It seems that the Republicans were not so strong in the US, so the results of the midterm elections remain unclear. This means that the balance of power in the two houses are unchanged, which significantly affected market sentiment and led to a sell-off in the US stock market. Dynamics of trading in Europe and Asia was also influenced.

Earlier, many were betting heavily that a noticeable shift in power, at least in Congress, will lead to cuts in various financial costs and tax increases. But this did not happen, which was the reason for yesterday's disappointment in the markets.

In addition, data on US consumer inflation is due, which is expected to grow by 0.6% m/m and fall to 8.0% y/y in October. This is also important as it will affect the dynamics in the markets, particularly in the demand for the dollar.

So far, the disappointment that befell the markets as a result of the elections in the US can significantly increase the negative trends and lead to a new collapse in the stock markets, primarily in the US. And if the data shows an increase in consumer prices, albeit insignificant, the Fed will have every reason to raise the discount rate again in December by 0.75%. In this case, the dollar will definitely receive support again against the backdrop of because of a likely resumption in growth of Treasury yields.

But if the inflation rate goes down, even if slightly, there will be a new wave of purchases as investors will once again expect the Fed to gradually reduce the pace of its rate increases.

Forecasts for today:

XAU/USD

Gold is trading below 1713.60. If dollar comes under pressure in the wake of the release of US inflation data, prices will grow to 1730.00 after overcoming the level of 1713.60.

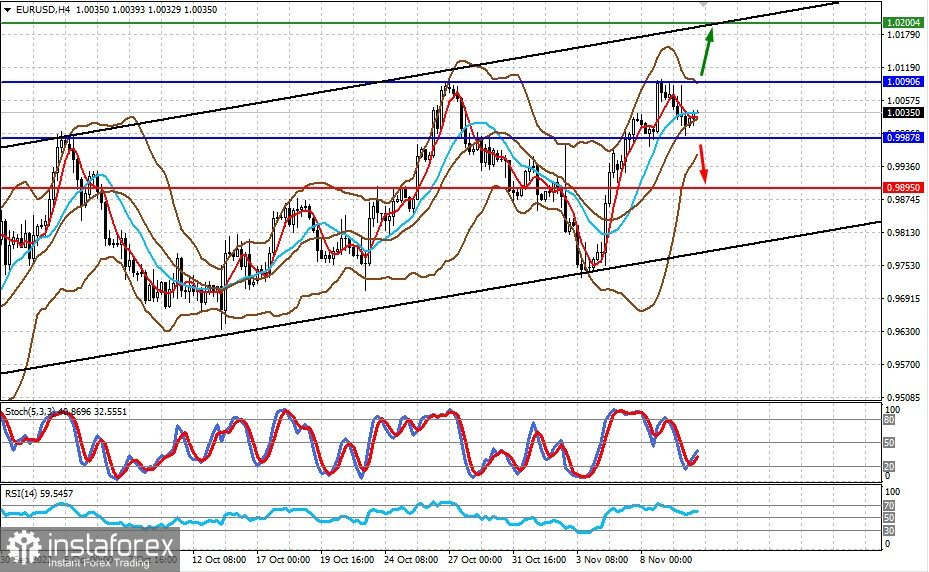

EUR/USD

The pair is consolidating in the range of 0.9987-1.0090 ahead of the release of inflation data in the US. If they show growth, dollar will rise again and the pair may fall to 0.9895. But if it decreases, the pair will surge above 1.0090 and head to 1.0200.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română