The euro and the British pound have notably strengthened against the US dollar but whether their rally will continue is still a big question. The further dynamic will depend on how buyers of risk assets will behave at the current highs and how the situation around the US elections will unfold.

The weakening of the US dollar was rather predictable so I don't think that markets will ignore this decline. In fact, nothing has happened that could potentially change the stance of the US Federal Reserve regarding interest rates. Even though inflation has slowed down, this does not mean that it won't accelerate in the coming months.

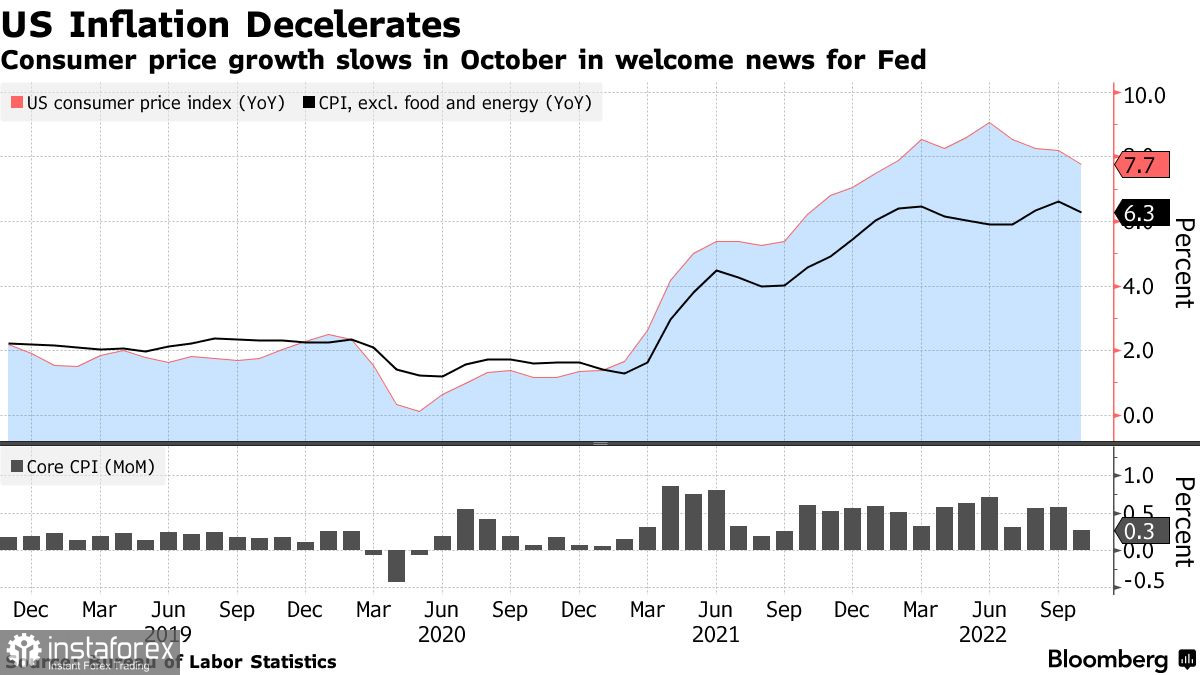

Naturally, a decline in consumer prices has boosted optimism of US households, investors, and Fed officials. Yet, high inflation is still far from being over. The data revealed that in annual terms inflation in the US dropped to 7.7% in October, marking its lowest reading since January. What is more, core inflation, which excludes food and energy prices, also eased more than expected.

As prices in such categories as food, clothes, and car are declining, there is hope that the most rapid price increase in the last 40 years may start to slow down. For the US central bank, this can serve as a signal to gradually ease its aggressive rate-hiking cycle next year given that the tendency will persist. Against this backdrop, the US Treasury yield has dropped sharply just like the US dollar index. Now traders expect the Fed to raise interest rates by just half a point in December. The upper limit of the rate has been revised to 5%.

However, these are just the first steps in fighting stubbornly high inflation that has been in place for a few months and that has been well above the pre-pandemic level. San Francisco Federal Reserve Bank President Mary Daly said that a slowdown in October in consumer inflation is "good news." Lorie Logan, President of the Federal Reserve Bank of Dallas, said that "it may soon be appropriate to slow the pace of rate increases" although such a move should not be perceived as a guide to action."

Earlier this month, Fed Chair Jerome Powell said that officials need to see a consistent pattern of weaker monthly inflation and that it is premature to consider pausing rate hikes. Before the two-day meeting in mid-December, Fed officials will have to evaluate another CPI report and the employment data.

As for the technical outlook for EUR/USD, bulls have succeeded to regain ground. So, demand for the euro is staying relatively high. To develop a further uptrend, the pair needs to break through the level of 1.0220, which will open the way to a higher target at 1.0270. After passing this mark, the price may easily move to 1.0310 and 1.0370. In case of a decline, a breakout of the 1.0165 support will push EUR/USD back to the level of 1.0100 and will increase the pressure on the instrument. If so, the pair may head for the low of 1.0050. If buyers fail to protect the area of 1.0050, the price may test the low near the parity level.

The technical picture for GBP/USD shows that the pound is strengthening. Yesterday, it gained more than 3.5% at the close of the session. Now, bulls are focused on the support level of 1.1630 and are trying to break through the resistance of 1.1725, which is limiting the pair's upside potential. Only a break of 1.1725 will allow the price to recover further to the level of 1.1760. This will pave the way for the pair to make a rapid move towards 1.1800 and 1.1840. The pressure on the pair may return as soon as bears take control of the 1.1630 level. This will shatter the current position of the bulls and cancel the bullish outlook in the short term. A breakout of 1.1630 will push GBP/USD back to 1.1550 and 1.1470.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română