Federal Reserve Governor Christopher Waller said at a conference in Sydney, "We're not softening...Quit paying attention to the pace and start paying attention to where the endpoint is going to be. Until we get inflation down, that endpoint is still a way out there."

On Sunday, speaking at a conference sponsored by UBS, Waller said that while the central bank is considering a slower rate hike, this should not be interpreted as softening its fight for price stability.

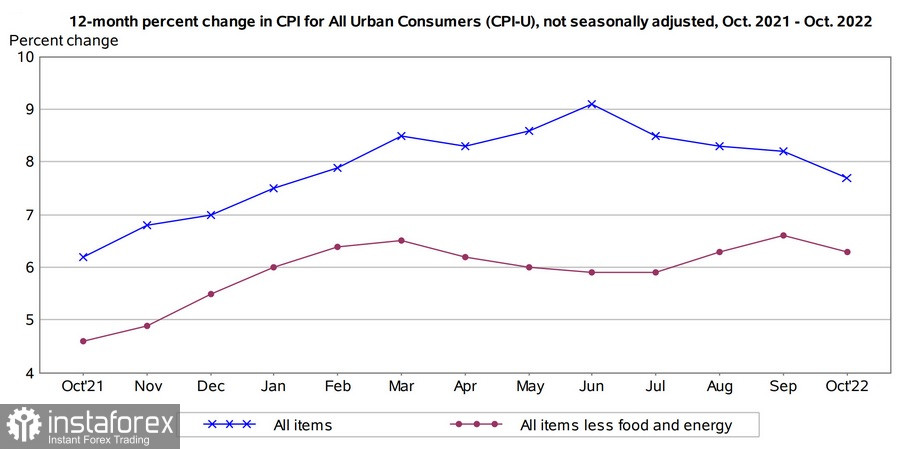

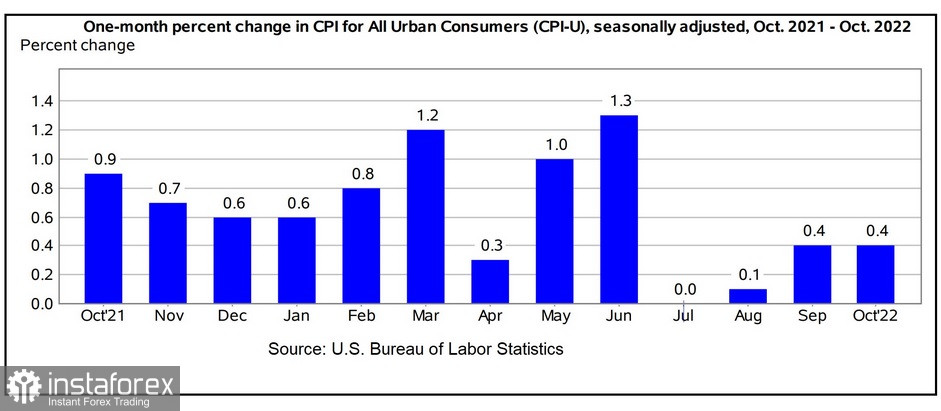

The table below shows the monthly CPI table from October 2021 to October 2022, published by the US Bureau of Labor Statistics. The CPI report last week showed that inflation eased slightly from 8.2% in September to 7.7% YoY in October. Inflation has been elevated for a long time, given that a year ago (October 2021), headline inflation was over 6%, and now, in 2022, the CPI is not down but rather higher than last Halloween. Now the public is realizing that instead, they were being treated to an ever-increasing cost of living.

While the Federal Reserve's aggressive rate hikes have certainly helped bring inflation down, the 1.4% decline that brought the CPI to 7.7% is still at a level not seen before 2021 for more than four decades. The CPI at 7.7% is far from the inflation target set by the Fed. The core CPI, which excludes food and energy costs, is over 6%, still three times the Fed's inflation target of 2%.

Dallas Fed President Lorie Logan said last week's report was a welcome relief but would not eliminate the need for further rate hikes, perhaps at a slower pace.

Currently, the probability of a 50 basis point rate hike at the December FOMC meeting continues to rise at an 85.4% probability, 5.2% more than the probability recorded by the CME FedWatch tool on Friday.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română