Long positions on GBP/USD:

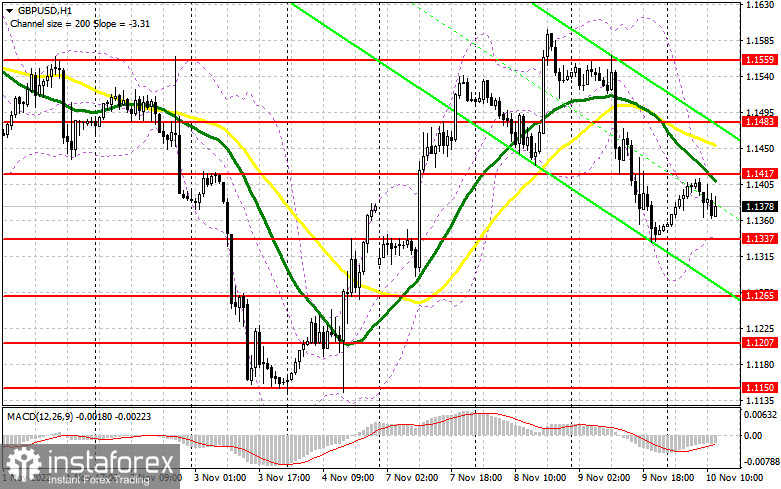

The US inflation statistics for October will drive the pair's quotes. Many expect that inflation's growth will slow down for the second month in a row, which will allow buyers of risky assets to relieve stress. Such news seriously influences the Federal Reserve System policy in regard to interest rates. If inflation rises again and is higher than economists' forecasts, the British pound will inevitably decline. It is better to be careful when making trading decisions as the market is facing excessive volatility. The best option to open long positions in the current conditions is a decrease of the pound and a false breakout near the support of 1.1337, which was formed yesterday. Only a false breakout at this level may give a buy signal with the aim to recover and reach the resistance of 1.1417, above which the moving averages pass, limiting the uptrend potential. A breakout and a top/bottom test of this level may change the situation in favor of bulls, allowing them to build a more powerful correction, returning to 1.1483. The next target is located at 1.1559, where traders may lock in profits. If bulls fail to pierce 1.1337, which will happen only on the strong inflation data in the US, the pressure on the pair is likely to increase again. In addition, it will confirm the absence of real buyers in the market. You may buy the pound after a false breakout near 1.1265. It would be better to open long positions on a rebound from 1.1207 or lower near 1.1150, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

Bears are ready to act at any moment if only there was a reason. That reason might be the CPI data. Definitely, bears need to keep control of the resistance at 1.1417, which is located just above the moving averages. As long as the pair is trading below this level, bears have a good chance to drag the price to new weekly lows. If the pound rises, a false breakout at 1.1417 may create a good signal to open short positions, which will help push the GBP/USD pair back to 1.1337, yesterday's low. A breakthrough and a reverse bottom/top test of 1.1337 will give an entry point, counting on a return to 1.1265. The next target is 1.1207, where traders may take profits. A test of this level is likely to ruin bulls' plans for the pound. If the GBP/USD pair grows and bears show weak activity at 1.1417, bulls may continue to return to the market counting on weak inflation and an uptrend. This will push the price to 1.1483. Only a false breakout at this level may give an entry point into short positions with the target located below. If we see no activity there either, it would be better to sell the pound from 1.1559, counting on an intraday rebound down by 30-35 pips.

The COT report for November 1 logged a reduction in both short and long positions. Most likely, the reason for that was the upcoming meetings of the Federal Reserve System and the Bank of England, after which the US dollar regained its demand for a while. The current COT report does not take the results of the meetings into account yet. The Bank of England's decision to raise interest rates was in line with economists' forecasts, with Governor Andrew Bailey saying he was willing to put the brakes on further aggressive policy in favor of the pace of economic growth, which is declining rapidly. He also voiced fears over the cost-of-living crisis in the UK, to which the real estate market crisis may soon be added due to a sharp rise in interest rates. Against this background, the continued pace of interest rate hikes by the Fed and a more cautious stance by the Bank of England led to a major sell-off in the pound. Everything changed after US labor market data showed a sharp decline, providing a strong reminder at the end of the week for the Fed to proceed more cautiously in the future. The latest COT report showed that long non-commercial positions declined by 8,532 to 34,979, while short non-commercial positions fell by 11,501 to 79,815, resulting in a slight decline in the negative non-commercial net position to -44,836 from -47,805 the week before. The weekly closing price rose to 1.1499 against 1.1489.

Indicator signals:

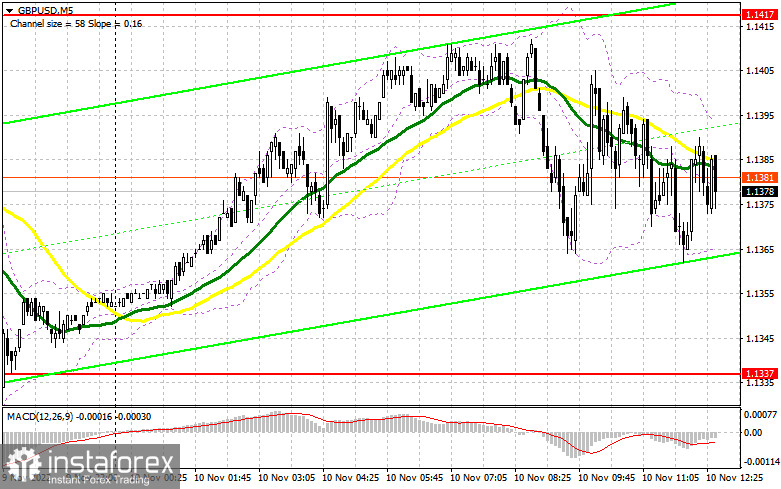

Moving averages

The pair is trading below the 30- and 50-day moving averages, indicating an attempted bearish correction.

Note: The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the general definition of classic daily moving averages on daily chart D1.

Bollinger Bands

If the pair grows, the upper boundary of the indicator near 1.1417 will act as resistance.

Description of indicators

- Moving average defines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average defines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator. Fast EMA 12. Slow EMA 26. SMA 9

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of noncommercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română