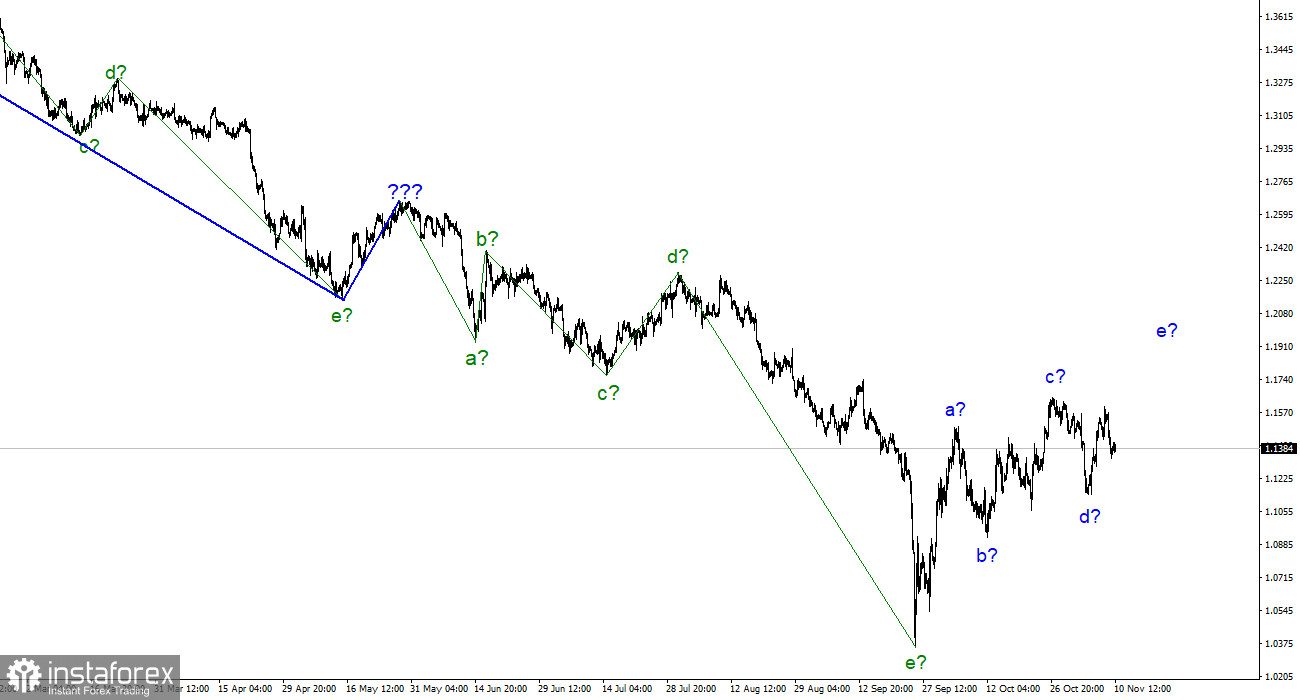

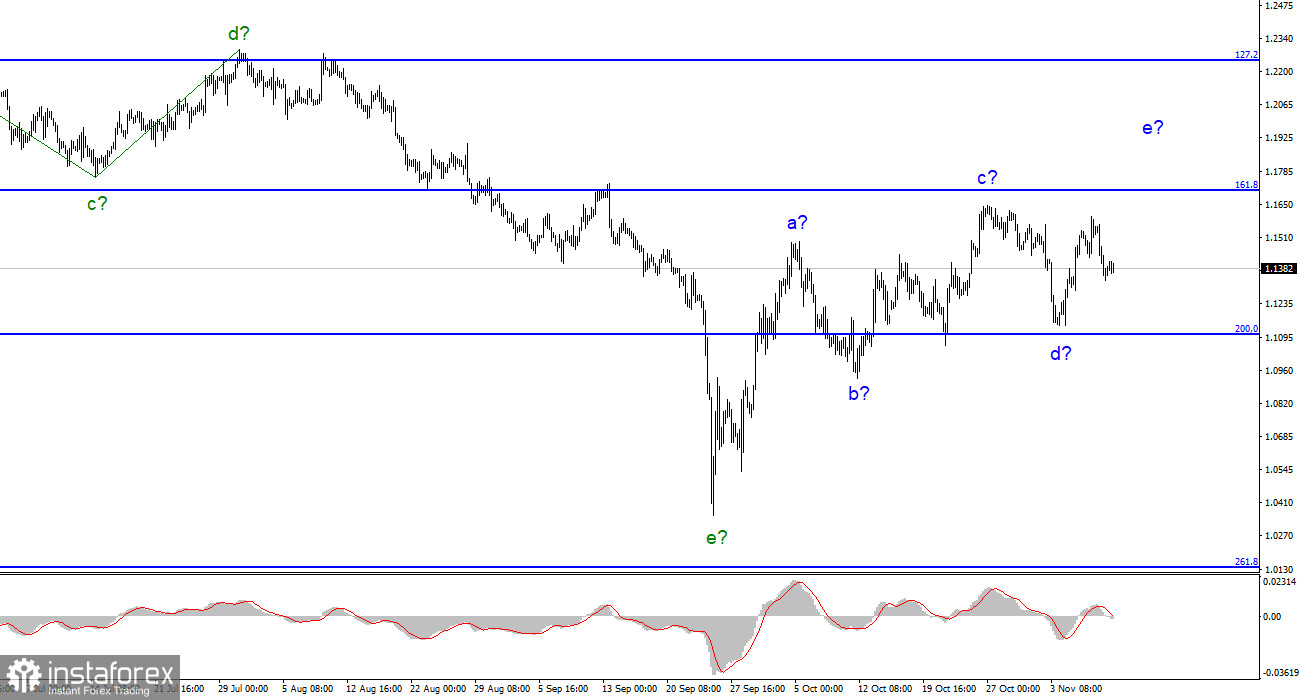

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but does not require any clarifications. We have a supposedly completed downward trend segment consisting of five waves a-b-c-d-e. We also have a three-wave upward trend section, which can take a more extended form a-b-c-d-e. Thus, I expect that the increase in the quotes of the instrument will continue, but it will be a wave of growth. The news background could be interpreted in any direction lately, as both central banks raised their interest rates, and last Friday, we saw the dollar fall against the news background, which could lead to its new growth. All this leads me to believe that the market has decided to complete a full-fledged five-wave structure, after which it will decide on building a new downward trend section. Consequently, in the near future, the British may grow to 17-18 figures. An unsuccessful attempt to break through the 1,1704 mark, which equates to 161.8% Fibonacci, will indicate the market's readiness for new sales and may mark the beginning of the construction of a new downward section.

The Fed is increasingly tightening its attitude toward rates.

The exchange rate of the pound/dollar instrument increased by 25 basis points on November 10, and a day earlier, it decreased by 190. I want to draw readers' attention to the fact that the euro and the pound have moved differently in the last two days, which rarely happens. The wave marking, according to the European, looks satisfactory. Five waves are built up. According to the British, the wave marking is not finished yet and will take either a three-wave form or a more complex one. One way or another, the British pound needs to rise slightly to complete the wave e. Will it be possible to do this so as not to confuse market participants?

Speaking generally about the prospects of the US currency, I would describe them as favorable. More and more data indicate that the Fed rate will continue to rise in the near future, followed by at least six months when the rate will remain unchanged, and only in the second half of 2023 may it begin to decline. Most analysts think so now. For example, an economist at ABN AMRO expects the interest rate to return to a neutral level no earlier than mid-2024, which means a smooth and gradual decline in the second half of 2023 and the first of 2024. It is very important for the US dollar that the divergence between the Fed and ECB rates persists as long as possible. To do this, the Fed rate should be higher than the ECB rate. But I think the US currency will not have such problems in the next six months or a year. All this time, the demand for the US currency may remain high, which will not allow the instrument to build an impulsive upward trend segment.

General conclusions.

The pound/dollar instrument wave pattern assumes the construction of a new downward trend segment, but it will probably start a little later. However, I can no longer advise buying the instrument since the wave marking for the euro allows the beginning of the construction of a downward trend section. Today – inflation in the US, tomorrow – GDP in the UK. These reports can help a Briton deal with the waves.

The picture is very similar to the euro/dollar instrument at the higher wave scale, which is good since both instruments should move similarly. At this time, the upward correction section of the trend is nearing completion. If this is true, we will soon build a new downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română