Market participants are assessing the results of the midterm elections to the US Congress and are preparing for the publication of updated data on inflation in the US. And they can have a significant impact on the Fed and the dynamics of the dollar. Economists assume that the annual CPI fell in October from 8.2% to 8.0% and the base CPI from 6.6% to 6.5%. If the data really indicate a slowdown in inflation, the Fed may begin to slow down the pace of tightening its policy, raising the interest rate in December by 0.50% and not by 0.75%, as before.

If today's publication of US inflation figures disappoints investors, it will provoke a new wave of dollar sales.

At the same time, the inflation rate remains four times higher than the Fed's target level, and this forces the heads of the US central bank to still adhere to a strict approach in determining the parameters of monetary policy.

Therefore, a strong report from the Bureau of Labor Statistics will strengthen the position of buyers of the dollar. As for its main competitor in the foreign exchange market, in this case, it will fall sharply against the dollar, putting an end to the upward correction provoked by the controversial report of the US Department of Labor last Friday.

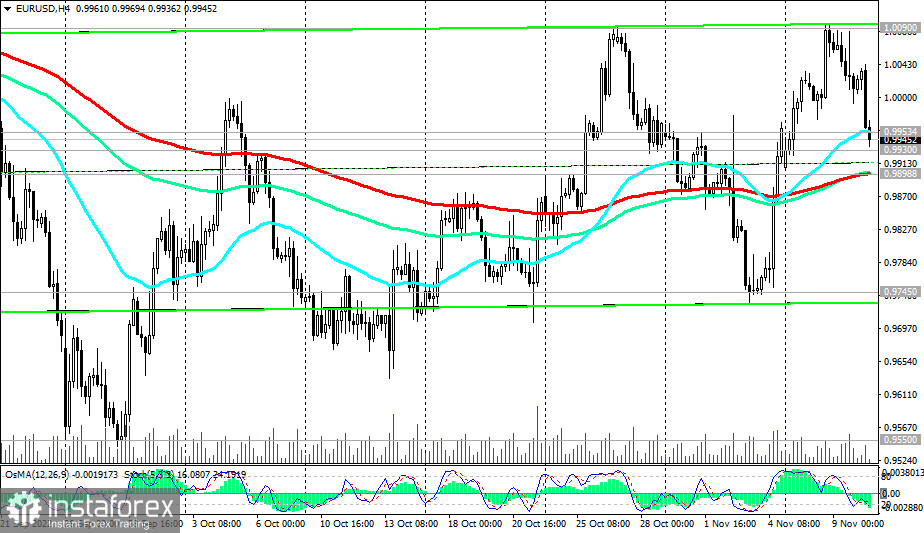

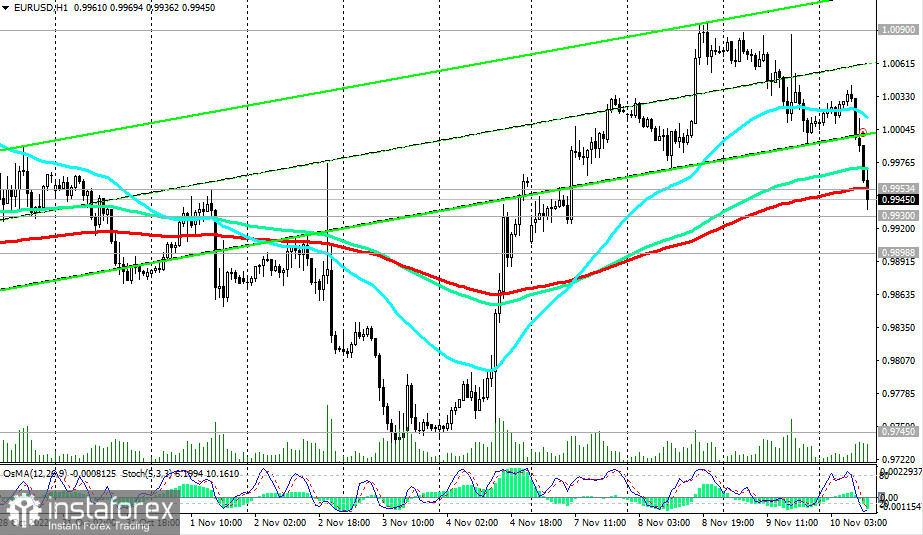

As of writing, the price is testing for a breakout of an important short-term support level 0.9953 (200 EMA on the 1-hour EUR/USD chart). Another important obstacle to the decline of EUR/USD and the pair's return to a long-term bearish trend lies at the 0.9898 support level (200 EMA on the 4-hour chart). Its breakdown will confirm the resumption of short positions.

In an alternative scenario, a resurgent upward correction will push EUR/USD to the recent local resistance level 1.0090. Our maximum growth forecast is 1.0210, through which one of the key long-term resistance levels (144 EMA on the daily chart) passes, separating the EUR/USD long-term bearish trend from the bullish one.

Below the key resistance levels 1.0210, 1.0390, EUR/USD is in the zone of a long-term bear market, which means that the advantage is still on the side of the sellers.

Support levels: 0.9953, 0.9930, 0.9898, 0.9800, 0.9745, 0.9700, 0.9600, 0.9535, 0.9500, 0.9400, 0.9300, 0.9200, 0.9000

Resistance levels: 1.0000, 1.0090, 1.0100, 1.0210, 1.0390, 1.0500

Trading Tips

Sell Stop 0.9920. Stop-Loss 0.9980. Take-Profit 0.9900, 0.9800, 0.9745, 0.9700, 0.9600, 0.9535, 0.9500, 0.9400, 0.9300, 0.9200, 0.9000

Buy Stop 0.9980. Stop-Loss 0.9920. Take-Profit 1.0000, 1.0090, 1.0100, 1.0210, 1.0390, 1.0500

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română