Why did the euro shoot up in early November? The answer to this question can be easily found in the securities market. In October, European stock indices rose by 11% compared to 5–6% for their US counterparts. German bond yields edged up amid hawkish rhetoric from members of the ECB's Governing Council, including a higher peak deposit rate than the 3% expected by investors. The flow of capital from North America to Europe has been the catalyst for the EURUSD rally, which is one step away from completion.

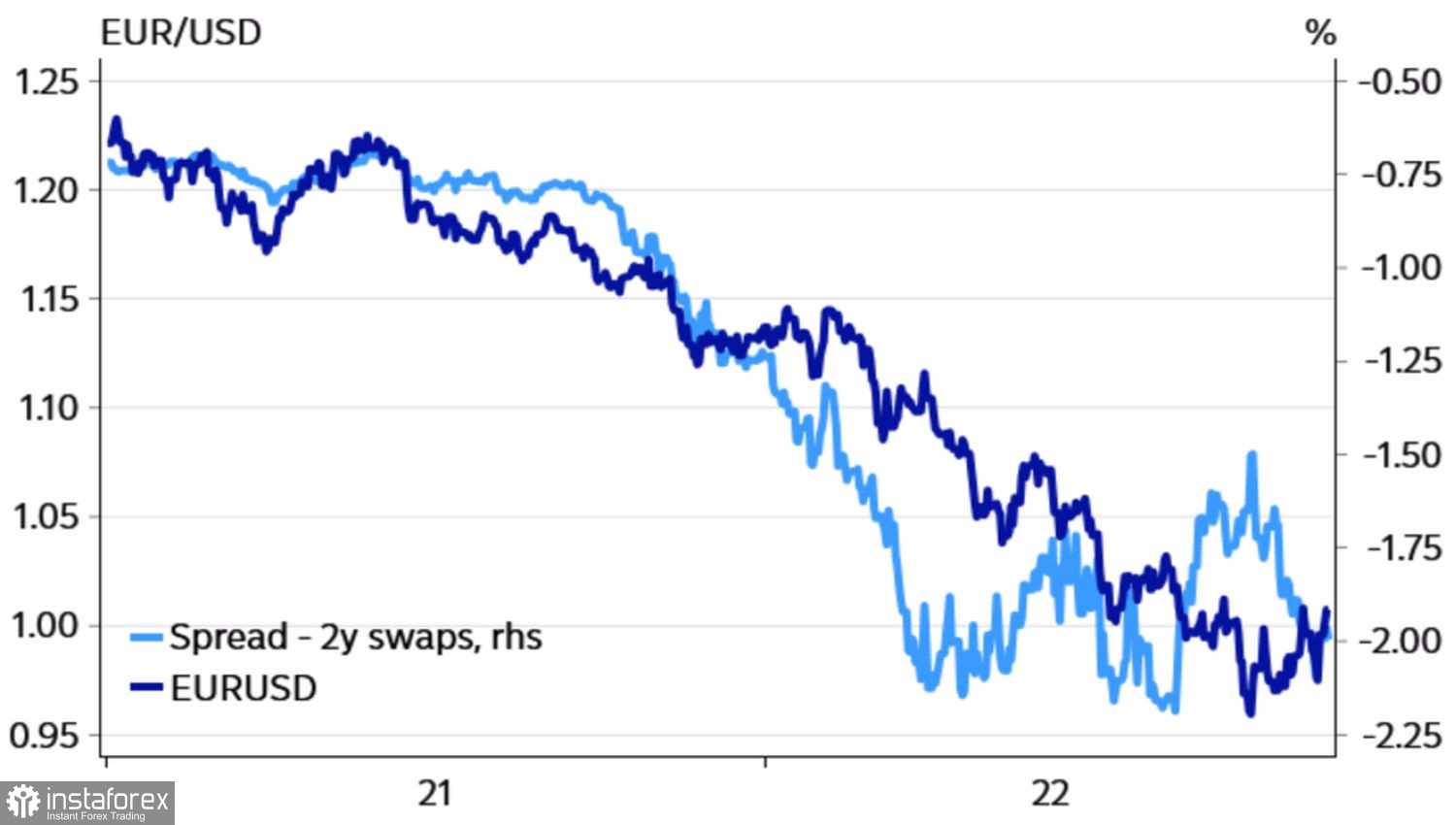

Indeed, despite the changed dynamics of stocks, bonds and other financial assets, their ratios still testify to the persistence of the downward trend in the main currency pair. A typical example is the interest rate swap market.

Dynamics of EURUSD and interest rate swap differential

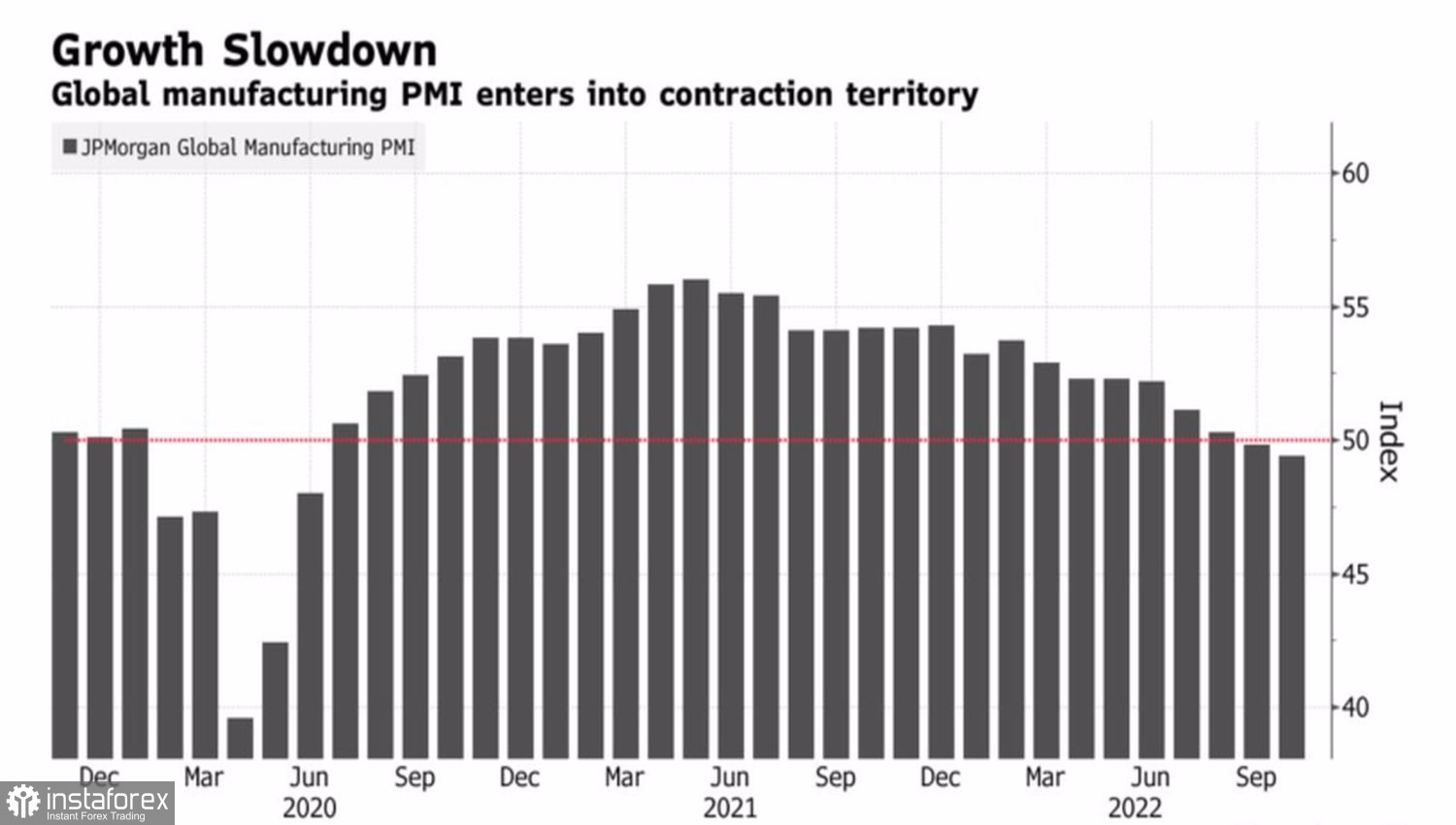

Plus, the US dollar rarely falls when the Fed hasn't done its job of tightening monetary policy and the global economy is on its last legs. It may have seemed to some that falling gas prices in the eurozone would allow it to avoid a recession, and thanks to a strong labor market, the US economy would make a soft landing. Alas, the substantially increased electricity bills for European households suggest otherwise, as is the slowdown in consumer spending in the US and the depletion of their savings and falling property prices. According to UBS, these data indicate that the US is in a hard landing.

If things are not going well in the world's leading economies, including the US, the eurozone and China, causing global business activity to decline, then demand for the dollar as the main safe-haven asset should remain strong.

Dynamics of global business activity

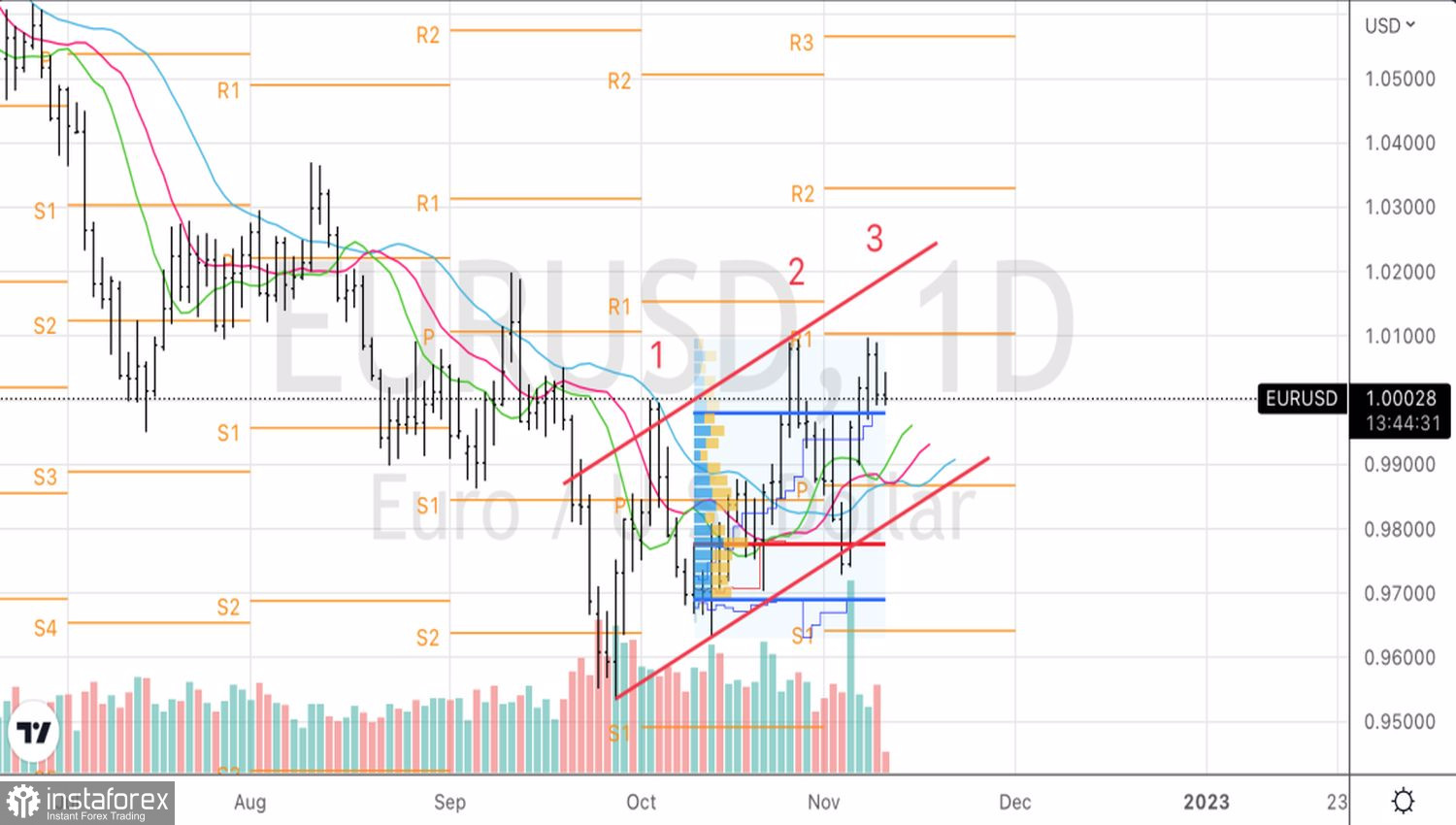

Keeping the trump cards "bears" on EURUSD allows large banks and investment companies to argue that the current rise of the pair is a temporary phenomenon. There can be no question of any change in the downward trend. At least for now. So TD Securities claims that in 2023 the USD index will lose 10% of its value, but its collapse will begin only in the second quarter, and not now.

The return of the US dollar to the game will most likely be associated with strong inflation statistics in the US. Just yesterday we discussed the question why the Fed looks more at the monthly dynamics of indicators than at the annual one. And forecasts of +0.5–0.6% MoM on consumer prices and core inflation do not give the Fed reason to relax. With such dynamics of CPI, the chances of a 50 bps increase in the federal funds rate in December will fall from the current 52%, which will support the "bears" on EURUSD.

Technically, the Three Indians reversal pattern is being implemented on the daily chart of the pair, as expected. I recommended selling euros from the levels of $1.007–1.008, which by that time were current. Due to the formation of an internal bar, we have the opportunity to increase short positions on EURUSD on a breakout of support by 0.995.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română