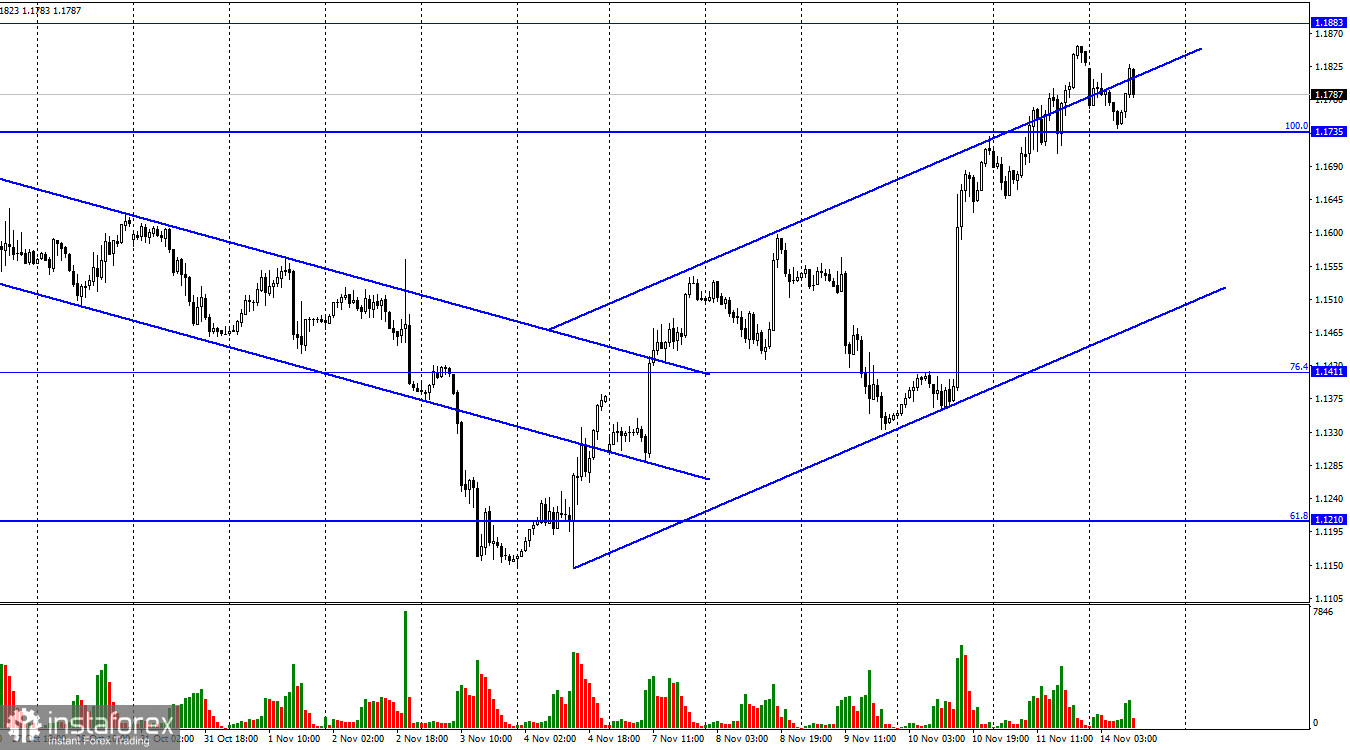

According to the hourly chart, the GBP/USD pair continued the growth process on Friday and secured above the Fibonacci level of 100.0% (1.1735). The upward trend corridor characterizes the mood of traders as "bullish." Thus, the growth process can be continued towards the next level of 1.1883. Closing the pair's exchange rate below the level of 1.1735 will work in favor of the US currency, and some will fall in the direction of the corrective level of 76.4% (1.1411).

On Friday, many important reports were released in the UK, of which four concerned the GDP. Every month, the indicator fell by 0.6% in September, by 0.2% quarterly, grew by 2.4% on an annual basis, and decreased by 0.2% on a three–month basis. In almost all cases, we saw a decline in the British economy, but the forecasts spoke in favor of an even greater decline. And not only forecasts. Let me remind you that a few weeks ago, the governor of the Bank of England, Andrew Bailey, said that a recession would begin in the third quarter and predicted a contraction of the economy of 0.5%. Thus, I can say that the most negative forecasts did not come true, which could support bull traders. However, at the same time, the European currency was growing steadily, so I am more inclined to believe that traders continued to get rid of the dollar due to the inflation report and did not buy the pound because of not-so-pessimistic statistics in Britain.

This week, the UK will release an inflation report for October. Traders expect its next acceleration to be 11%, leaving the Bank of England with nothing but a new rate hike of 0.75% at the next meeting. The picture is the same as for the euro currency. Since the Federal Reserve Fund will stop tightening the PEPP in the foreseeable future, and the Bank of England will not, the British pound can show strong growth.

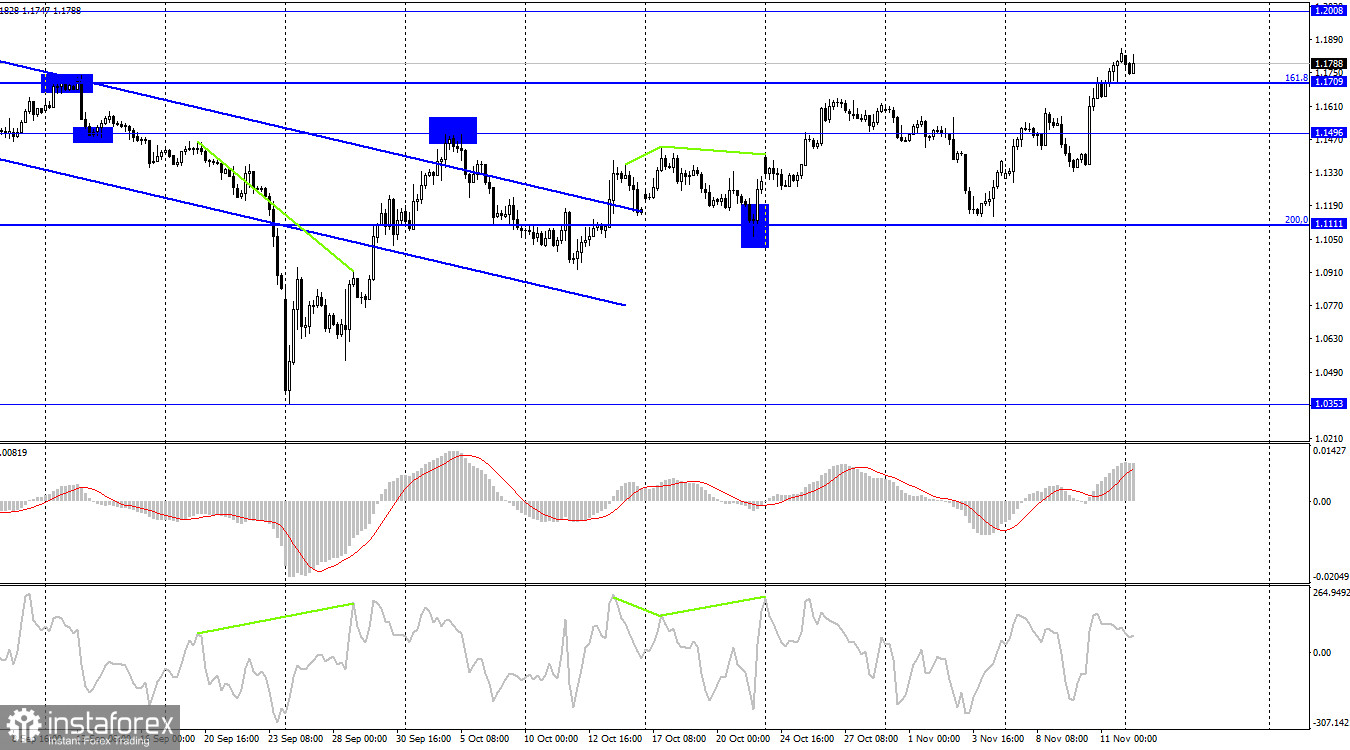

On the 4-hour chart, the pair consolidated above the Fibo level of 161.8% (1.1709(. The growth process can be continued towards the next level of 1.2008. Closing the pair's exchange rate below the level of 1.1709 will favor the US currency, and some will fall in the direction of 1.1496. There are no emerging divergences today.

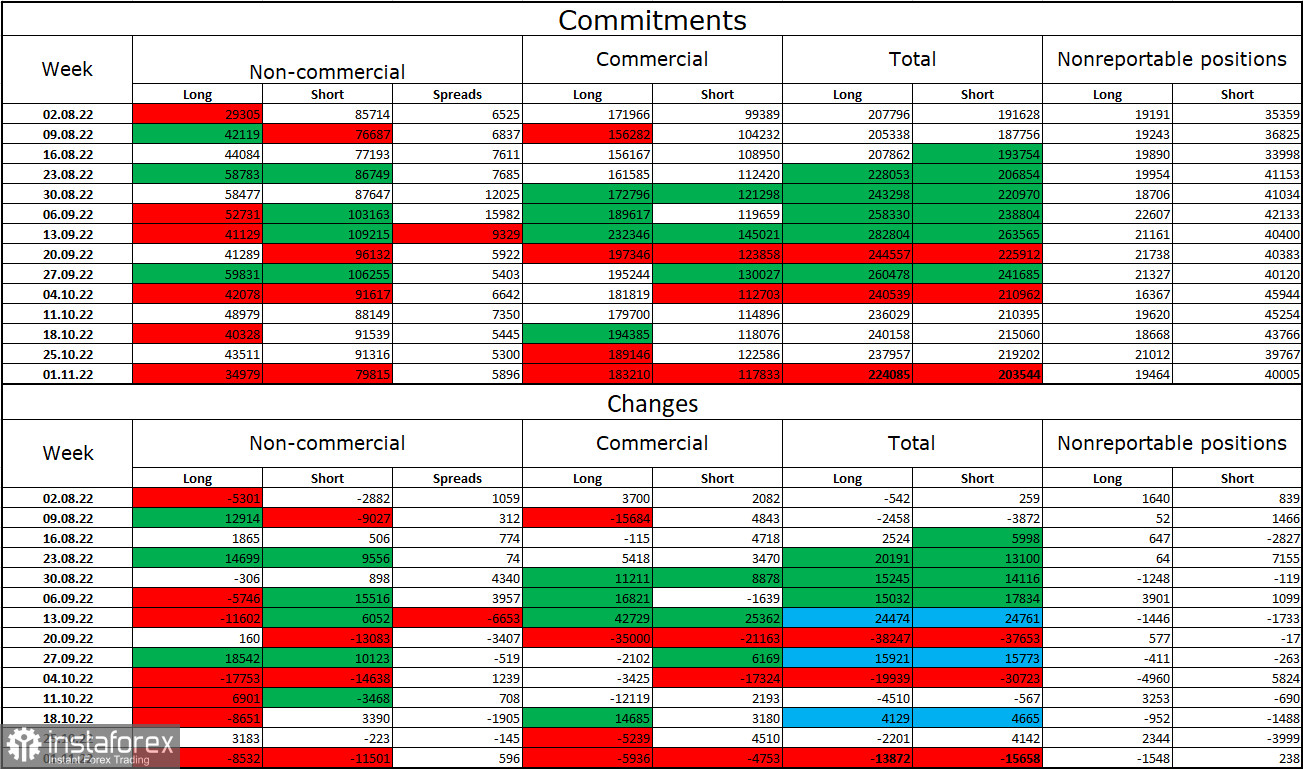

Commitments of Traders (COT) Report:

Over the past week, the mood of the "non-commercial" category of traders has become slightly less "bearish" than a week earlier. The number of long contracts in the hands of speculators decreased by 8,532 units and the number of short – by 11,501. But the general mood of the major players remains the same – "bearish," and the number of short contracts is still much higher than the number of long contracts. Thus, large traders remain mostly in the pound sales, and their mood has been gradually changing toward "bullish" in recent months, but this process is too slow and long. The pound can continue to grow if there is a strong information background, with which problems have been observed in recent months. I draw attention to the fact that the mood of speculators on the euro has long been "bullish," but the European currency is still not popular among traders. And for the pound, even COT reports do not give grounds to buy it.

News calendar for the USA and the UK:

On Monday, the calendars of economic events in the UK and the USA are empty, so the influence of the information on the mood of traders will be absent for the rest of the day.

GBP/USD forecast and recommendations to traders:

I recommend selling the pound in case of consolidation below the trend channel on the hourly chart with a target of 1.1210. I recommended buying the pound with a target of 1.1709; if a close above the level of 1.1411 is completed, this goal has been fulfilled. The deal can be kept open with the targets of 1.1883 and 1.2007 until the quotes close at 1.1709.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română