This week has become one of the most shocking and disastrous for the cryptocurrency market. The FTX crisis, the update of the local Bitcoin bottom and general panic moods put an end to the local upward trend of the previous week.

Despite the complexity of the situation, several positive news provoked a surge in volatility and activation of buyers, thanks to which the price of Bitcoin settled above $17k. A combination of local and fundamental positive factors can become an important factor in the rapid recovery of trading activity in the cryptocurrency market.

Fundamental factors

Shortly before the publication of inflation reports, experts from Goldman Sachs and other leading banks conducted a study of the money supply in the markets. The experts came to the conclusion that in the coming months, the rate of slowdown in inflation will increase significantly.

This is exactly what happened, because in October, the annual inflation rate slowed down from 8.2% to 7.7%. At the same time, experts expected the CPI to fall to 8%. The aggressive policy of the Fed has begun to bear fruit, which may have a positive impact on the general state of the global economy.

The markets are laying down a 0.5% increase in the key rate in December and February, and in the spring, investors expect a gradual curtailment of the reduction program. Given the current inflation rate, it is likely that the rate will begin to be brought to neutral status in the second quarter of 2023.

This is a positive signal for the cryptocurrency market and high-risk assets. At the same time, the stock market continues its upward passage to local highs. Given the gradual stabilization of the situation after the FTX crisis, it is likely that the market will follow the example of the funds.

Local factors

Continuing the theme of the crisis around the FTX exchange, it is important to note that yesterday, November 10, the withdrawal of funds was resumed, according to the Nansen data. This is a positive signal and may indicate that management has moved forward in seeking funding for the $8 billion liquidity hole.

Another positive news provoked by the FTX situation was the mass publication of reports by large companies. Such giants as Binance and Circle presented their reserves to the public, which largely reassured investors.

BTC/USD Analysis

Thanks to the positive dynamics of lower inflation, Bitcoin and other cryptocurrencies showed a confident rebound to local support zones. Over the past day , Bitcoin has risen in price by 4% and tested the resistance zone at $18.1k. Subsequently, the asset price rolled back to the local support zone near $17k.

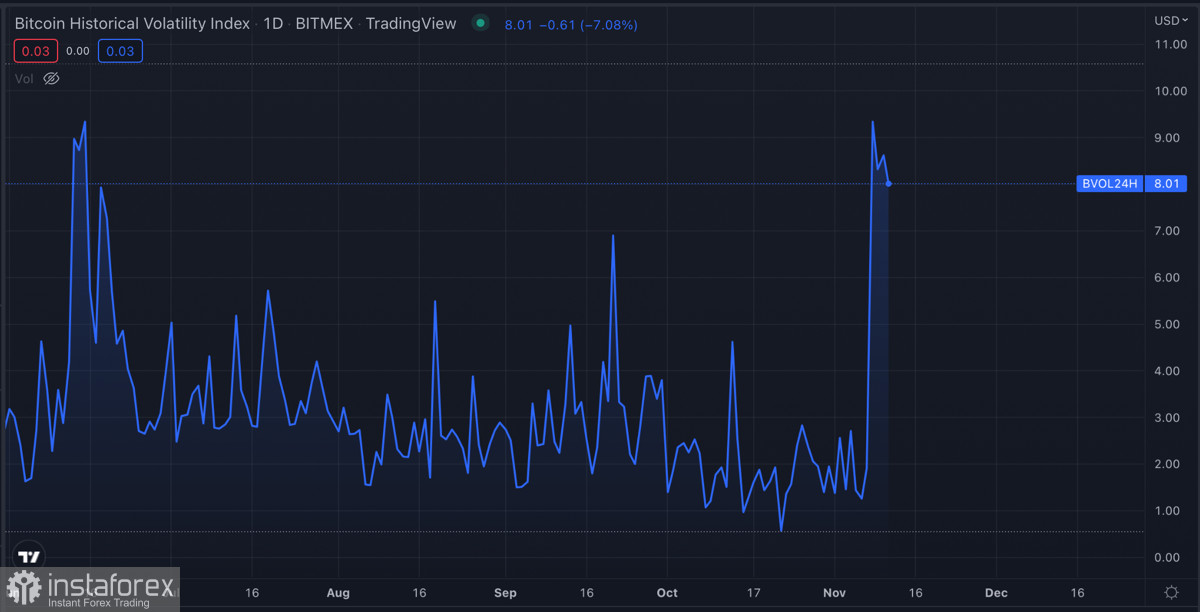

Technical metrics also bounced sharply but subsequently turned sideways. This indicates the need for a stabilization period and a reduction in the level of volatility in the market. With the weekend approaching, we should expect a lull in the market and Bitcoin price movement within the $16.8k–$18.5k range.

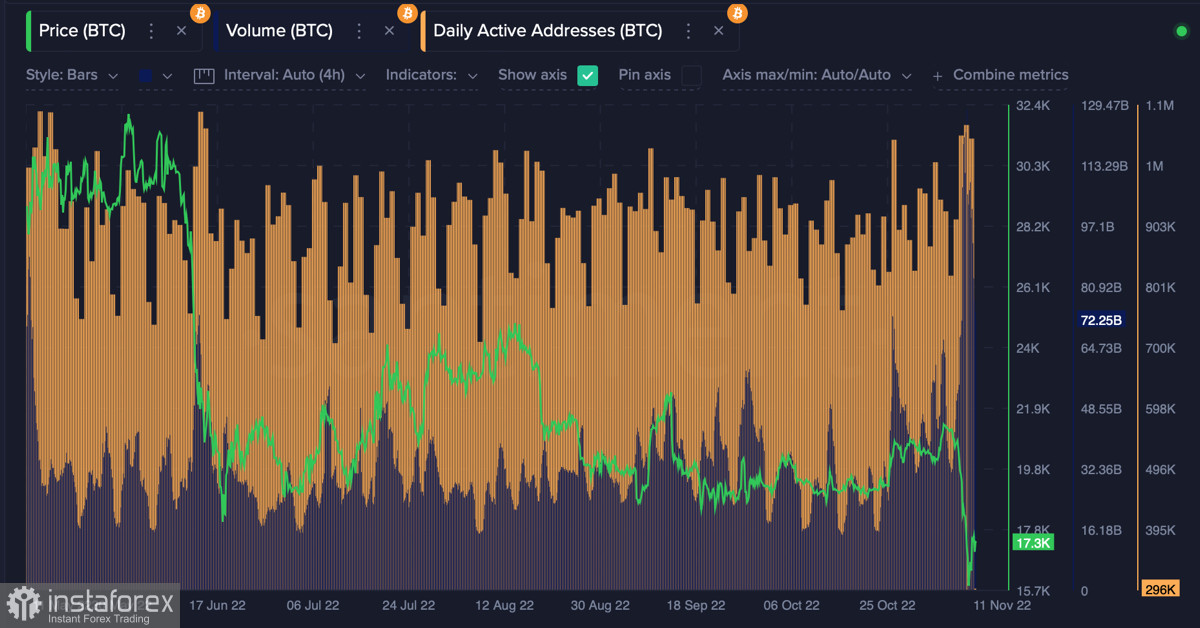

In this case, there is a high probability of a second attempt to go beyond the current fluctuation range. This is primarily due to the high level of volatility, which is just beginning to subside. In addition, high rates of on-chain activity remain.

Trading volumes are high, and the number of unique addresses in the BTC network showed only a slight drop, which is an important signal for increased market activity. However, the failed retest and the weakness of Bitcoin's technical metrics point to a slight advantage for the bears.

Results

In the short term, we should expect another attempt by bears to push the price below the $17k level. As of November 11, the accumulation of BTC by long-term owners has just begun, and therefore the asset is in a vulnerable position. A drop in trading activity is not ruled out over the weekend, but the option with a surge in volatility and the activation of sellers is also relevant.

In the medium term, we can expect a New Year rally, as there are positive signals for this as of November 11. The stock market continues to grow, the Fed's policy is bearing fruit, and the rate hike in December will be no more than 0.5%. At the same time, it is important to take into account local factors that can negatively affect the price movement of cryptocurrencies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română