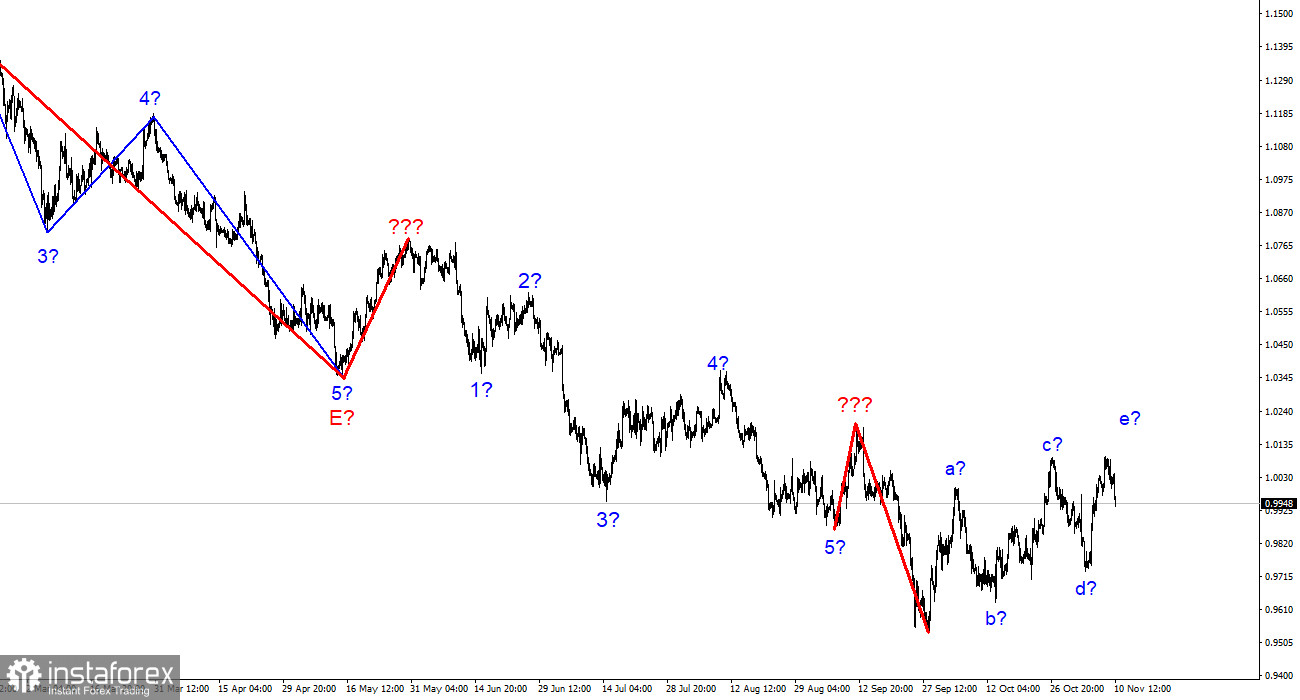

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes. The upward section of the trend continues its construction, but now it takes a pronounced corrective form. Initially, I thought that three waves would be built up, but now it is visible that there are five waves. Thus, we get a complex correction structure of waves a-b-c-d-e. If this assumption is correct, then the construction of this structure can already be completed since yesterday, the peak of wave e exceeded the peak of wave C. In this case, we are now waiting for the construction of at least three waves down, but if the last section of the trend was corrective, then the next one will most likely be impulsive. Therefore, I am preparing for a new strong decline in the instrument.

The most important thing now is that the wave markings of the pound and the euro coincide. If you remember, I have repeatedly warned about the low probability of a scenario in which the euro and the pound will trade in different directions. Theoretically, this is certainly possible, but it happens extremely rarely in practice. Now both instruments are presumably building corrective trend sections, which may be completed in the near future. Thus, the British dollar may also begin to decline within the framework of a new downward trend segment.

The wave program is at least completed.

The euro/dollar instrument fell by 65 basis points on Wednesday and 60 a day earlier. It wouldn't be surprising if there were at least some news background this week. At the beginning of the week, I assumed that at least a few FOMC members would make important statements, but even from them, no important information was received. And what could the market look like on Monday, Tuesday, and Wednesday? In the course of the US elections? The final results are still unknown. Republicans have won in the Lower House of Parliament but may lose in the Senate again. It is also quite strange to expect a market reaction to the election results at a time when it is still unclear who will control which chamber. And in any case, it is impossible to say what is good for the dollar and the US economy: the victory of the Republicans or the Democrats?

In just an hour, perhaps the most interesting report of this week will be released, about which everyone has already said so much that there is nothing to add. Therefore, I will only draw your attention to the fact that the dollar has been actively growing over the past two days. I think this may be a premature market reaction to the inflation report. If this is true, the market is waiting for a weak decline in the consumer price index and from the Fed – more and more interest rate hikes. At the moment, many analysts agree that the rate will rise to 5%. Therefore, we are waiting for 3 or 4 more tightening of monetary policy. This is a good reason to wait for a new increase in the US currency.

General conclusions.

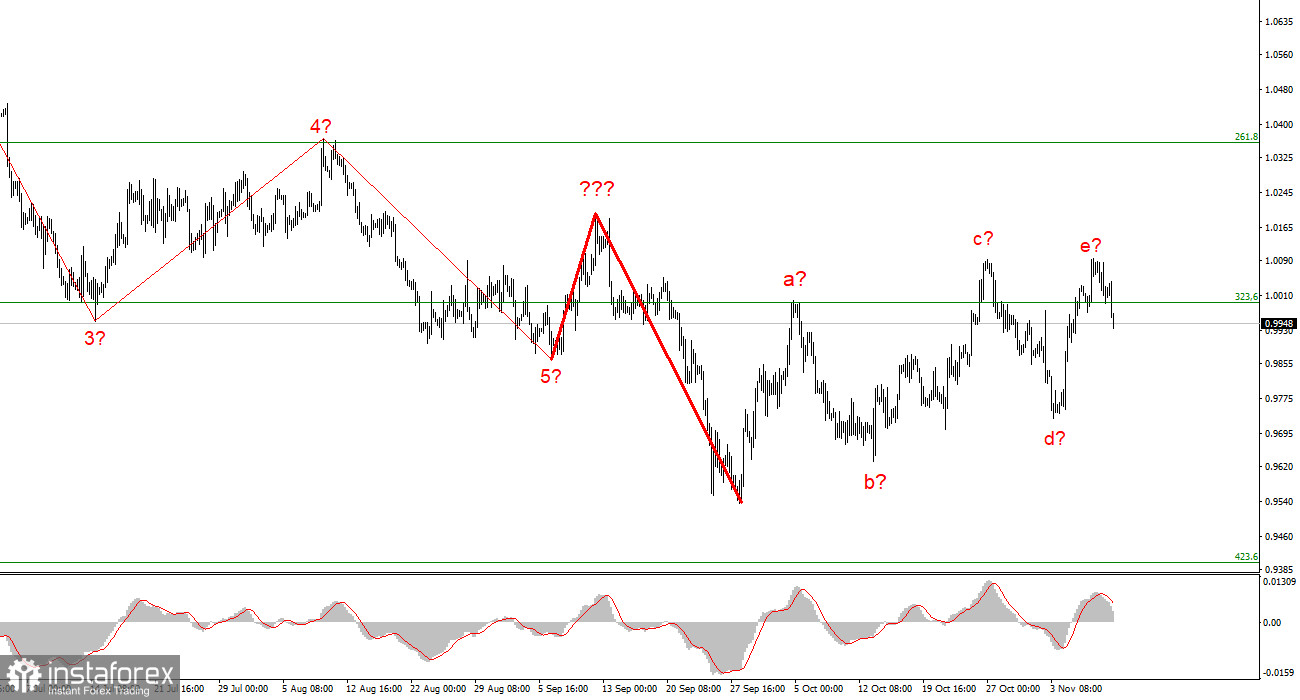

Based on the analysis, I conclude that the construction of the upward trend section has become more complicated than the five-wave but can already be completed. At this time, the instrument could start building the first wave of a new downward section, so I advise selling with targets near the annual low, according to the MACD reversals "down." Wave e turned out to be quite weak and not entirely convincing, so the increase in quotations may still resume. But the probability of a decline in the instrument is already higher.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. We saw five upward waves, which are most likely the a-b-c-d-e structure. The construction of a downward trend section may resume after the completion of the construction of this section.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română