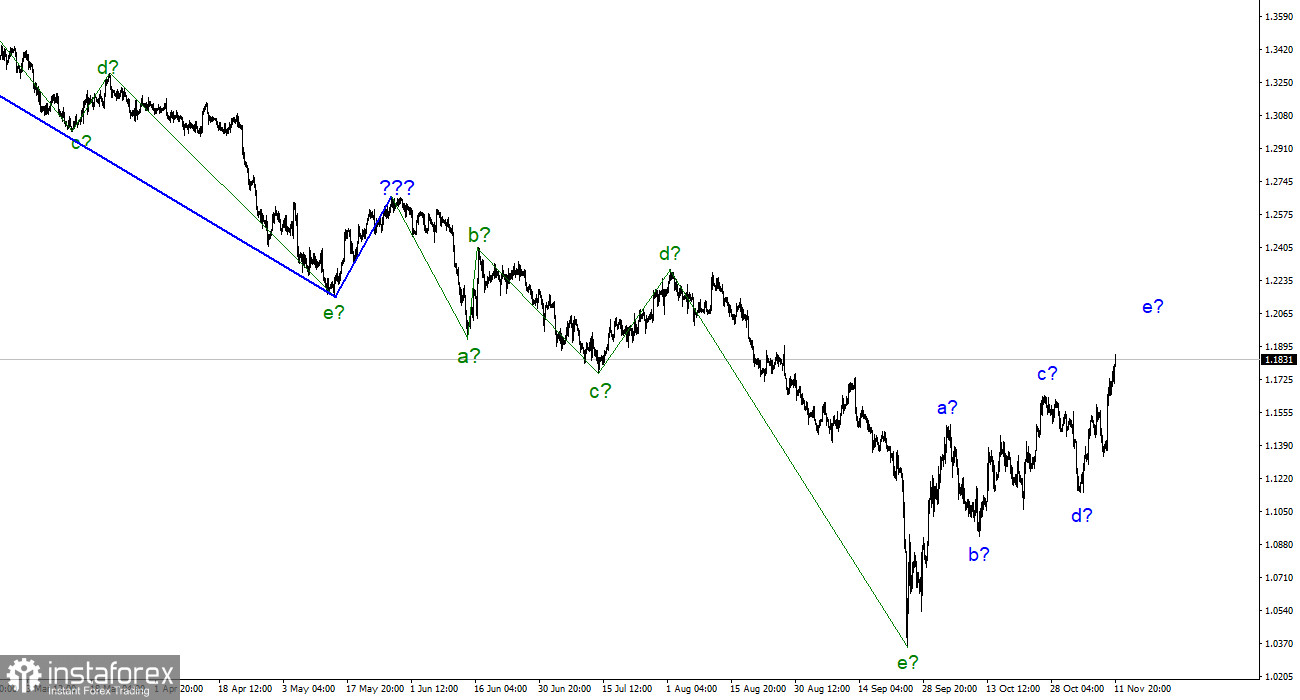

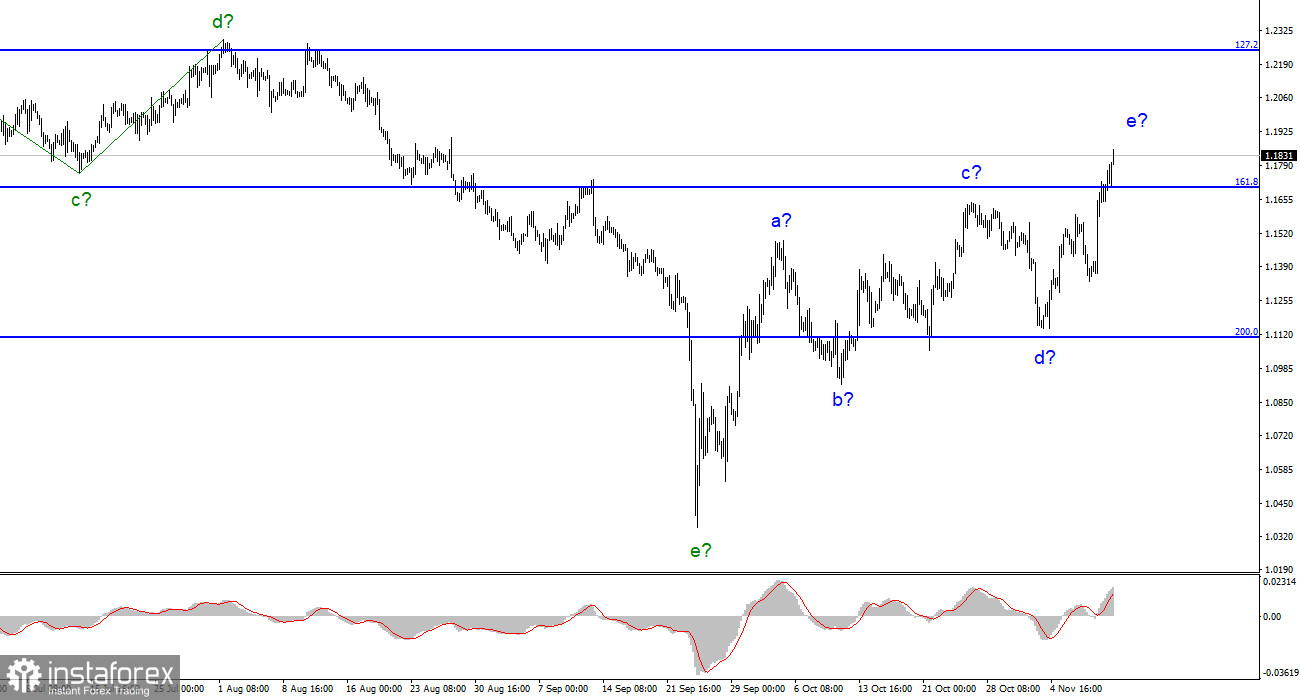

The wave marking looks complicated for the pound/dollar instrument but needs to be clarified. We have a supposedly completed downward trend segment consisting of five waves (a-b-c-d-e). We also have a five-wave upward trend section, which took the form a-b-c-d-e. Thus, the increase in the quotes of the instrument may continue for some time, but it will be a wave growth and is unlikely to be long. The news background could be interpreted in any direction lately, as both central banks raised their interest rates, and last Friday, we saw the dollar fall against the news background, which could lead to its new growth (Nonfarm Payrolls report). All this leads me to believe that the market has decided to complete a full-fledged five-wave structure, after which it will decide on building a new downward trend section. A successful attempt to break through the 1.1704 mark, which equates to 161.8% by Fibonacci, indicates the incompleteness of the upward trend section, but in general, the wave structure looks fully equipped.

Mary Daly is also in favor of reducing the pace of rate hikes.

The exchange rate of the pound/dollar instrument increased by 120 basis points on November 12. Remember that a day earlier, the report on American inflation caused the instrument to increase by 360 points. Thus, the British dollar rose by almost 5 cents in two days. The reasons for its growth (or the dollar's decline) are the same: a noticeable US inflation decrease and a weakening of the "hawkish" rhetoric of FOMC members. These two factors cannot sustain the tool's growth for an extended period. The wave marking for the British indicates readiness to build a downward trend segment, which implies a rise in the dollar, not a fall. The conflict between the news background and the waves is also present here, but at least both wave markings now coincide, which already facilitates the analysis process.

In addition to Patrick Harker, San Francisco Fed President Mary Daly also gave a speech this week. She said that the decline in inflation is certainly good news, but "this is just one report; it is not enough to announce the achievement of the result." She urged other FOMC members to remain resolute on the issue of the impact on the consumer price index and to adjust monetary policy until the task was fully completed. She also noted the good state of the labor market, noting that the growth in the number of employees is higher than expected. At the same time, Daly said considerable uncertainty about how the economy will continue to respond to high rates. It may start to slow down faster than it is now. Daly believes there will be several more rate hikes in the near future. She adheres to the principle that "slightly higher rates are better than not high enough." Although the demand for the British dollar has increased this week, the news background does not fully support the continuation of the increase in the instrument.

General conclusions.

The pound/dollar instrument wave pattern assumes the construction of a new downward trend segment, but it will probably start a little later (if it starts at all). I can no longer advise buying the instrument since the wave marking already allows the beginning of the construction of a downward trend section. The demand for the pound is still growing, but the wave e will not take on an extended form.

The picture is very similar to the euro/dollar instrument at the higher wave scale, which is good since both instruments should move similarly. At this time, the upward correction section of the trend is nearing completion. If this is the case, we will soon be building a new downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română