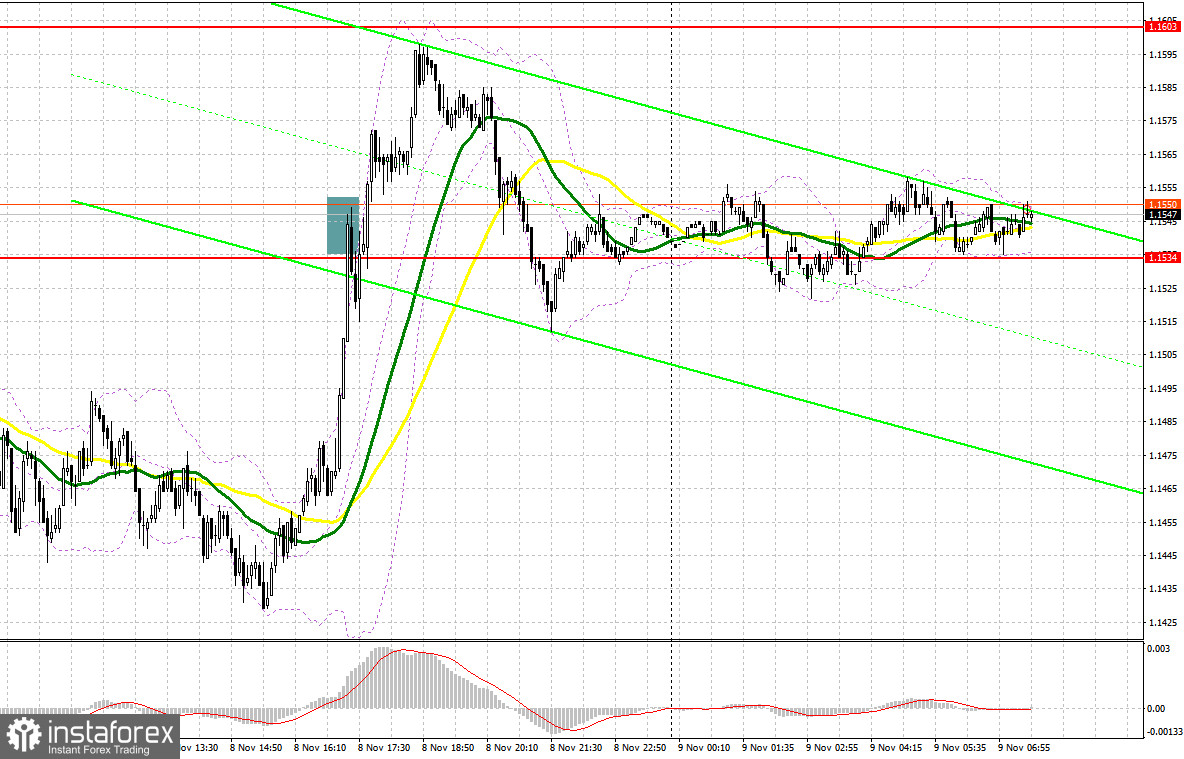

Yesterday, there were several signals to enter the market. Let's take a look at the 5-minute chart and see what happened. Earlier, I asked you to pay attention to 1.1466 to decide when to enter the market. The bears did not make us wait long and pushed the pound to the 1.1466 area. A false breakout there led to a good entry point into long positions in continuation of the upward trend, but it did not result in growth. In the best case, it turned out to be zero. After the pound sharply rose in the afternoon amid the midterm elections in the US, there was a false breakout in the resistance area of 1.1534. However, short positions brought losses, as I did not wait for the pair to move down.

When to go long on GBP/USD:

Expectations that the Republican Party will win during the US midterm elections put pressure on the US dollar, which is what bulls on the pound will use. However, in fact, there is simply no serious reason to build up long positions, especially before tomorrow's US inflation report. So be careful with buying at the current highs. I won't be surprised if the bulls seize the moment today and continue to buy amid the absence of important fundamental statistics on the UK. Speeches are expected from Bank of England MPC member Jonathan Haskell and BoE Deputy Governor for Financial Stability John Cunliffe, who will most likely talk about the dangers of an aggressive policy for the economy.

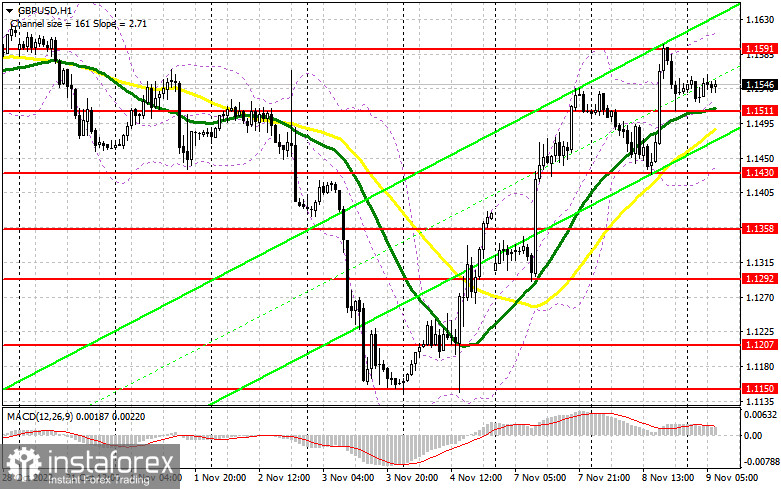

The best option for buying in the current conditions would be a false breakout in the area of the nearest support at 1.1511, where the moving averages are just passing, playing on the bulls' side. A false breakout there will give a signal to buy in order to further restore and update the resistance of 1.1591, formed on the basis of yesterday. A breakout and a downward test of this range may change the situation in favor of the bulls, allowing them to build a more powerful correction with the prospect of updating 1.1666. The farthest target will be 1.1722, where I recommend locking in profits.

If the bulls do not cope with the tasks set and miss 1.1511, and everything suggests that this is exactly what will happen in the near future, the pair will significantly be under pressure, as this will confirm the absence of real buyers in the market. If this happens, I advise you to buy only on a false breakout at 1.1430. It is also possible to buy the asset just after a bounce off from 1.1358, or even lower - around 1.1292, expecting a rise of 30-35 pips.

When to go short on GBP/USD:

Bears are still observing what is happening and are not very active, although it is obvious that there are quite a lot of people who want to sell even after such a sharp upward spurt of the pair - especially after the latest statistics indicating a rather gloomy situation with the economy and inflation in the UK. The initial task is to regain control of the support at 1.1511, formed on the basis of yesterday, however, don't forget to protect 1.1591, the weekly high. If the pound rises after the speech of the BoE representatives, a false breakout at 1.1591 will be an excellent signal to open shorts, which will help push the pound back to 1.1511, where the moving averages pass, the break of which will put bulls in a deadlock before tomorrow's US inflation report. A breakout and test upwards at 1.1511 would provide an entry point in anticipation of a return to the 1.1430 low. The farthest target will be 1.1358, where I recommend locking in profits.

In case the pair grows and bears fail to protect 1.1591, the bulls will continue to enter the market, counting on building an upward trend. This will push the GBP/USD to the 1.1666 area. A false breakout at this level will provide an entry point into shorts with the goal of moving down. If bears are not active there, I advise you to go short from 1.1722, expecting a decline of 30-35 pips.

COT report:

The Commitment of Traders (COT) report for November 1 showed that both long and short positions decreased. Most likely, the upcoming meetings of the Federal Reserve and the Bank of England were to blame, after which the US dollar regained its appeal again, albeit only for a while. The current COT report does not yet take these decisions into account. The English central bank's decision to raise interest rates coincided with economists' forecasts, while BoE Governor Andrew Bailey said he was ready to slow down with further aggressive policies in favor of economic growth, which is declining rapidly. He also expressed concern about the crisis in the cost of living in the UK, which in the near future, due to a sharp increase in interest rates, may add to the crisis of the real estate market. Against this backdrop, the continued pace of interest rate hikes by the Fed and a more cautious position from the BoE led to a major sell-off of the pound. That all changed after data on the US labor market indicated a sharp contraction, becoming a serious reminder for the Fed at the end of the week that it needs to act more cautiously in the future. The latest COT report indicated that long non-commercial positions decreased by 8,532 to 34,979, while short non-commercial positions decreased by 11,501 to 79,815, resulting in a slight decline in the negative non-commercial net position to -44,836 against -47,805 a week earlier. The weekly closing price increased and amounted to 1.1499 against 1.1489.

Indicator signals:

Trading is performed above the 30- and 50-day moving averages, which indicates further growth for the pound.

Moving averages

Note: The period and prices of moving averages are considered by the author on the one-hour chart, which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case the pair drops, the lower limit of the indicator around 1.1430 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română