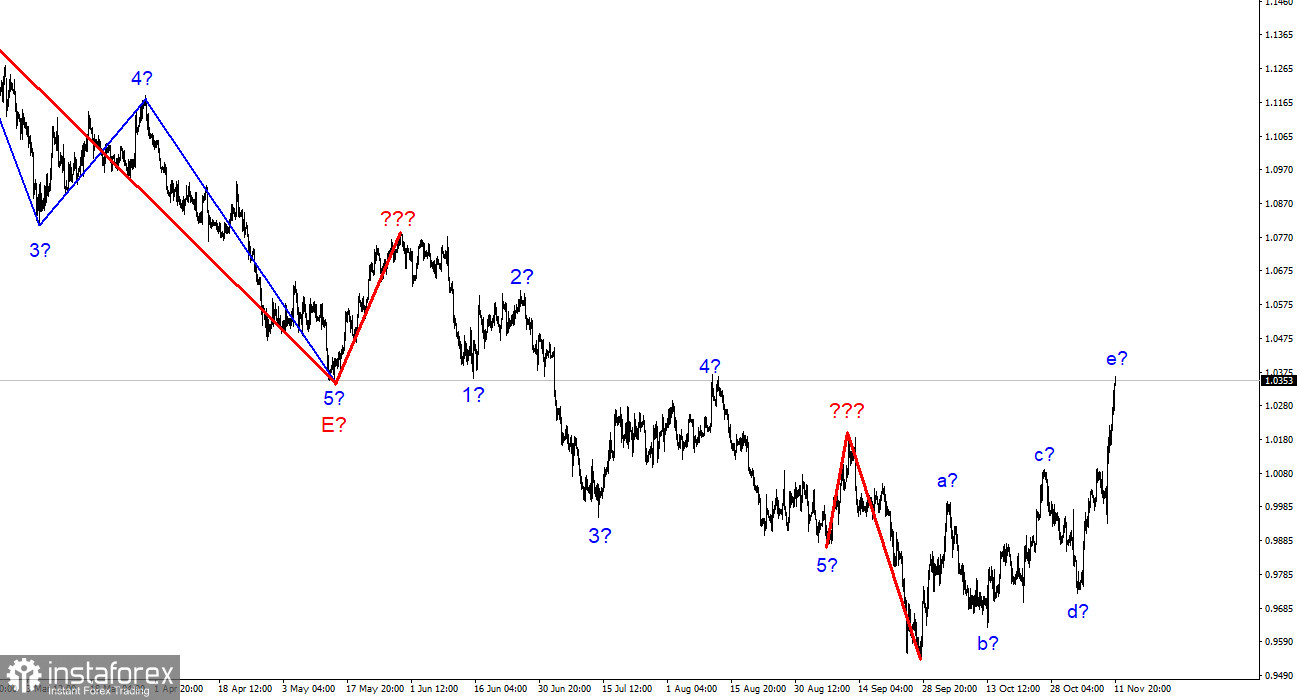

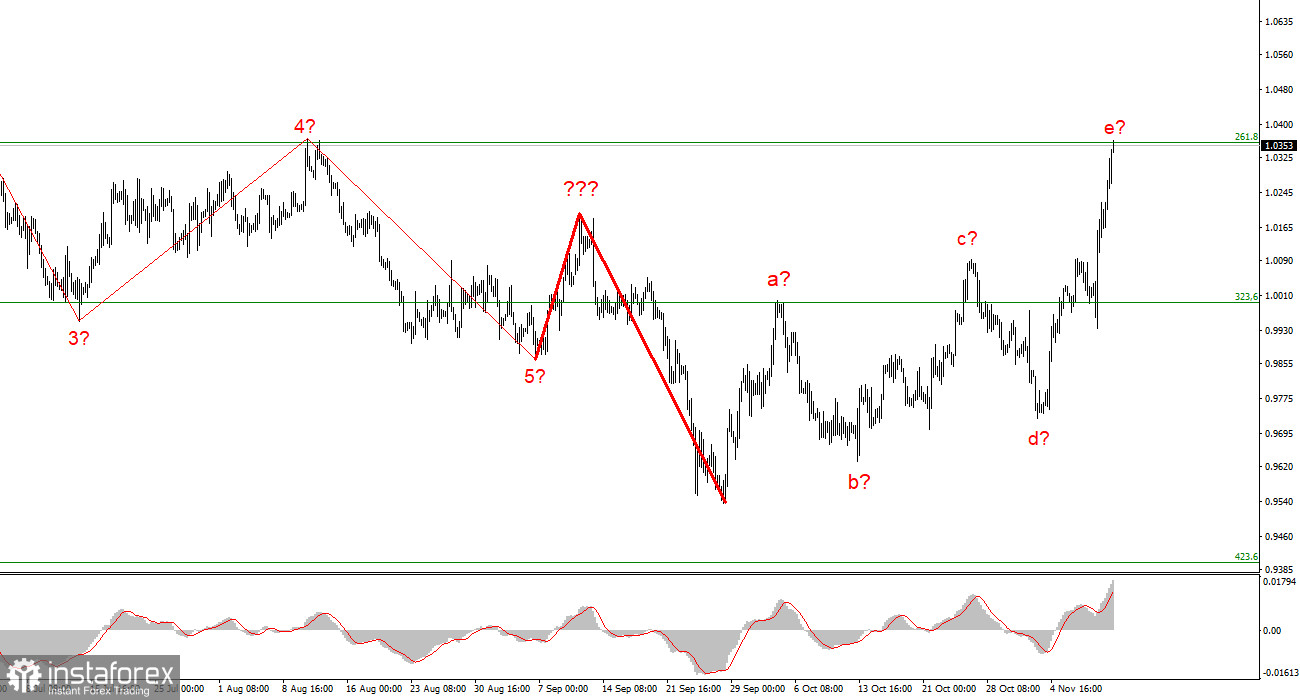

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes. The upward section of the trend continues its construction, but now it takes on a pronounced corrective form. Initially, I thought that three waves would be built up, but it is already clearly visible that there are five waves. Thus, we get a complex correction structure of waves a-b-c-d-e. If this assumption is correct, then the construction of this structure may be nearing its completion since the peak of wave e exceeds the peak of wave C. In this case, we are expected to build at least three waves, but if the last section of the trend is corrective, then the next one will most likely be impulsive. Therefore, I am preparing for a new strong decline in the instrument. An unsuccessful attempt to break through the 1.0359 mark, corresponding to 261.8% Fibonacci, will indicate the market's readiness to sell.

The most important thing now is that the wave markings of the pound and the euro coincide. If you remember, I have repeatedly warned about the low probability of a scenario in which the euro and the pound will trade in different directions. Theoretically, this is certainly possible, but it rarely happens in practice. Now both instruments are presumably building corrective trend sections, which may be completed in the near future. Thus, the British dollar may also begin to decline within the framework of a new downward trend segment.

FOMC members caused a decline in demand for the dollar.

The euro/dollar instrument rose by 150 basis points on Friday. In two days, it has grown by 350 points. Of course, the main reason for the decline in demand for the dollar is a sharp decline in the consumer price index in the United States. However, others played a role in the fall of the dollar. As I expected, a strong decline in inflation will cause a weakening of the "hawkish" rhetoric of FOMC members, and already this week, the first echoes of this weakening became known. In particular, Philadelphia Fed President Patrick Harker said that in the coming months, the regulator would reduce the pace of interest rate hikes, as its rapid growth has begun to put pressure on the American economy. The rate has already risen quite high, and Harker believes it's time to start reducing its growth rate. US monetary policy is approaching the concept of "restrictive," Harker said. But at the same time, the president of the Philadelphia Fed made it clear that the slowdown would be smooth. The interest rate will rise by 50 basis points in December, "which will still be a significant tightening." However, the market interpreted this statement as if Harker had announced the beginning of the rate reduction process. The market no longer believes that the US dollar will strengthen and is in a hurry to sell it.

And here, a contradictory situation arises since the wave marking implies the construction of a new downward section of the trend. The background news, it turns out, is a further decline in demand for the US currency. We get a conflict between the types of analysis, and any one of these factors will have to "retreat."

General conclusions.

Based on the analysis, the construction of the upward trend section has become more complicated with five waves. It continues due to the inflation report and impartial statements by FOMC members. However, I cannot advise buying now since the entire upward structure may complete its construction in the near future. I advise selling in case of an unsuccessful attempt to break through the 1.0359 mark with targets located near the estimated 0.9994 mark, which corresponds to 323.6% Fibonacci.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. We saw five upward waves, which are most likely the a-b-c-d-e structure. The construction of a downward trend section may resume after the completion of the construction of this section.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română