EUR/USD

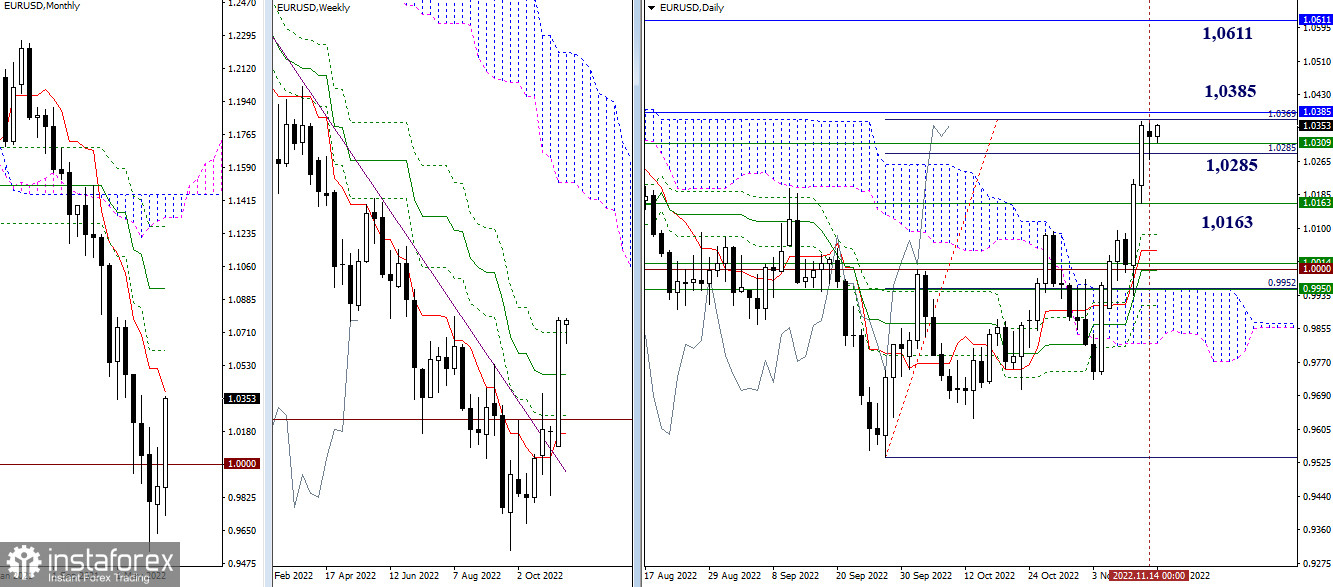

Higher timeframes

Bulls took a break on the first day of the new working week. The resumption of the rise, the update of the highs, and the breakdown of the resistances 1.0369–85 (daily target + monthly short-term trend) will allow us to consider new upward targets: the nearest can be noted at 1.0611 (weekly Fibo Kijun). If the current support (1.0309 - 1.0285) does not hold the situation now, then there will be a decline, where the main attention will be directed to support the weekly medium-term trend (1.0163).

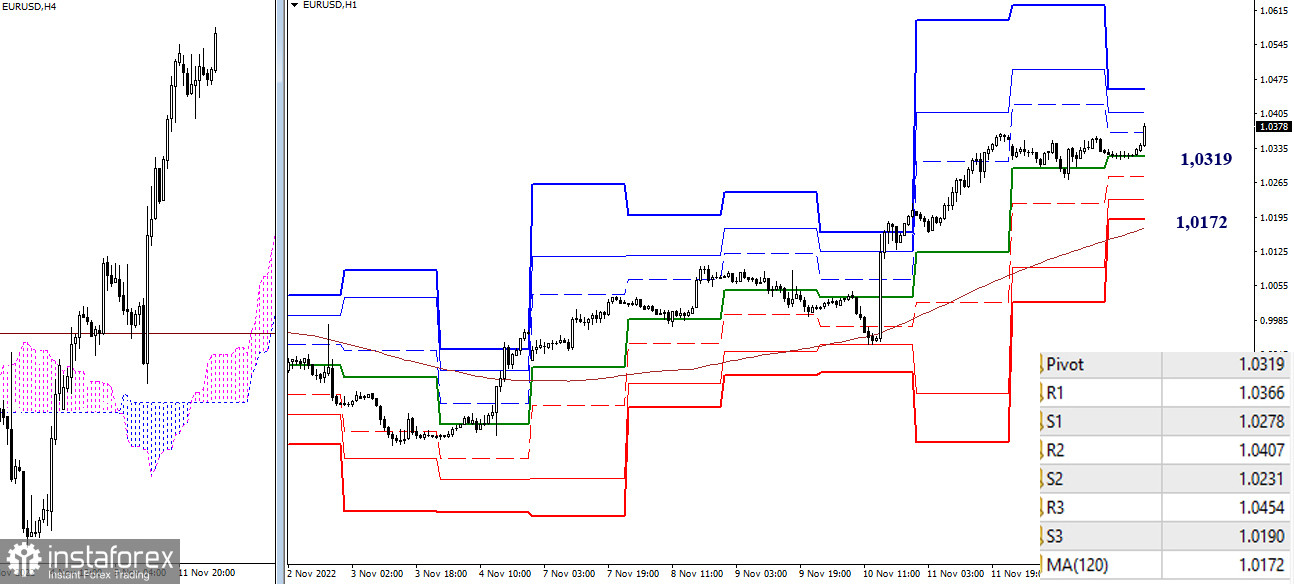

H4 – H1

On the lower timeframes, the main advantage belongs to bulls. Today they have updated the high of last week. Intraday benchmarks for the rise can now be noted at 1.0407 - 1.0454 (classic pivot points). For players to increase in this area, you need a reliable consolidation above. Today's key levels of the lower timeframes form supports located at 1.0319 (central pivot point of the day) and 1.0172 (weekly long-term trend). Intermediate supports between key levels in the current situation can be noted at 1.0278 – 1.0231 – 1.0190 (supports of classic pivot points).

***

GBP/USD

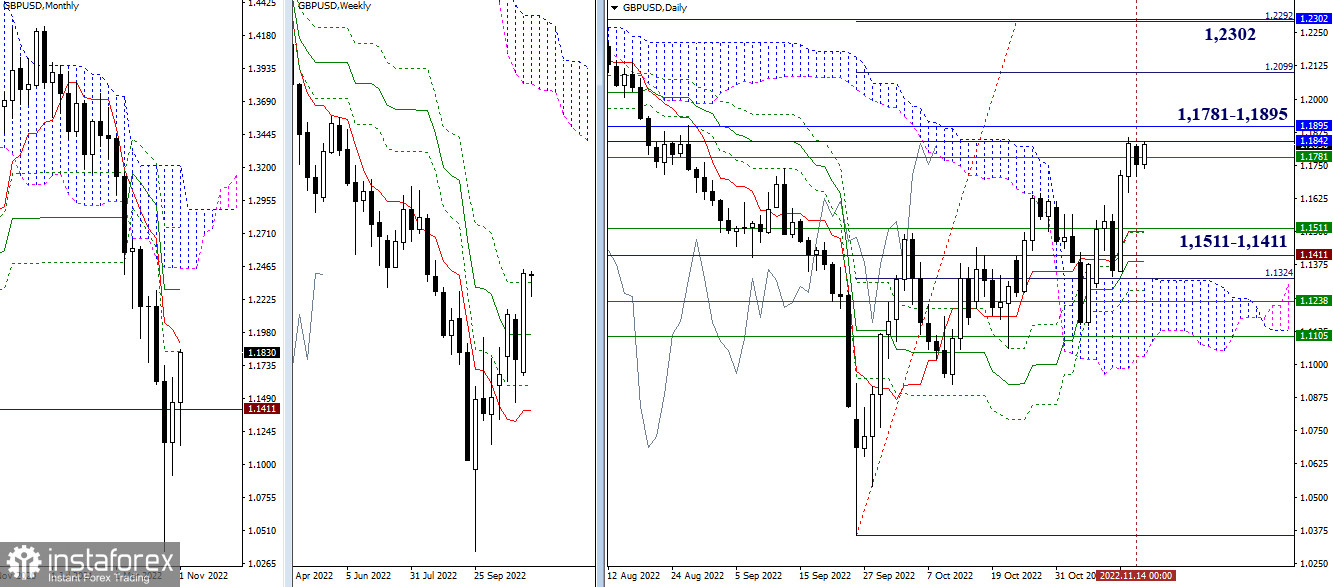

Higher timeframes

Over the past day, the situation has not changed significantly. Testing of a rather strong resistance zone 1.1781 - 1.1842 - 1.1895, which combines weekly and monthly levels, continues. The breakdown will open new prospects for bulls. The nearest upward target is the daily target for the breakout of the cloud (1.2099 - 1.2292), reinforced by the monthly medium-term trend (1.2302). In case this fails and a rebound from the met resistances forms, the movement can be directed to the levels passed earlier, which will now work as support 1.1511 - 1.1411.

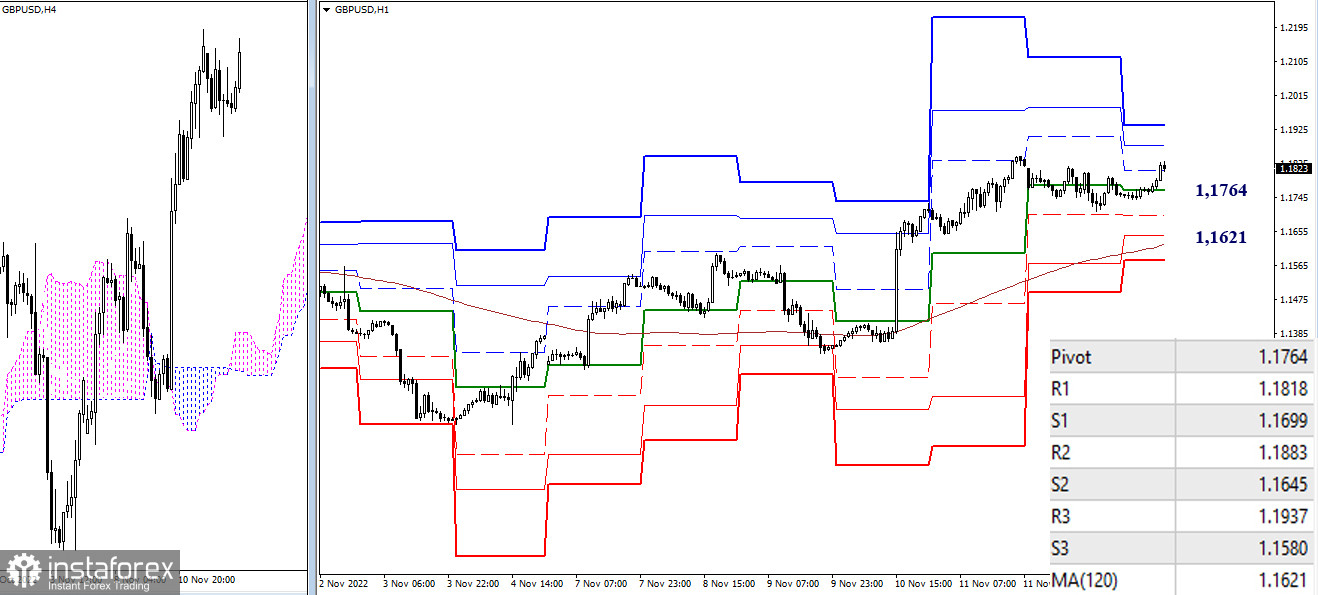

H4 – H1

The main advantage is now on the side of the bulls, but the pair is in the correction zone. Intraday benchmarks for the rise can be noted at 1.1883 - 1.1937 (resistance of classic pivot points). Today's key supports are at 1.1764 - 1.1621 (central pivot point + weekly long-term trend). Consolidation below can change the current balance of power in the lower timeframes.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română