Tomorrow, the US and Canada are celebrating national holidays, US banks and stock exchanges will be closed, and on the eve of the long weekend, strong movements may be observed in the market, provoked by the fixation of some of the trading positions of traders.

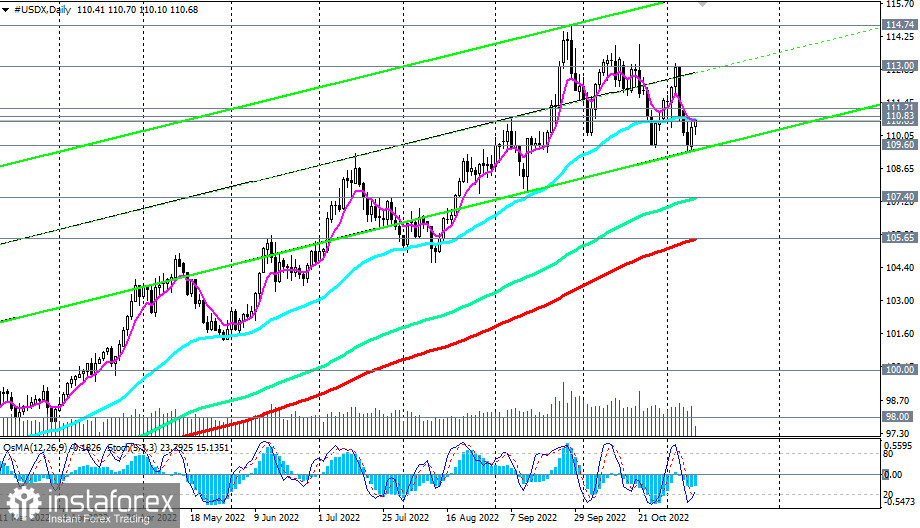

If today's publication of US inflation figures will disappoint investors, it will cause a new wave of dollar sales and a drop in DXY towards support levels 109.60, 109.00. The breakout of these levels may provoke a deeper fall of the DXY, up to key support levels 107.40 (144 EMA on the daily chart), 105.65 (200 EMA on the daily chart).

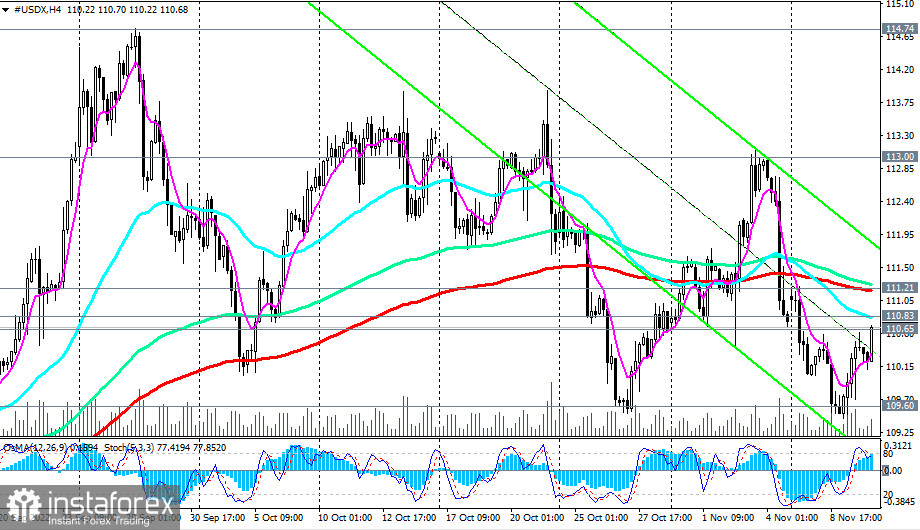

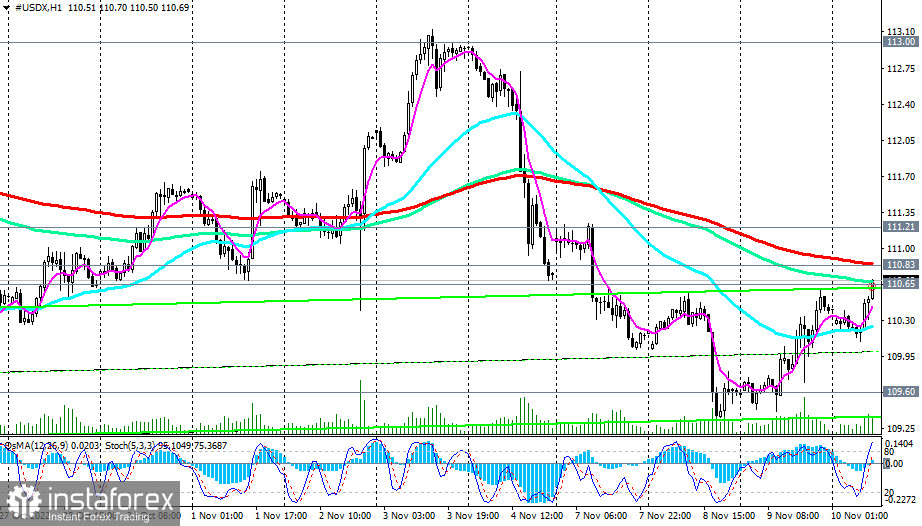

Therefore, while CFD #USDX remains in the zone of the long-term bull market, long positions still look preferable. However, a signal is also needed to resume them. The first such signal will be the breakout of an important short-term resistance level at 110.83 (200 EMA on the 1-hour chart), and the confirmation signal will be the breakout of an important, also short-term, resistance level 111.21 (200 EMA on the 4-hour chart). The nearest growth target is the local resistance level 113.00.

Support levels: 109.60, 109.00, 107.40, 105.65

Resistance levels: 110.83, 111.21, 112.00, 113.00, 114.00, 114.74, 115.00

Trading Tips

Sell Stop 109.90. Stop Loss 110.90. Take Profit 109.60, 109.00, 107.40, 105.70

Buy Stop 110.90. Stop-Loss 109.90. Take-Profit 111.20, 112.00, 113.00, 114.00, 114.74, 115.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română