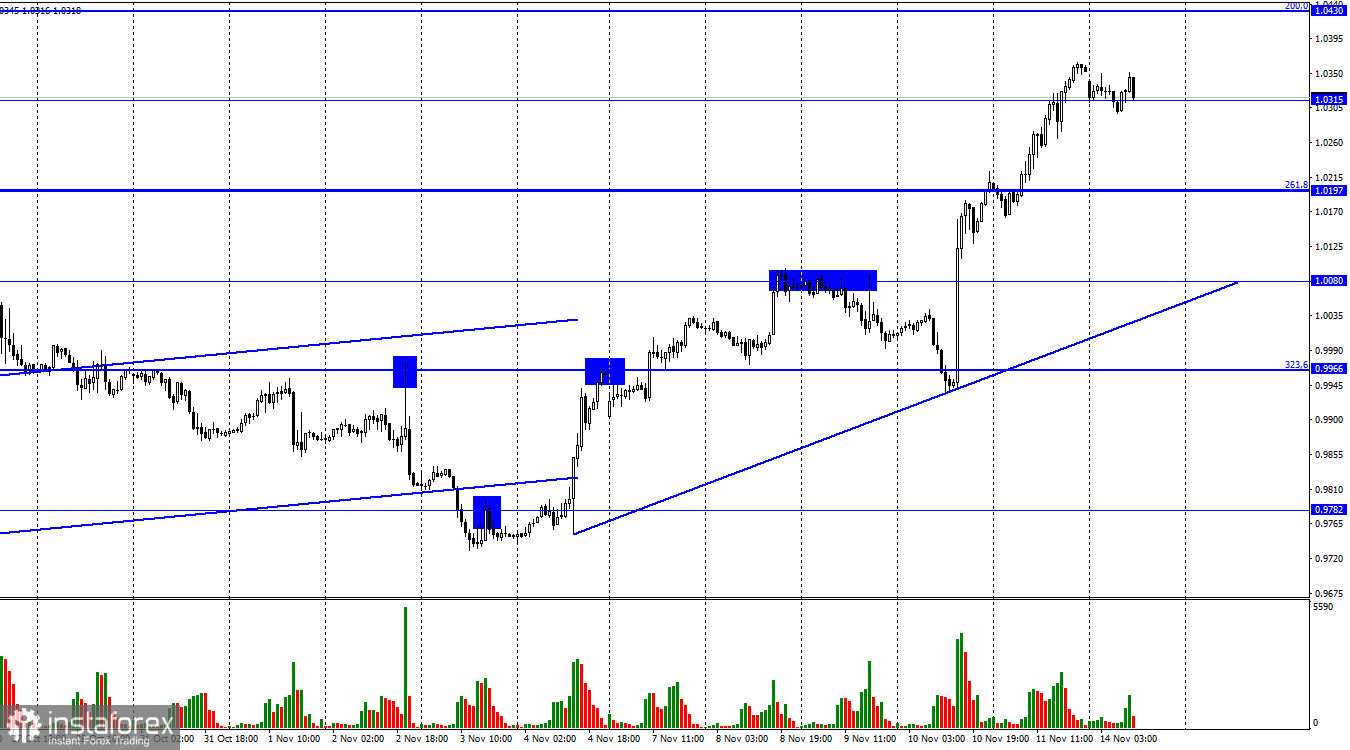

The EUR/USD pair continued the growth process on Friday and secured above the 1.0315 level. In recent weeks, the European currency has shown almost record growth, which is good news for the bulls. The ascending trend line characterizes the mood of traders as "bullish," and only the closing below it can now be regarded as the beginning of a new fall.

There was no background information on the European Union on Friday. The consumer sentiment index in the US became known, falling from 59.9 to 54.7. There has been more bad news for the US currency lately than positive news. Last week, inflation in the United States dropped sharply to 7.7%. Most traders immediately regarded this report as a call to get rid of the dollar, expecting a softening of monetary rhetoric from the Fed. The Fed will not soften this approach. Still, one thing is indisputable – the American regulator will slow down the PEPP's pace in the coming months. Thus, the times when the dollar grew based on expectations of more and more tightening monetary policy are behind us. Now the market knows that the rate will rise to 4.75–5.00%, spend some time at this level, and then begin to decline.

The situation in the European Union is somewhat different. The ECB has just started raising its rate, so it has plenty of room to tighten policy. Inflation in the European Union continues to grow, which leaves almost no choice for the ECB. Thus, if the Fed rate was growing earlier, and it was unclear what to expect from the ECB, now it's the opposite: the ECB rate will rise, and the Fed rate will stop growing in the next few months. This factor may be the main factor supporting the euro currency in the near future. This week, a report on inflation in the EU will be released, which will record its growth at 10.7% y/y. This will further increase traders' expectations for a new tightening of the PEPP in Europe.

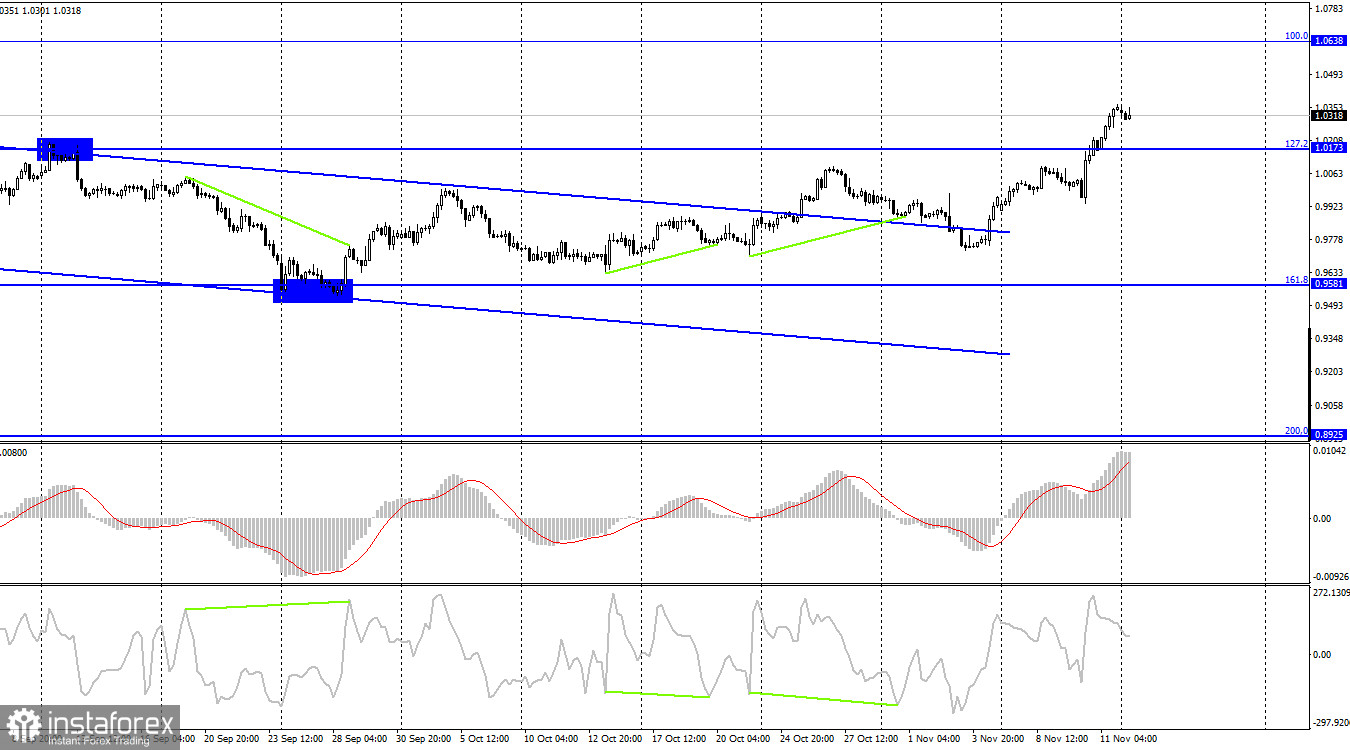

On the 4-hour chart, the pair has secured above the corrective level of 127.2% (1.0173). Thus, the growth process can be continued toward the next Fibo level of 100.0% (1.0638). No indicator is currently experiencing any brewing divergences. Closing the pair's quotes at 1.0173 will work in favor of the US currency and some fall.

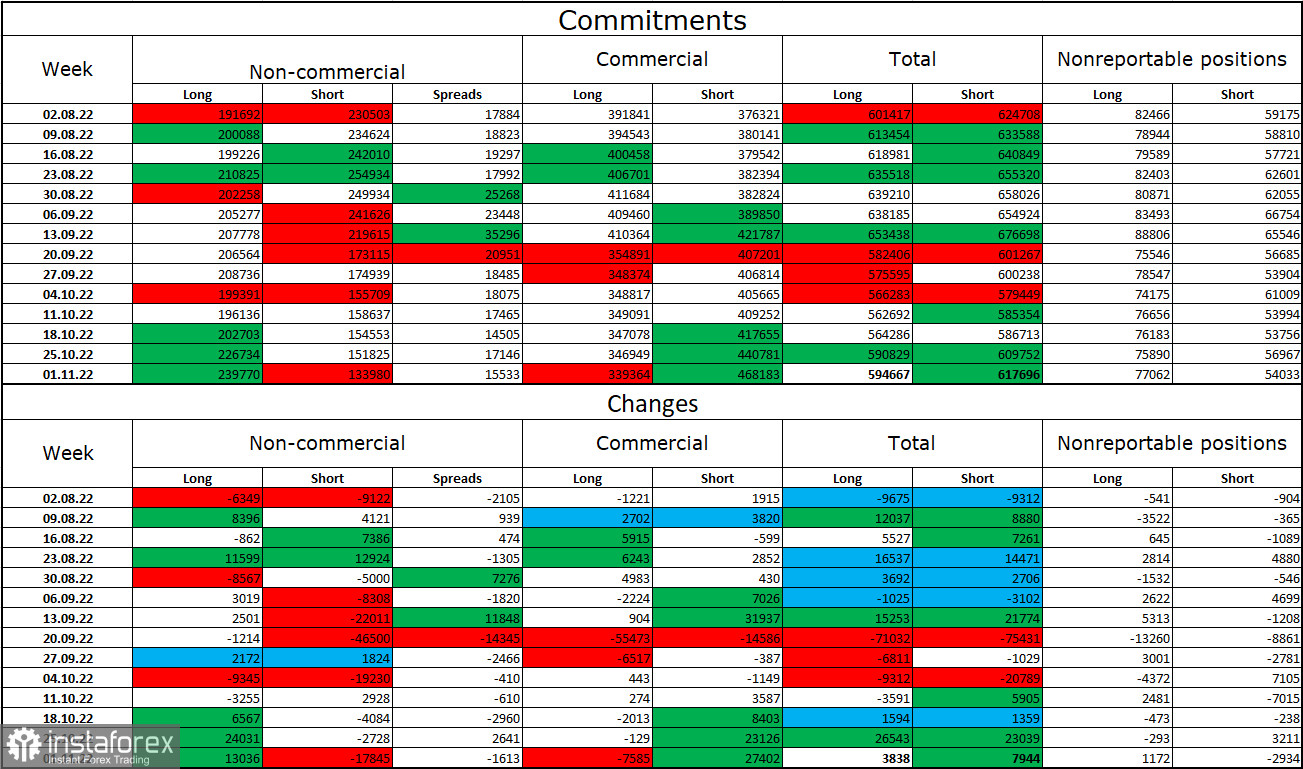

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 13,036 long contracts and closed 17,845 short contracts. This means that the mood of large traders has become much more "bullish" than before. The total number of long contracts concentrated in the hands of speculators now amounts to 239 thousand, and short contracts – 133 thousand. However, the euro is still experiencing serious problems with growth. In the last few weeks, the chances of the growth of the euro currency have been increasing, but traders are not yet ready to completely abandon purchases of the US dollar. Therefore, I would now bet on a descending corridor on a 4-hour chart, over which it was still possible to close. Accordingly, we can see the continuation of the growth of the euro currency. However, even the bullish mood of major players does not allow the euro to show strong growth.

News calendar for the USA and the European Union:

EU - the volume of industrial production (10:00 UTC).

On November 14, the calendar of economic events of the European Union contained one entry. In America, the calendar is empty. The influence of the information background on the mood of traders for the rest of the day will be minimal.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair when fixing quotes under the trend line on the hourly chart with a target of 0.9782. I recommended buying the euro currency when rebounding from the 0.9966 level on the hourly chart with a target of 1.0080. The plan has been exceeded twice, and now it is possible to hold these positions with the goals of 1.0315 and 1.0430.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română