FTX may have more than 1 million creditors, a new bankruptcy filing by the company said. This statement showcases the enormous influence the exchange had on the crypto industry and proves that trader fears over the company's collapse were not unfounded. Earlier, FTX indicated that it had about 100,000 creditors.

In such cases, debtors are generally required to provide a list of the names and addresses of the top 20 unsecured creditors. However, given the scale of its debts, the group instead intends to file a list of the 50 largest creditors by the end of the week.

It remains unclear how many major investors and creditors FTX had. Recently, Chinese venture firm Sino Global Capital stated that its direct exposure to FTX was in "mid-seven figures held in custody."

Five new independent directors were appointed to each of FTX's main parent companies. Former Delaware district judge Joseph J. Farnan will serve as lead independent director. According to FTX's lawyers, the company has been in contact with "dozens" of regulators both in the US and overseas, including the US. Attorney's Office, the Securities and Exchange Commission, and the Commodity Futures Trading Commission.

The crypto industry has suffered major losses this year, with companies such as Celsius and Voyager Digital folding due to a liquidity crunch triggered by falling digital asset prices. In earlier bankruptcy cases, traders on similar platforms have been designated "unsecured creditors," meaning they'll likely be at the back of a long queue of entities seeking repayment.

Before its collapse, FTX offered amateur and professional investors spot crypto investing, as well as more complex derivatives trades. At its peak, the platform was valued by investors at $32 billion and had more than 1 million users. Several major crypto companies and exchanges have recently informed investors about their financial health.

On the technical side, Bitcoin has stabilized in the $16,800 area. Few are willing to go long on BTC even at this price. The key level at this point is the support level of $16,600. A breakout below this level would jeopardize Bitcoin's situation. If BTC increases, it could surge towards $17,400. After settling at this level it could break above the resistance at $18,101. If BTC breaks below the support at $16,630 under continuing pressure, it could push the cryptocurrency towards the low at $15,800 and open the way towards $14,650.

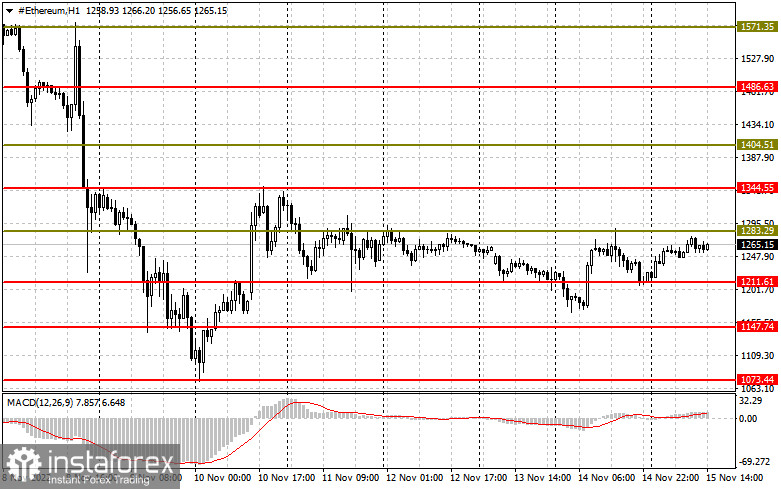

Ethereum's outlook is also not particularly good. ETH bulls remain focused on breaking above the closest resistance level of $1,280, which would influence the situation in the market significantly. ETH would need to settle above $1,280 to stabilize the situation and return balance. From there, Ethereum could rise towards $1,344, with a more distant target located at $1,404. Continuing pressure on the instrument and a breakout below $1,211 could send the instrument down towards the newly formed support level of $1,147. If ETH breaks through this level, it would slide down to the low of $1,073, opening the way towards hitting new yearly lows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română