Since Tuesday, the feud between the two largest cryptocurrency exchanges in the industry — Binance and FTX — has led to a downturn in the market, as traders chose to stay away in the safety of stablecoins.

Likewise, the fall in the price of cryptocurrencies comes amid the midterm elections in the US, which took the pressure off the financial markets, as all attention is on which party will come out ahead in one of the most contentious elections of our time.

According to various analysts and strategists, many expect a Republican victory to be positive for the stock market, while a Democratic victory is less promising.

Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, wrote on Monday, "If Republicans do well and take back control of one or both chambers of Congress, we see the event as a positive for the stock market into year-end. We believe the October move was fueled in large part by the shift in momentum away from Democrats and back towards Republicans that we started to see in polling data and betting markets that was building in August and September."

The BTC price spike came after Binance CEO Changpeng Zhao posted the following tweet saying that the exchange was in the process of acquiring FTX.com to ease the liquidity crisis.

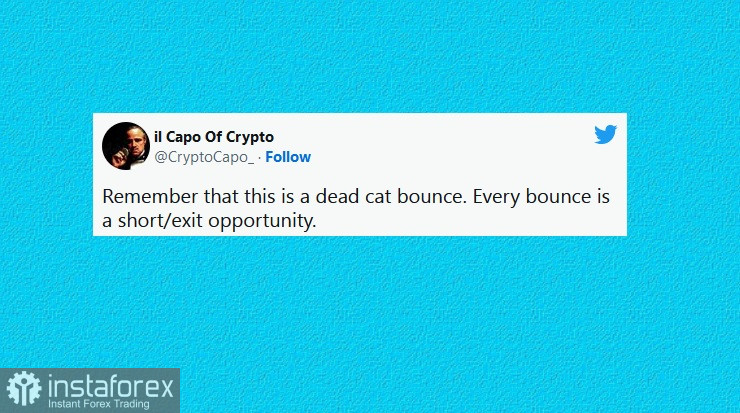

While many were quick to speculate that this would end the current pullback and resume the upward trend seen a week earlier, crypto analyst Il Capo of Crypto posted the following warning tweet.

As for what a worst-case BTC pullback would look like: crypto market analyst Tony suggests that bitcoin could eventually drop to the $8,000 to $10,000 range.

As has historically been the case, when bitcoin falls, so does the broader altcoin market, and today is no exception.

The total market capitalization of the cryptocurrency is currently $1.025 trillion, and the Bitcoin dominance rate is 38.3.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română