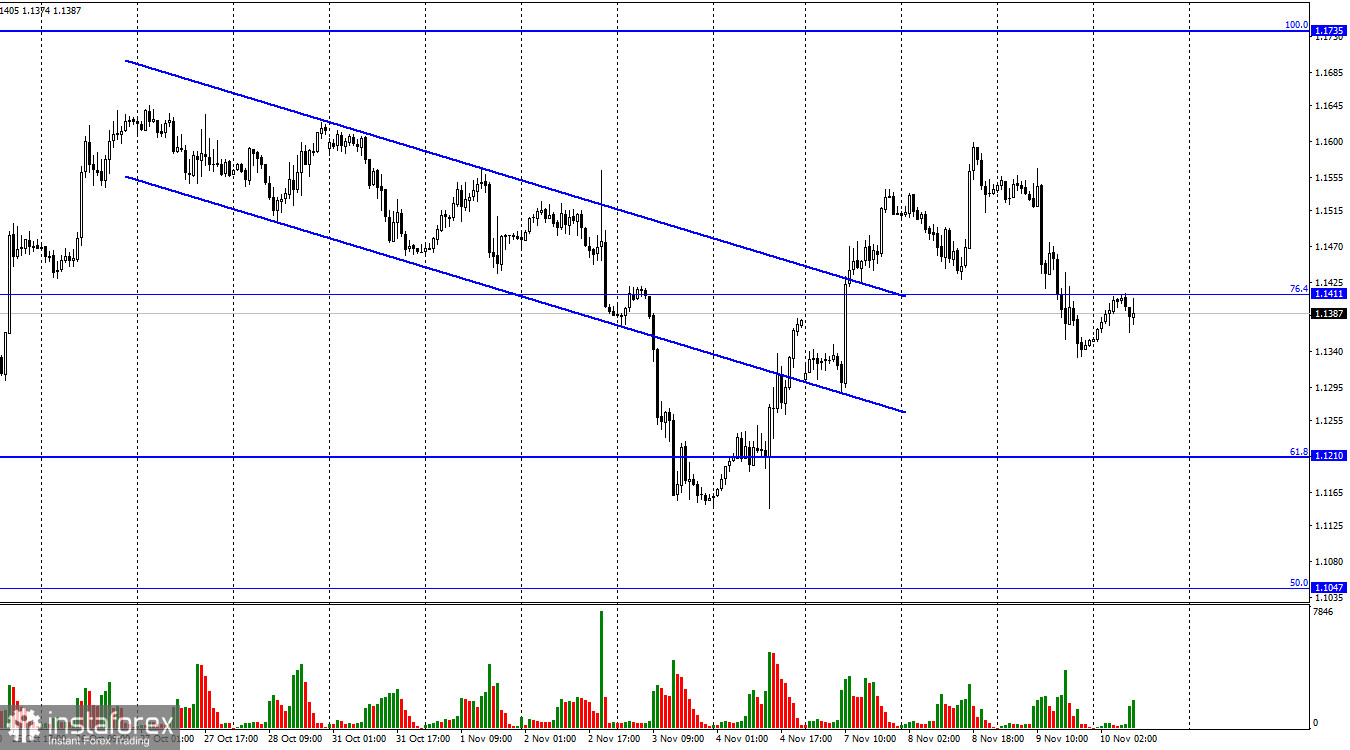

Hi everyone! On the 1H chart, the GBP/USD pair declined on Wednesday, settling below 1.1411, the correction level of 76.4%. Today, the pair retreated from 1.1411. So, there is a high likelihood of a decline to 1.1210, the correction level of 61.8%. Don't forget that in the afternoon, the inflation report is due. Market reaction is likely to be rather sharp. Traders should be ready for volatility.

Apart from inflation data, traders are assessing the interim results of the US election. The parties are trying to win the majority of seats in both chambers – 435 sears in the house of Representatives and 25 seats in the Senate. Republicans have already wrested control of the House of Representatives, winning 220 seats out of 218 necessary for victory. However, Democrats and Republicans are still tussling for the Senate. According to various sources, the Republicans are now leading, winning only 1-2 seats more than the Democrats. The final results remain unknown in three states: Arizona, Nevada, and Georgia. I would also note that Democrats do not need to gain more seats than Republicans to control the Senate. Even with an equal number of seats, they will have the upper hand as the decisive vote belongs to US Vice President Kamala Harris, who is a Democrat. The final results of the elections will be known only in early December. The votes are still being counted.

The US currency has been growing for two consecutive days. Hence, I assume that the victory of the Republicans will be a favorable outcome for it. However, traders may be betting on weak inflation data. They could buy the US dollar, expecting further sharp rate hikes. If the Fed sticks to aggressive tightening for a longer period than expected, it will also be bullish for the greenback. Therefore, it is difficult to say what is the main driving force for the US dollar: the results of the election or the inflation report.

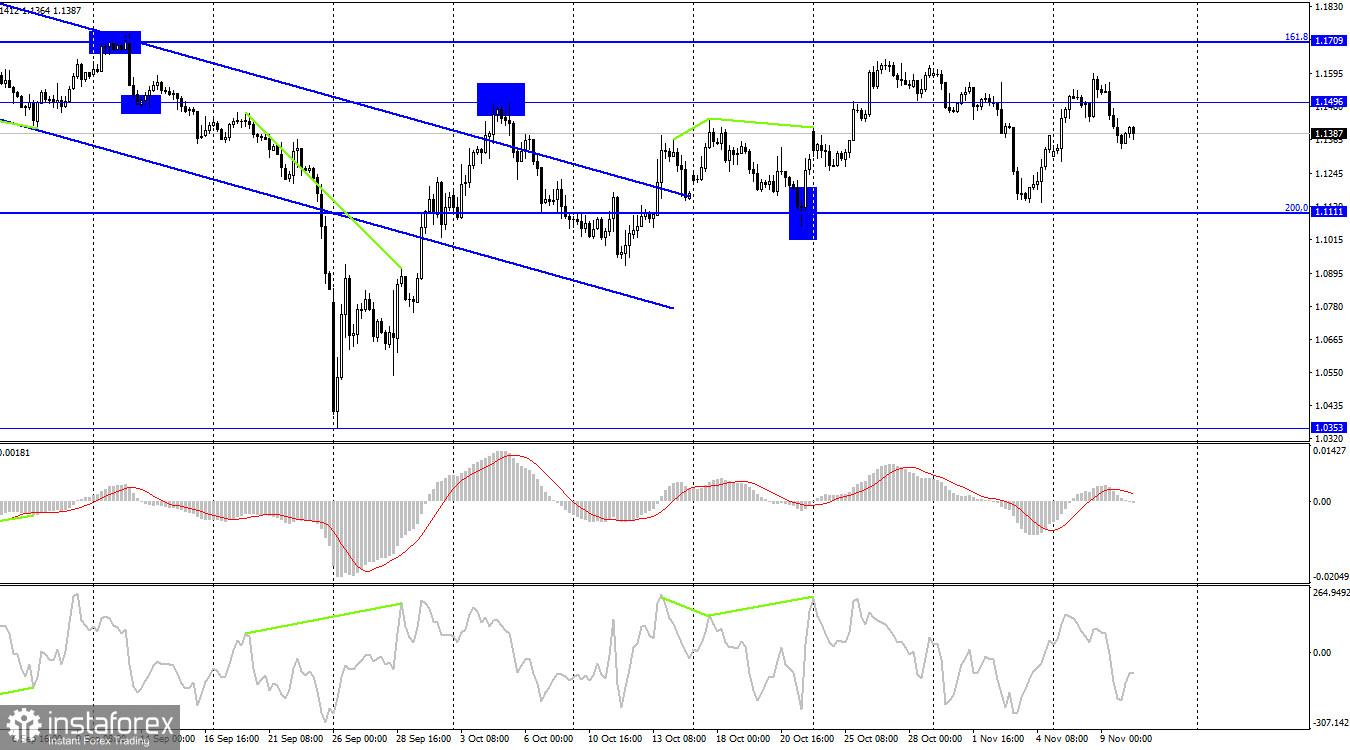

On the 4H chart, the pair dived down to 1.111, the Fibo level of 200.0%. No divergences are seen in any indicator today. The bulls failed to push the price to the pivot level of 1.1709. The pound sterling may drop lower.

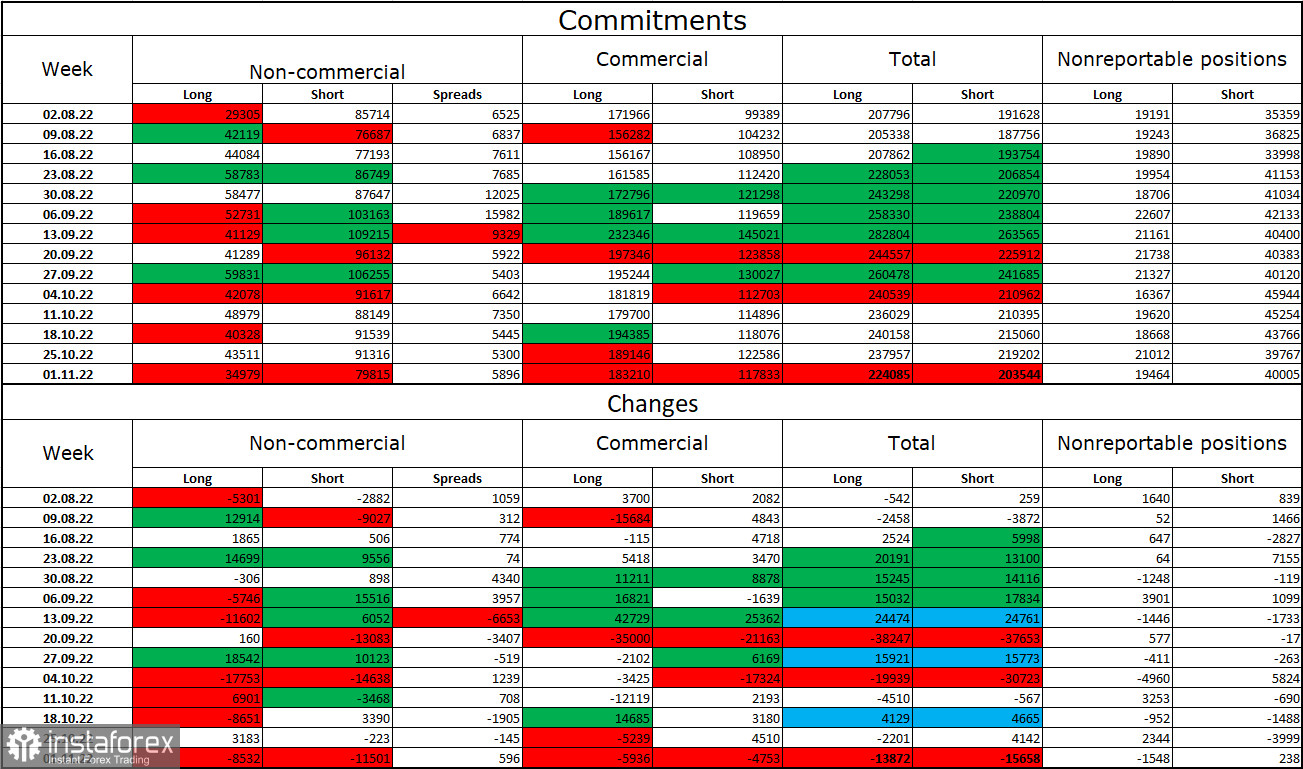

Commitments of Traders (COT):

Last week, the sentiment of the non-commercial traders became less bearish on the pair than the week earlier. Investors closed 8,532 long positions and 11,501 short ones. However, the overall sentiment of large traders remains bearish as short positions still exceed long ones. Therefore, large traders are more prone to sell the pound sterling even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound sterling may continue its uptrend only amid strong fundamental factors which have not been quite weak lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still declining against the US dollar. As for the pound sterling, even COT reports do not favor buying the pair.

Economic calendar for UK and US:

US- Consumer Price Index (13:30 UTC).

US – Initial Jobless Claims Report (13:30 UTC).

The economic calendar for the UK is completely empty today. The US will unveil the inflation report, which traders have been awaiting since the start of the week. The impact of fundamental factors on the market sentiment will be strong today.

Outlook for GBP/USD and trading recommendations:

It is recommended to open short positions if the pair drops below 1.1411 on the 1H chart with the prospect of a decline to the target level of 1.1210. It would be appropriate to hold short positions. It is better to open long positions on the pound sterling with the prospect of a rise to the target level of 1.1709 if the price consolidates above 1.1411.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română