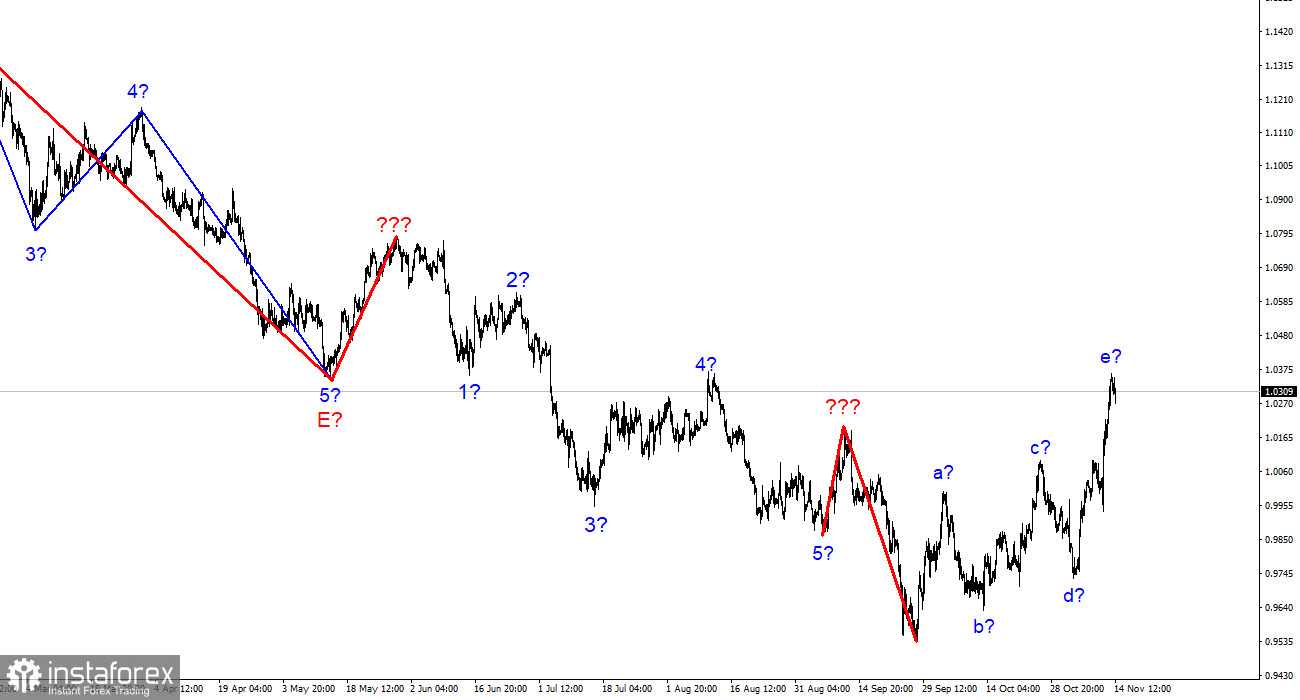

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes. The upward section of the trend continues its construction, but now it takes on a pronounced corrective form. Initially, I thought that three waves would be built up, but now it is obvious that there are five waves. Thus, we get a complex correction structure of waves a-b-c-d-e. If this assumption is correct, then the construction of this structure may be nearing its completion since the peak of wave e exceeds the peak of wave C. In this case, we are expected to build at least three waves, but if the last section of the trend is corrective, then the next one will most likely be impulsive. Therefore, I am preparing for a new, strong decline in the instrument. An unsuccessful attempt to break through the 1.0359 mark, corresponding to 261.8% Fibonacci, will indicate the market's readiness to sell.

The most important thing now is that the wave markings of the pound and the euro coincide. If you remember, I have repeatedly warned about the low probability of a scenario in which the euro and the pound will trade in different directions. Theoretically, this is certainly possible, but it rarely happens in practice. Now both instruments are presumably building corrective trend sections, which may be completed in the near future. Thus, the British dollar may also begin to decline within the framework of a new downward trend segment.

Has the time of the euro currency passed or not yet?

The euro/dollar instrument fell by 35 basis points on Monday. It is strange, but today I did not see a strong decrease in demand for the instrument, although such a scenario suggested itself after last week when the increase was several hundred points. Let me remind you that last week, not only the report on US inflation caused panic in the foreign exchange market but also several speeches by FOMC members, who hinted with all their might that the Fed would begin to slow down the pace of rate hikes in the near future. Together, these two factors caused a strong decline in demand for the US currency. However, a new week has begun, and the market needs new growth or decline factors.

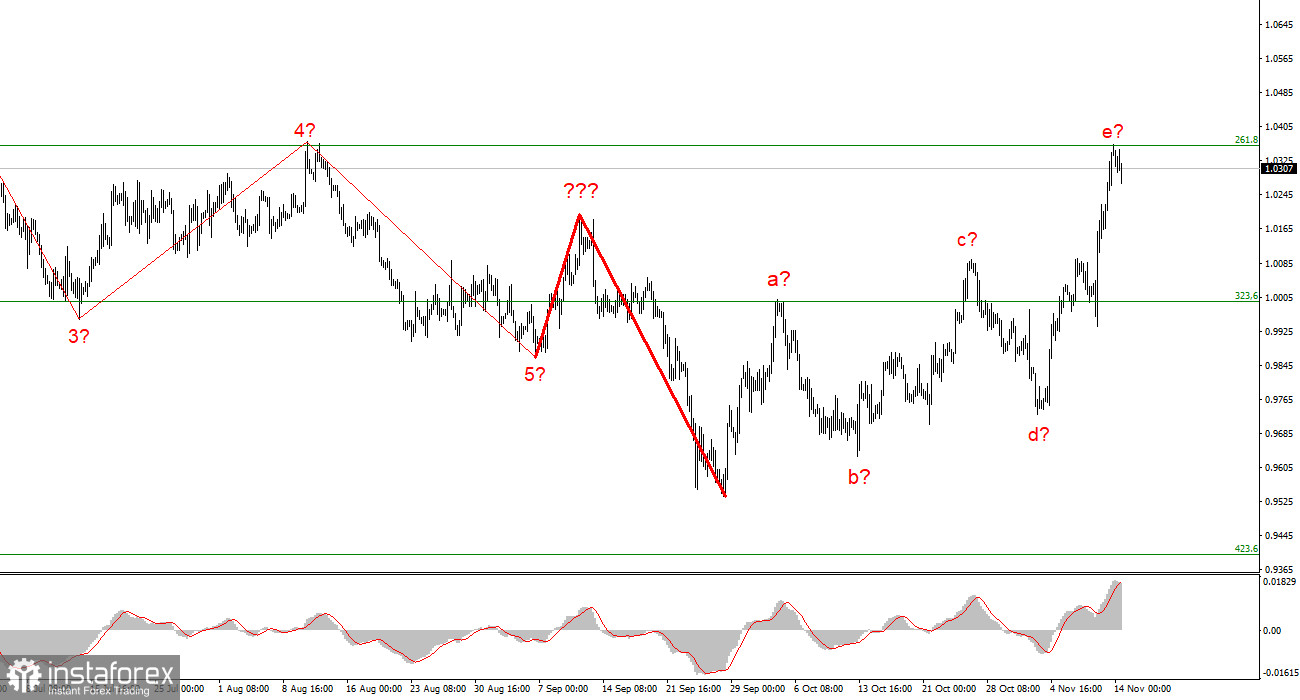

Currently, the wave pattern for the euro currency is close to ideal. Five upward correction waves were built, so at least a three-wave downward correction structure should be built. An unsuccessful attempt to break through the level of 261.8% indirectly indicates the readiness of the market for sales. However, as I have already said, the instrument practically stayed the same on Monday. The day is certainly still ongoing, but a successful attempt to break the 1.0359 mark will announce that the market is buying again. Today's only event was the release of the September report on industrial production in the European Union. Its value is 0.9% mom and 4.9% y/y. The market expected a weaker value but, at the same time, did not react to it in any way. The increase in quotations began later and looks very dangerous for the current wave markup. If the high demand for the euro continues, this may lead to a complication of the already upward trend section, which has recently begun.

General conclusions.

Based on the analysis, the construction of the upward trend section has become more complicated, consisting of five waves. It continues due to the inflation report and impartial statements by FOMC members. However, I cannot advise buying now since the wave marking still needs to imply a further increase. I recommend selling in case of an unsuccessful attempt to break through the 1.0359 mark with targets located near the estimated 0.9994 mark, which corresponds to 323.6% Fibonacci.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. We saw five upward waves, which are most likely the a-b-c-d-e structure. The construction of a downward trend section may resume after the completion of the construction of this section.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română