The EUR/USD currency pair was trading fairly calmly again on Thursday. Exactly until the moment when the inflation report was published in the USA. We will talk about it below, but for now, it should be noted that the pair bounced off the moving average line, so the current upward mood remains. Its prospects still need to be clarified. Some important report is often published, and the pair goes first, then the other. Therefore, we will not be surprised if the European currency falls again today. In any case, even with the new inflation report, the Fed's plans are unlikely to change, which means we are waiting for more than one rate hike. And the new tightening of monetary policy is a plus for the dollar, not for the euro, which, by and large, continues to ignore similar actions of the ECB. Here, we believe that everything is logical. The dollar is the world's reserve currency, and there are many more in the world than the euro. Therefore, the actions of the Fed have a more significant impact on the pair's movement than the ECB's actions. In any case, the ECB rate will remain lower than the Fed rate for a long time. And this means that the advantage will remain on the side of the dollar. Maybe it won't be as obvious as before, but it will be. This means that it will be extremely difficult for the European currency to continue to show growth over the long term.

In addition, no one knows how events will develop in Ukraine this winter. New escalations are possible, and the European Union will completely abandon oil from Russia in the near future, which comes by sea. The Nord Stream gas pipelines have been blown up. The situation is already tense to the limit, but it can worsen. And for the euro currency, any escalation is a new reason to fall since traders prefer to buy dollars in any incomprehensible and dangerous situation.

Inflation in the US has started to accelerate in its slowdown.

As mentioned above, the US inflation report for October provoked strong movements in the market. The US dollar fell against almost all its competitors as the consumer price index slowed to 7.7%. Thus, the decrease compared to September was 0.5% in annual terms. And this is already very strong. At this rate, inflation may return to 2% in less than a year, and the Fed may start lowering the rate in six months.

Moreover, the October inflation report does not consider the last Fed rate hike, which happened only in November. The next report may also show a noticeable slowdown in price growth. In such conditions, the fall of the US currency is quite justified since it makes no sense for the Fed to bring the rate to 5% or higher. If the next report shows a decrease of 0.5% in December, the rate may increase by 0.5%, and then only once by 0.25%. Jerome Powell and the company have repeatedly stated that they will closely monitor and respond to inflation. Thus, the dollar is slowly losing its advantage in the foreign exchange market but still retains it.

Conclusions about the dollar's positions should be drawn only today during the day. As we have already said, the pair could grow significantly and then fall. The European trading session will open, and European traders will also want to work out inflation in the United States. Therefore, after such an important report, the results should be summed up 24 hours later. Moreover, no important events are planned for Friday. Therefore, today, we can conclude where the pair will finish the week and whether it has grounds to continue its growth. The last local maximum was updated, which is the third update in recent weeks. In technical terms, the European currency may continue to grow.

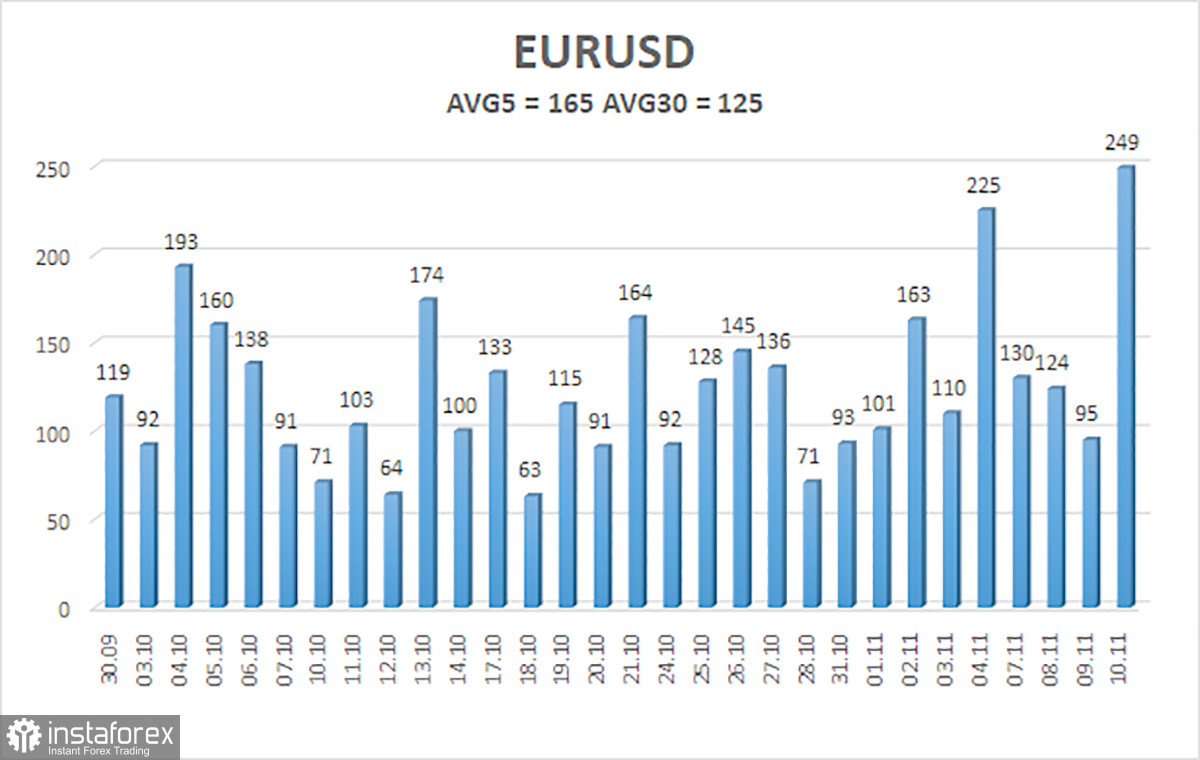

The average volatility of the euro/dollar currency pair over the last five trading days as of November 11 is 165 points and is characterized as "high." Thus, we expect the pair to move between 1.0009 and 1.0339 on Friday. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading Recommendations:

The EUR/USD pair continues to be located above the moving average. Thus, it would be best if you stayed in long positions with targets of 1.0254 and 1.0339 until the Heiken Ashi indicator turns down. Sales will become relevant again by fixing the price below the moving average line with targets of 0.9888 and 0.9766.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română