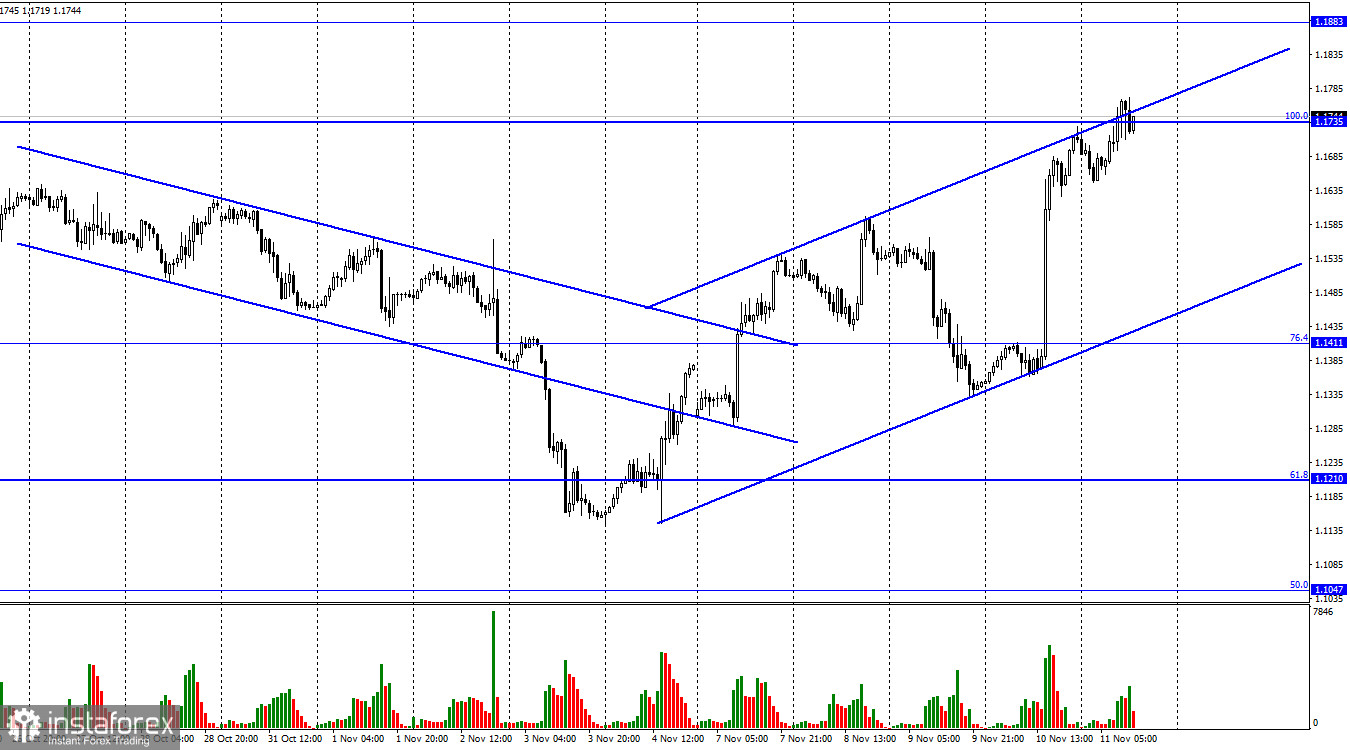

Hi everyone! On the 1H chart, the GBP/USD pair rose to 1.1735, the Fibonacci correction level of 100.0%. At the time of writing this article, the quotes climbed slightly above this level. It means that the pair is likely to hit 1.1883. The uptrend corridor indicates that the sentiment on the pair is bullish.

Analysts believe that the US dollar plummeted considerably yesterday following inflation data. In my opinion, there are plenty of other factors that could have also affected the greenback. For instance, this morning, the UK released the GDP report for the third quarter. The reading was -0.6% on a quarterly basis. It hardly came as a surprise for traders. Andrew Bailey warned a week earlier that the economy was sliding into a long recession starting in the third quarter. Bailey even stated that GDP would shrink by 0.5%.

However, the reading turned out to be even worse. For this reason, the Bank of England is strongly committed to aggressive tightening. Perhaps that is why traders did not pay any attention to the negative economic macro stats, which could only be the first in a series of downbeat reports. At the same time, industrial production in September expanded by 0.2%, exceeding traders' expectations of -1% on a monthly basis. However, investors seemed to ignore this report as well as GDP data. Speculators are now paying zero attention to fundamental factors. It is rather risky. The US currency could rise on such weak data.

Apart from statements on rate hikes, it is quite hard to see any driver for the current rally of the pound sterling. Although its growth was weaker than yesterday, there were reasons for a decline.

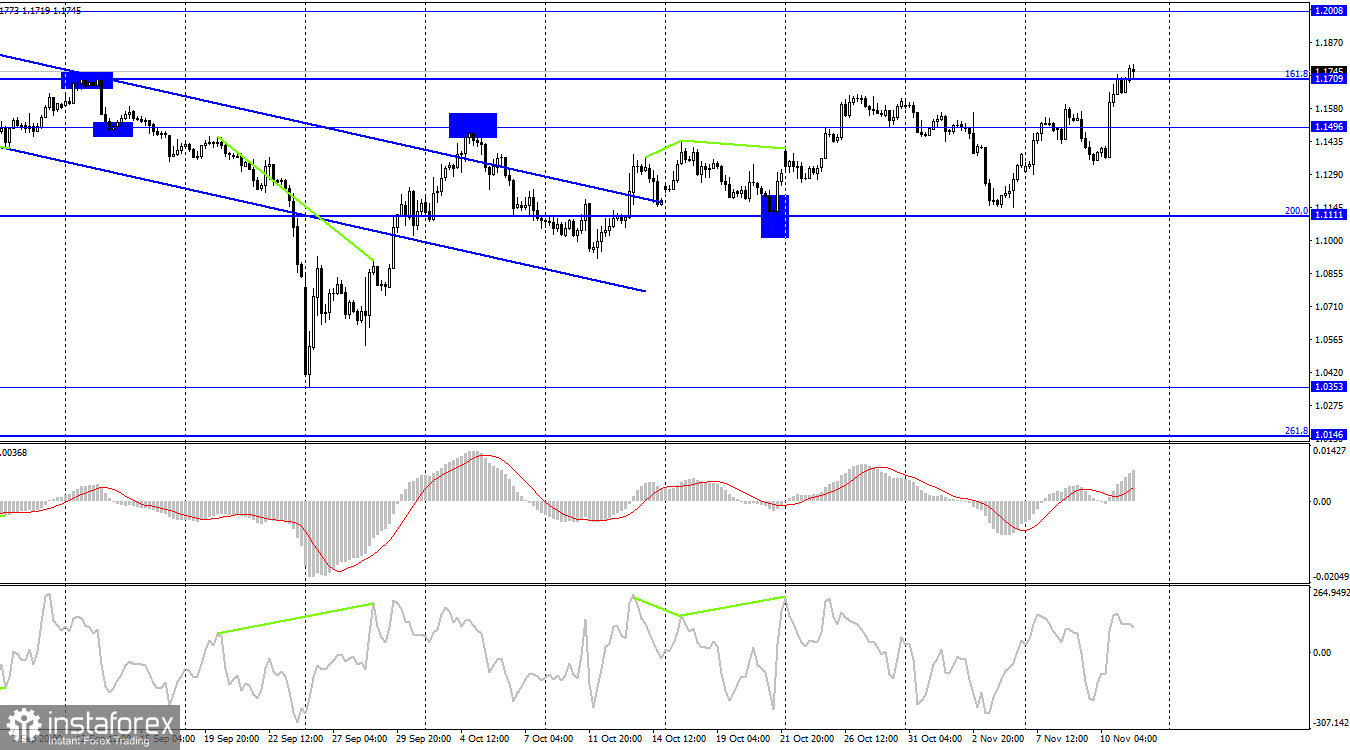

On the 4H chart, the pair climbed to 1.1709, the Fibonacci correction level of 161.8%. If it consolidates above this level, it may grow to 1.2008. If the price retreats from 1.1709, it could fall to 1.1496. There are no divergences today.

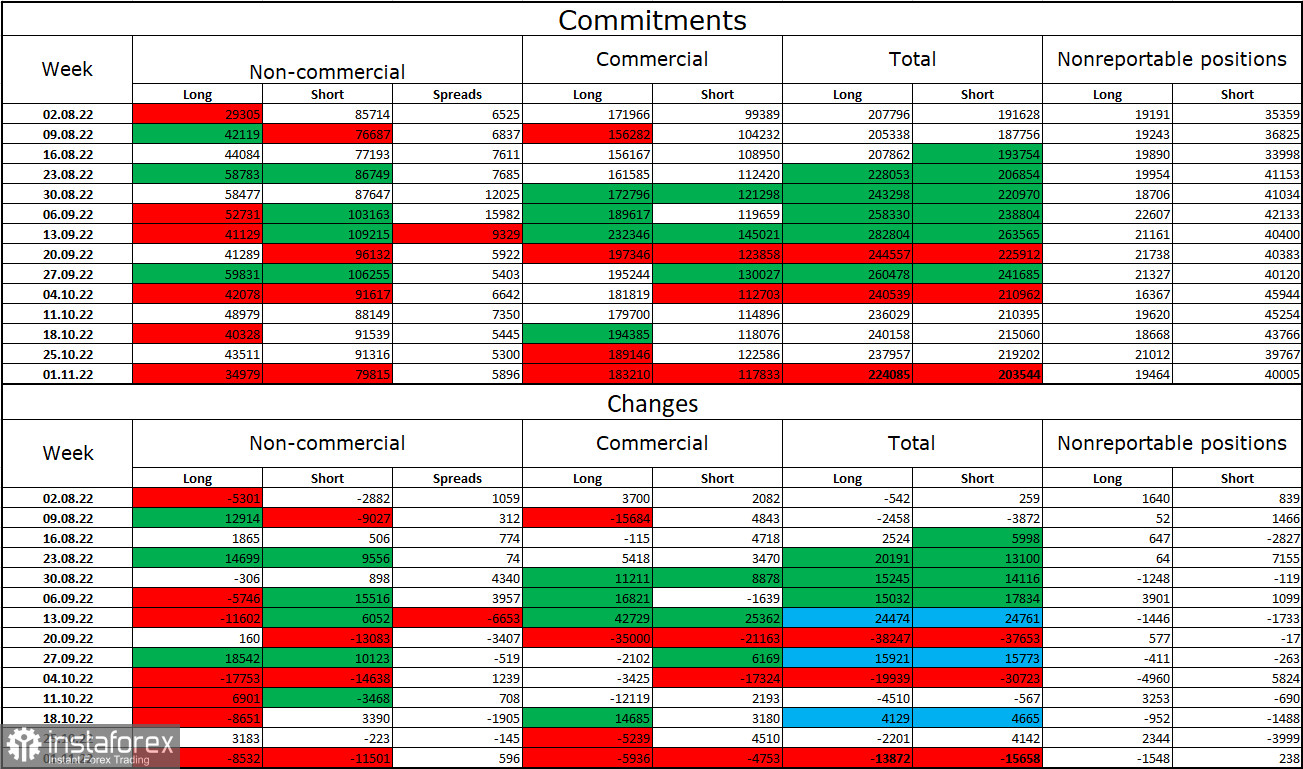

Commitments of Traders (COT):

Last week, the sentiment of the non-commercial traders became less bearish on the pair than the week earlier. Investors closed 8,532 long positions and 11,501 short ones. However, the overall sentiment of large traders remains bearish as short positions still exceed long ones. Therefore, large traders are more prone to sell the pound sterling even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound sterling may continue its uptrend only amid strong fundamental factors which have not been quite weak lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still declining against the US dollar. As for the pound sterling, even COT reports do not favor buying the pair.

Economic calendar for US and UK:

UK – GBP third-quarter report (07:00 UTC).

UK – Industrial Production (07:00 UTC).

US- University of Michigan Consumer Sentiment Index (15:00 UTC).

Today, the UK revealed plenty of crucial economic reports which were ignored by traders. The US unveiled only the University of Michigan Consumer Sentiment Index. So, the impact of fundamental factors on market sentiment will be weak for the rest of the day.

Outlook for GBP/USD and trading recommendations:

It is recommended to open short positions if the pair drops from 1.1709 on the 4H chart with a target level of 1.1411. It is better to open long positions with a target level of 1.1709 if it settles above 1.1411. The price has already reached this level. It would be appropriate to keep the position open if the pair climbs above 1.1709 with target levels of 1.1883 and 1.2007.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română