The US dollar index recovered slightly by Wednesday morning, following a steep fall on Monday. Stock indices are trading mixed. Yesterday, markets in Europe and the United States closed higher. Meanwhile, in the Asia-Pacific region, minor sell-offs took place after it became known that there had been no truth in rumors that China would ease Covid restrictions as well as amid growth in crude oil quotes. Bond markets are stable. Since no important macro releases are scheduled for Wednesday, we may expect low volatility in the forex market.

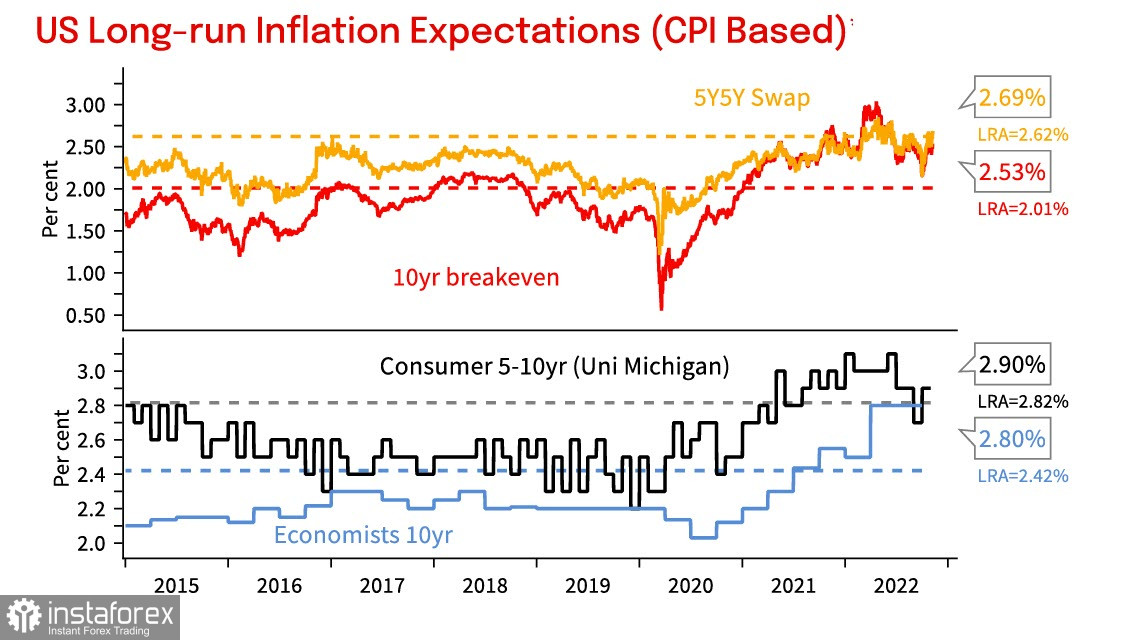

The fact that the world's leading central banks consider reducing the pace of tightening may indicate a possible slowdown in global inflation. Such an approach makes sense because, with each new increase, economies feel additional pressure. This way, central banks hope to buy them some time. However, there is also a flip side – slower tightening may boost inflationary expectations, and it will require one more rate-hike cycle. At the moment, inflation expectations are above the long-term average, which means central banks are likely to remain hawkish.

The US Fed is more likely to raise interest rates by 50 basis points in December, with the midterm election results and the inflation report, due on Thursday, seen as the main driving force. The downtrend in the US stock market stopped. Meanwhile, a rise in crude oil quotes, which correlates with the US dollar index, and not vice versa, as it is now happening, indicates rising economic slowdown concerns. The latest CFTC report shows a change in speculator sentiment with a surge in short positions on USD, which also reflects the possibility of a downtrend continuation.

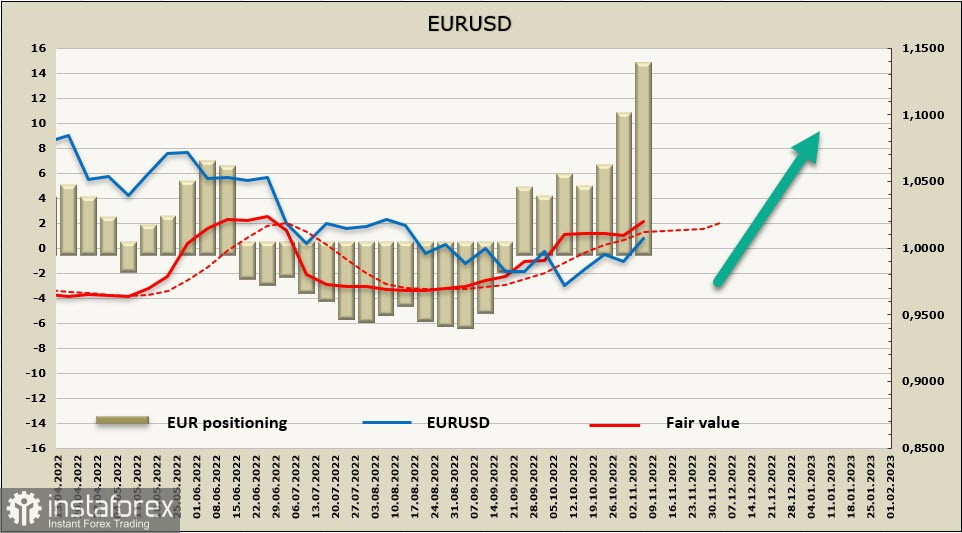

EUR/USD

The eurozone economy has shown unexpected resilience. Its Q3 GDP grew by 0.2%, down from the previous quarter (+0.8%). Still, it is acceleration, not contraction. Consumption remained robust in Q3, with support measures taken (energy subsidies, cost-cutting, and tax reliefs) proving to be effective.

The eurozone's main problem is the possibility of stagflation. In October, the ECB lifted interest rates by 75 basis points and announced the revision of the TLTRO program, which may lead to a sharp reduction in excess liquidity from 0.5 to 1 trillion euros. The ECB chose to stay hawkish due to record inflation and high inflation expectations. In December, the European regulator is forecast to hike rates by another 50 basis points. While other central banks are likely to reduce the pace of tightening, the ECB's aggressive stance will provide support for the euro.

EUR net long position grew by 3.7 billion to 13.1 billion in a week, the high unseen since March 2021. EUR positioning is bullish, with fair value heading north and above the long-term MA.

A pullback we expected last week turned out to be deeper. The price attempted to test 1.0092 resistance. In the near term, we may see another attempt, which is likely to be successful. The target stands in the 1.0190/0200 resistance zone.

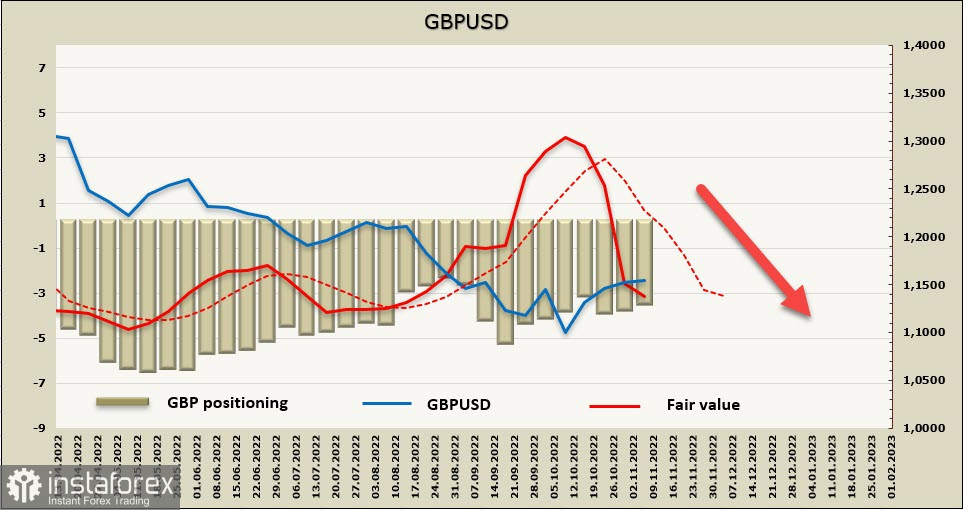

GBP/USD

Last week, the Bank of England increased interest rates by 75 basis points, in line with economists' expectations. However, the disappointing economic outlook exerted pressure on GBP. The British regulator sees interest rates peaking at 5.25%, almost in line with the Fed's rate expectations. This will unlikely have a significant impact on the yield spread. Meanwhile, a recession in the UK may last for 8 quarters. At the same time, the growth forecast for the American economy is more optimistic. Even a scenario with the bank rate at 3% suggests a recession in 5 out of 6 quarters. Therefore, the pound is set to feel pressure anyway.

GBP net short positions contracted by 0.2 billion to -3.2 billion. GBP positioning is bearish. GBP is now weaker than EUR and will hardly extend growth.

The pair is unlikely to break above 1.1644 resistance. If it attempts to rise to the swing high of October 27th, it may trigger a sell-off to the 1.1480/1.1500 support zone, with the price entering a sideways range and extending the downtrend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română