According to the latest weekly gold survey, a potential peak in the US dollar due to changes in interest rate expectations creates a positive attitude towards gold in the market.

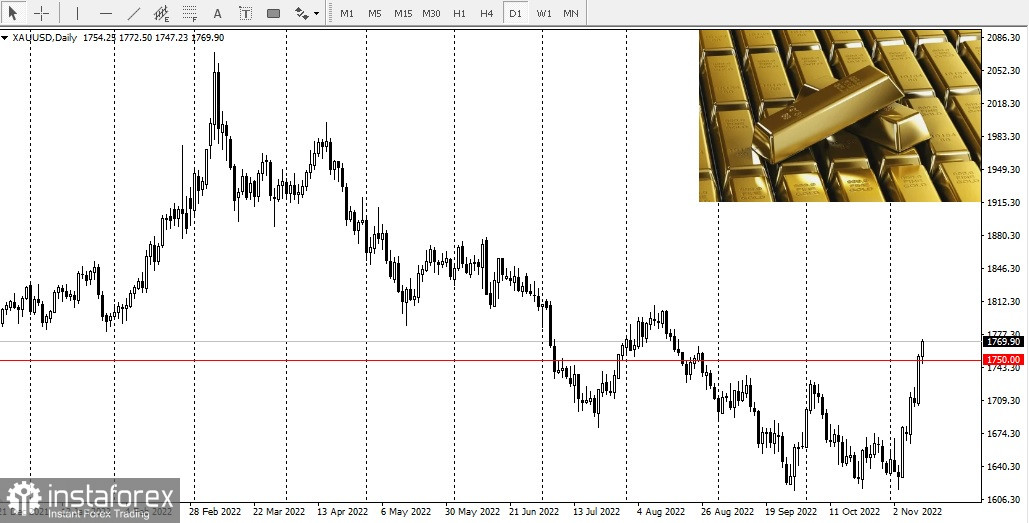

The gold market ended last week up more than 5% as prices maintain a solid position above $1,750 an ounce.

In the futures market, the precious metal is posting its best weekly gain since early April 2020, and both Wall Street analysts and Main Street retail investors are expecting higher prices this week.

Fears of a recession and concerns that chaos in cryptocurrencies would spill over into the broader economy fueled the initial rally in gold last week. Since then, weak inflation data has added momentum as markets wait for the Federal Reserve to slow down its aggressive monetary policy moves.

According to Forexlive.com chief currency strategist Adam Button, everyone is now drawn to gold because if inflation has truly peaked, then so has the US dollar and that will continue to support gold prices.

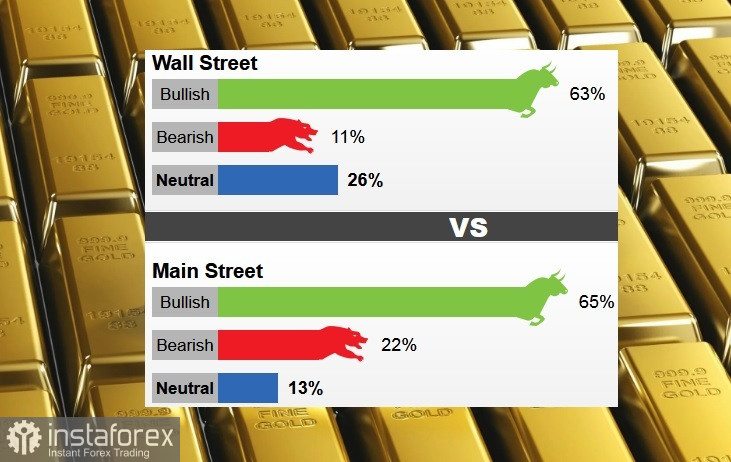

Last week, 19 market professionals took part in the World Street survey. Twelve analysts, or 63%, said they are bullish about gold this week. Two analysts, or 11%, said they were bearish. Five analysts, or 26%, said they were neutral about the precious metal.

Regarding retail, 905 respondents took part in online surveys. A total of 588 voters, or 65%, voted in favor of rising gold prices. Another 199, or 22%, predicted a fall in prices, while the remaining 118 voters, or 13%, called for a sideways market.

Main Street is not only significantly more optimistic than before, even sentiment is at its highest level since June. Interest in the precious metal also picked up as participation in last week's survey rose to its highest level since the end of September.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is also bullish on gold as he sees further weakness in the US dollar.

However, not all market analysts expect this gold momentum to last. Adrian Day, president of Adrian Day Asset Management, believes that gold prices will decline slightly this week.

From a neutral perspective, some analysts have said they want to see if gold prices can gain a foothold at these higher levels to confirm the market is in a new upward trend.

Others say it's just hedge funds buying gold again.

Phillip Streible, chief market strategist at Blue Line Futures, said he is now neutral on gold because the market is rising too fast. He added that the Fed's rate hike will peak around 5%, and this higher final rate could still create some headwinds for gold.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română