The US dollar received several sensitive blows that knocked it off its feet. The Republican victory in the midterm elections in the United States reduces the likelihood of large-scale fiscal stimulus in 2023, when the American economy plunges into recession. China is still moving away from the zero-COVID strategy and gradually opening up the economy. Slowing inflation is forcing the Fed to slow down. Finally, rumors of a ceasefire in Ukraine contribute to the growth of the euro. Will the EURUSD bears be able to recover?

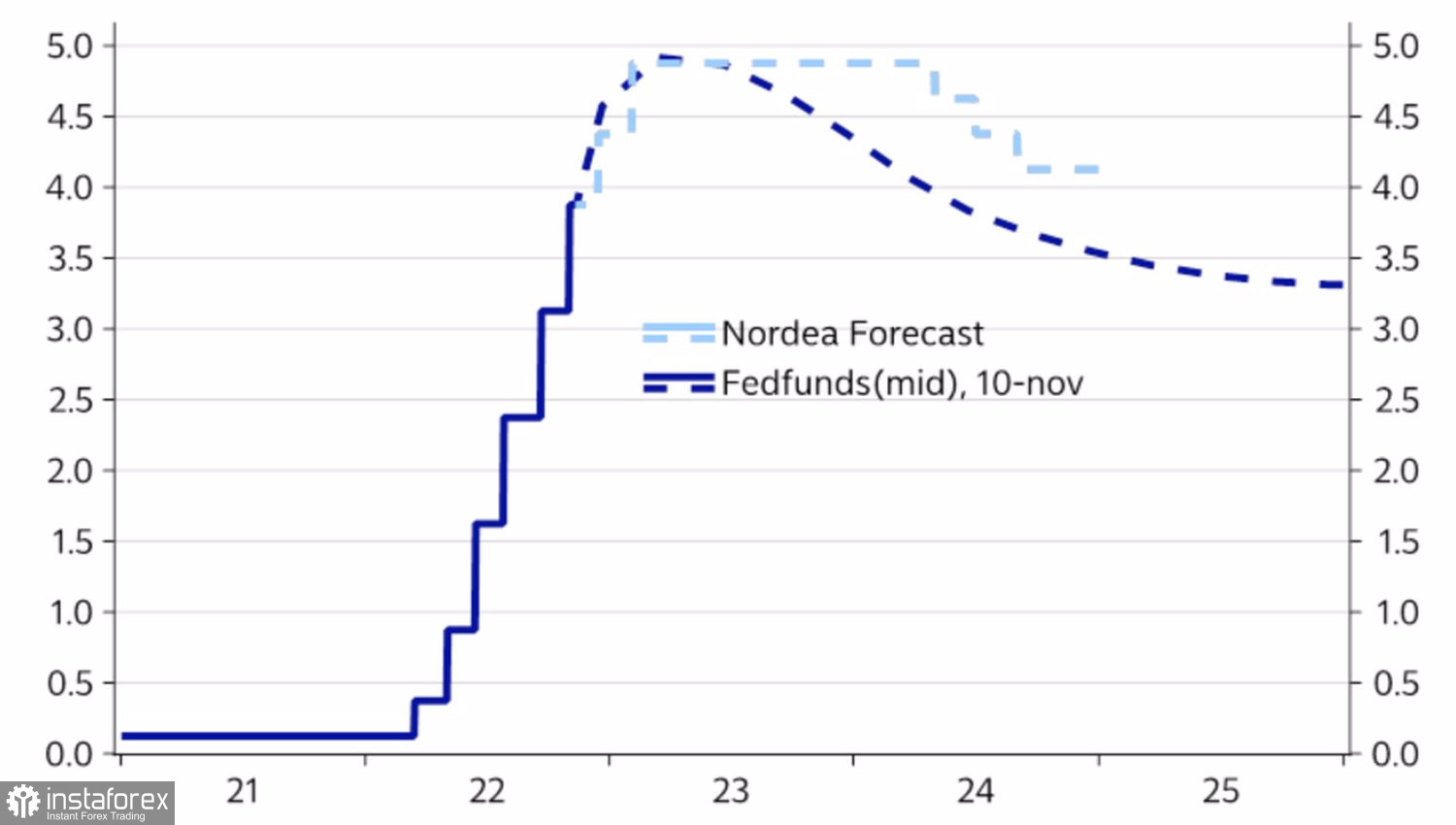

Of course, the main catalyst for the defeat of the USD index was the slowdown in US consumer prices from 8.2% to 7.7% in October. The growth rate of core inflation also decreased from 6.6% to 6.3%, which allowed the futures market to increase the probability of an increase in the federal funds rate in December by 50 bps, to 85%. Only a statement by FOMC member Christopher Waller about an overreaction to the release of CPI data caused these chances to drop to 80%. Even more important is to stop talking about the rise in the cost of borrowing in 2023 to 6%. It is not a fact that the rates will reach 5%, although Nordea predicts that they will remain at an elevated level for longer than the market currently assumes.

Fed Rate Forecasts

This allows the company to expect the pair to return to 0.97 in three months. Earlier, the figure 0.95 appeared in the estimates, but due to the warm weather in Europe and rumors about negotiations between Russia and Ukraine, the euro's positions look stronger. Nevertheless, Nordea notes that the cold snap and the inability of Moscow and Kyiv to find a compromise will lead to a new round of the energy crisis in Europe and an increase in demand for the dollar as a safe haven asset.

The same opinion is shared by Credit Agricole, pointing to the strength of the US economy and the fact that further tightening of the ECB's monetary policy will lead to an expansion of European bond spreads, which will negatively affect EURUSD.

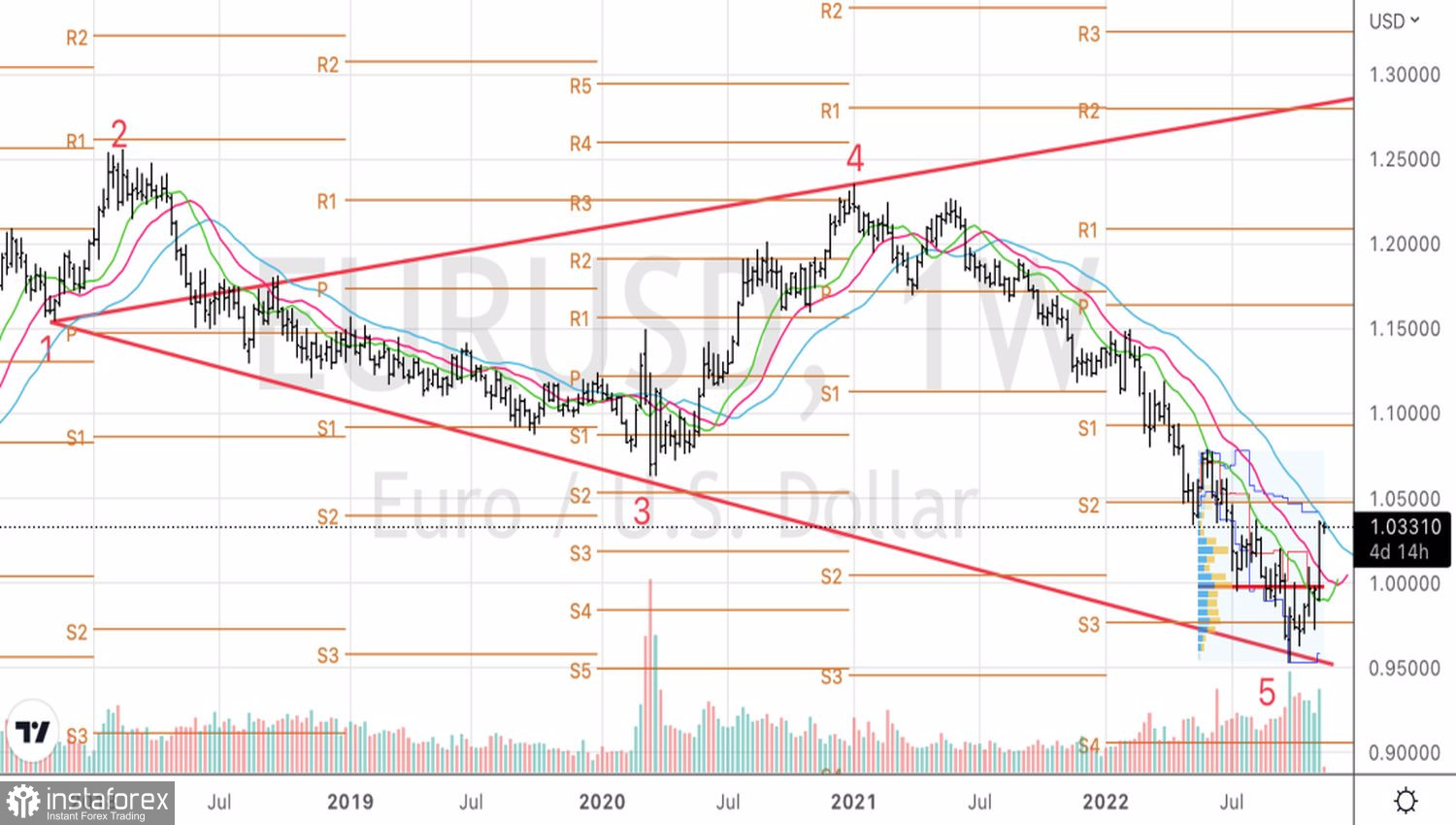

However, in the short term, the major currency pair could rise to 1.05 amid a bare economic calendar and improved global risk appetite. Indeed, until December 2 and 13, when US employment and inflation reports are released, there is hardly an event capable of rocking the EURUSD. And there, even before the announcement of the results of the last FOMC meeting in 2022, it will be a stone's throw away.

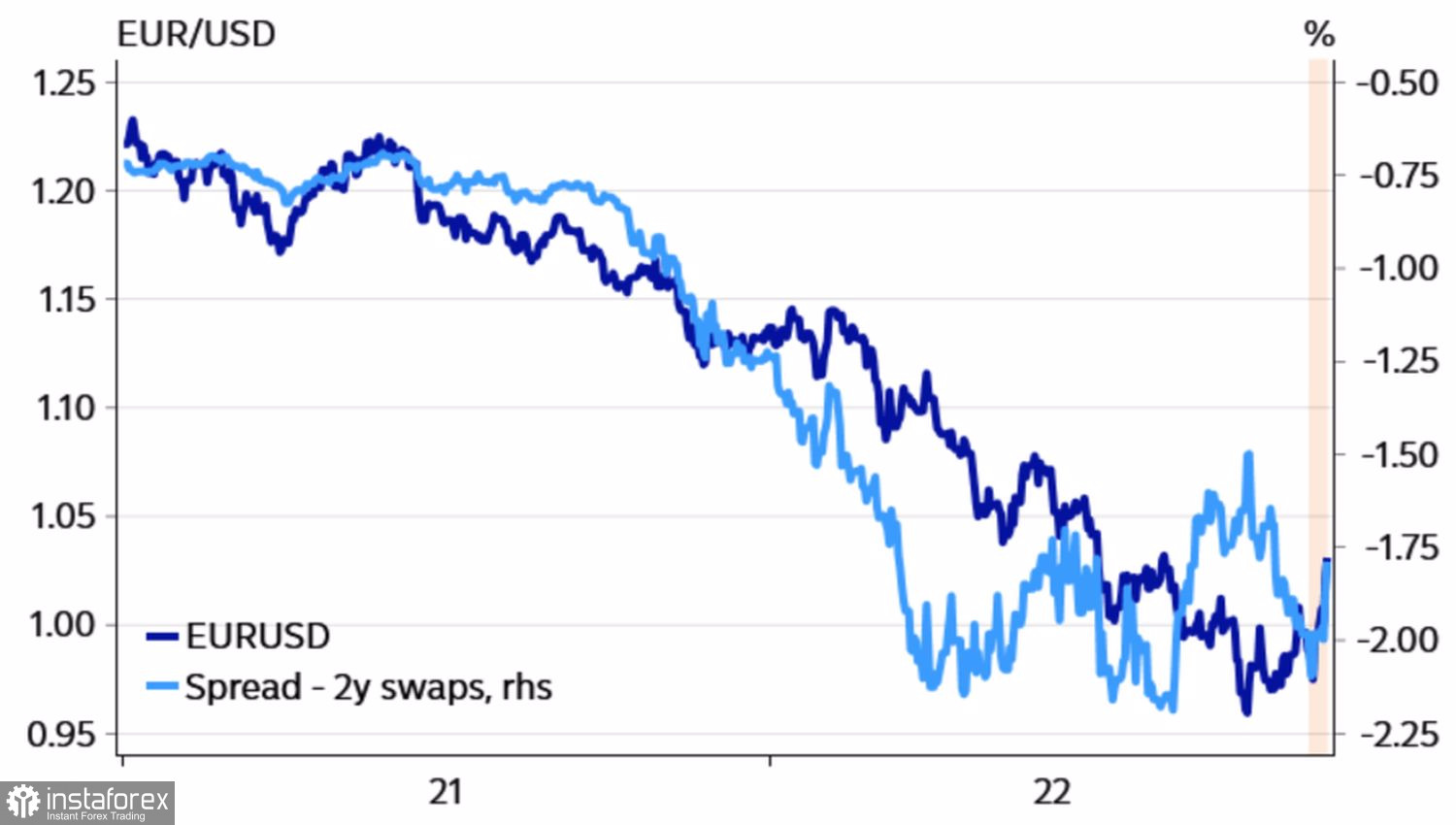

In the meantime, financial market instruments signal the growing risks of an upward movement in the euro.

Dynamics of EURUSD and interest rate swap differential

Whether the downward trend is broken or not, time will tell. In the meantime, consolidation or continuation of the rally of the main currency pair seem to be the most likely scenarios for further developments.

Technically, a Wolfe Wave pattern is forming on the weekly chart of EURUSD. Its activation is usually signaled by an increase above point 3, that is, above 1.065. However, it will be possible to talk about this only in case of a successful assault on the pivot point 1.05. In the meantime, we use kickbacks for purchases.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română