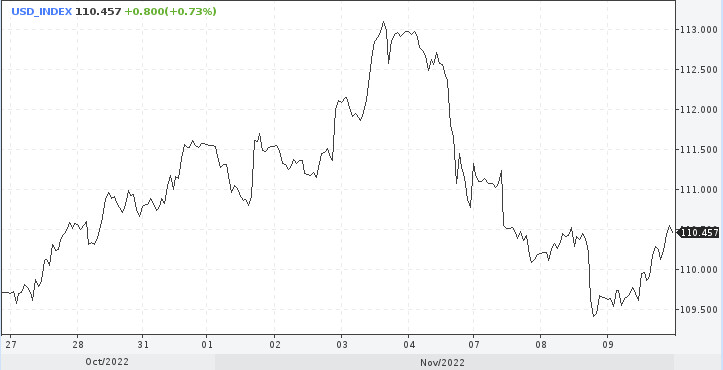

The dollar index regained positions above 110.00 on Wednesday. Investors are evaluating the results of a tougher-than-expected midterm election. The Republicans are in the lead, but not as confidently as expected. It may take a second round to determine the winner.

The Democrats have failed. However, there is nothing surprising. Historically, events since the Second World War have developed in this way. In the middle of the presidential term, the party of the current head of the United States loses seats in the House of Representatives in the midterm elections. Analysts initially said that the Joe Biden administration was not among the rare lucky ones. And so it happened.

Despite the fact that the Republicans failed to fully implement their plans, their party is likely to take control of the House of Representatives, which, according to analysts, may support the dollar in the short term.

However, how the US currency ends the week will ultimately depend on the results of the inflation report on Thursday. A key catalyst for the markets is the October CPI report, which will provide insight into the Federal Reserve's rate. Money markets are currently pricing in a more moderate 50 basis point rate hike in December. However, a hotter-than-expected inflation report could spur bets on another 75 bps hike.

Until the release of the data, investors will continue to follow the news feed on the elections, although this is not such a significant topic for them. Markets are more likely to fill the gap until the next really important event.

Elections are a minor factor influencing the outlook for the dollar, however, they may have some implications for price action in the short term. This is what happened on Wednesday.

If the weekly close is below 110.05, then analysts will have another reason to start talking about the formation of the top for the US currency index. While it is too early to talk about it, we are waiting for the CPI.

"The first results of the midterm elections indicate that the Republican wave is unlikely to materialize. The most likely outcome will be a split in Congress, with Republicans seizing power in the House of Representatives and Democrats retaining the Senate. If the result is confirmed by the final vote count, Joe Biden will have to resort to executive orders, as his legislative powers will be severely curtailed," UniCredit Bank notes.

The split between the government and Congress is more of a market story next year, when debt ceiling concerns resurface.

"If the Democrats still surprise the world and hold the House of Representatives, it will be negative for the dollar, but not more than 1% on the index," economists believe.

Dollar 2023

The dollar has shown a breathtaking rally this year. The US currency index reached levels not seen in more than 20 years. Since the beginning of the year, it is up 13% against the euro, 17% against the pound and 22% against the yen. This has important implications for international portfolios and, since it is the world's reserve currency, also for global financial conditions. And the reason for this is higher interest rates, the Fed's hawkish attitude, the strong economic outlook, and the unwillingness of investors to take risks.

A weaker dollar will weaken financial conditions and increase global risks. For this to happen, an improvement in global economic growth prospects will be required to begin with. An important component of the end of the dollar growth is the end of the cycle of rate hikes.

Given these two factors, it is reasonable to assume further growth of the dollar in 2023.

Some central banks have recently slowed down their rate hikes. The Fed, unlike them, focuses solely on inflation and plans to raise rates above 5%.

Higher US rates continue to attract global capital flows seeking higher returns.

As global economic risks emerge or continue, the dollar is likely to remain the best safe haven. Although it may peak when the Fed eventually slows down its policy of tightening monetary policy. This alone may not be enough to cause a significant depreciation of the dollar.

Although there are doubts about the forecasts for further growth of the dollar, the driving forces of its strength have not yet been exhausted.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română