after the release of the consumer price index.

Yes, rising prices should put upward pressure on the pound, as it suggests further tightening of policy by the Bank of England. As we know, the British currency interprets the CPI somewhat differently. Stronger inflation is seen as negative as rising prices and interest rates will eat into England's growth potential.

Thus, signals for a slowdown in inflationary pressure in the country will be positive for bulls on the pound.

The British economy, accustomed to stagflation, is suffering hard from rising prices. This creates unfavorable conditions for the pound.

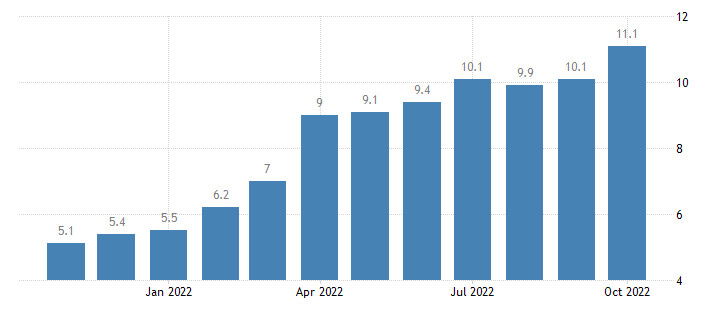

The headline CPI was 11.1% y/y in October, accelerating from 10.1% in September and well above the consensus estimate of 10.7%.

Core inflation, which better reflects domestic inflationary pressures, rose 6.5% in October, also worse than the 6.5% forecast.

All this is very far from the central bank's target of 2% and means that there is no other choice but to keep raising interest rates.

Ahead of the release of the CPI, markets were estimating the likelihood of a rate hike in England in December by 50 bps at 65%. At the same time, the probability of a rate increase by 75 bps was estimated at 35%.

After the release of the data, the probability of an increase of 50 bps and 75 bps is 50% in both cases. Consequently, the markets have raised their expectations of a more decisive response to inflation from the central bank.

BoE representatives can't pretend that price pressures are easing or will ease next month, analysts say emotionally. Is this really the case? Maybe the central bank has a fundamentally different vision of the situation. The December meeting will show.

The pound has another test

The economic outlook for the UK remains under threat due to rising prices and interest rates. Meanwhile, it will hurt even more on Thursday when the United Kingdom Chancellor of the Exchequer, Jeremy Hunt, announces a new round of tax hikes and spending cuts.

If we compare two events - another inflation record and the update of the UK government budget, of course, the budget will become more significant for expectations of a rate hike and, consequently, the pound.

Do not forget about the dollar's influence. Sterling received strong external support from the sudden fall of the US currency in recent days after the reduction of inflationary pressures in the US. Most of the recent strengthening still should be attributed not to internal fundamental factors, but to external events.

The global context will continue to be key for the pound. Not the next few days, but before the end of the year.

About the dollar

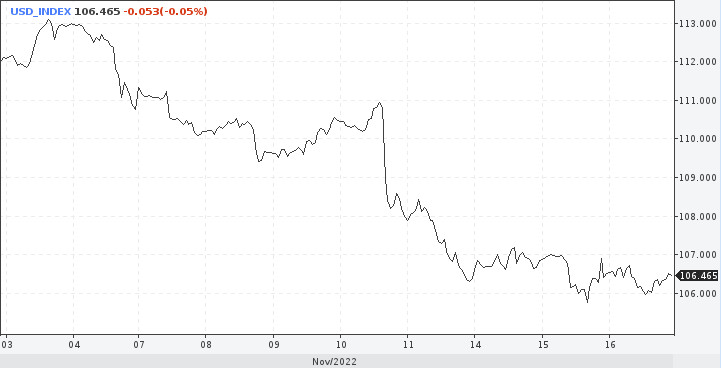

The dollar's sharp fall over the past week looks somewhat awkward. It is hard to believe that the world's main currency will give up so quickly without a fight, while the Federal Reserve does not yet plan to complete the cycle of raising rates.

A similar opinion is shared by Capital Markets. Economists see the correction as protracted and exaggerated. The dollar should recover much of its recent decline.

"The scale of the dollar decline is overstated, we doubt it can be sustained," Bank of Montreal analysts wrote.

The US currency index is expected to rise by about 3% in the near term and by about 4% by the end of the year.

On Wednesday, the dollar continued to decline against a basket of major currencies. Fluctuations are within the mark of 106.00. Investors continue to bet that the Fed will soon slow down its aggressive tightening campaign. Softer-than-expected inflation readings of late and early signals from senior central bank officials reinforced that sentiment.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română