The EUR/USD currency pair traded very weakly on Tuesday. It spent most of the day near the Murray level of "2/8"-1.0010, that is, near price parity. Although the euro currency has grown significantly in the last few days, a new fall of the pair may begin directly from the current positions, without updating its last local maximum. However, it should be recognized that over time, the situation is still gradually changing in favor of the euro currency. For example, on the 24-hour TF, quotes still overcame the Ichimoku cloud, which is a strong buy signal. However, it should also be understood that the situation is still not in favor of the euro, it's just that now it's a little less negative than before.

The fundamental and geopolitical backgrounds remain very complex for all risky assets. The Fed's rates may rise more than previously expected, as Jerome Powell has almost openly stated. The ECB has also tightened its rhetoric on rates, but many experts note that the ECB will not be able to keep up with the Fed, and will not be able to raise its rate as much as the American regulator. Thus, the negative divergence in rates for the euro will continue. And this is a reason, if not for the strong growth of the dollar, then at least for the lack of strong growth of the euro currency.

Recently, everyone has even begun to forget about geopolitics, although the Ukrainian-Russian conflict has not gone away and, according to many military experts, may experience a new phase of escalation this winter. The confrontation between NATO (the West) and Russia has not gone away either, so at any moment relations can deteriorate even more. However, now a lot will depend on the results of the elections to the US Parliament. Some political scientists believe that further escalation between the United States and the Russian Federation will not happen if the Republicans win. However, from our point of view, this is "written with a pitchfork on the water." Therefore, there are still very few real reasons for the dollar to fall.

A large-scale rate hike and a reduction in the Fed's balance sheet will continue to support the dollar.

Alan Greenspan, the former chairman of the Fed, who is currently 96 years old, spoke yesterday about monetary policy and the prospects for the US currency. We believe that his words are of great importance since, after all, the man held the post of head of the Fed for 19 years. Mr. Greenspan believes that the US dollar can continue to grow in 2023, even if the Fed slows down the rate hike or stops it. "Inflation may reach its peak by the first half of 2023, and the Fed may refuse to tighten further in the same period, but for the US dollar it will still mean a tailwind," Greenspan believes. He noticed that the Fed was raising its rate on a much steeper trajectory than other central banks. He also believes that it was extremely important to start raising the rate to one of the first in the world. The Fed not only raises the rate but also actively reduces its balance sheet (the QT program), all this will provide strong support for the dollar in the future, Greenspan says. "The supply of US dollars in the market will decrease, which will extinguish inflation and make it the best means of saving," the former head of the Fed believes.

It is difficult for us to disagree with the opinion of the former head of the Fed since we adhere to approximately the same opinion. High rates are a plus for the dollar. The status of the reserve currency of the world is a plus for the dollar. The reduction of the Fed's balance sheet is a plus for the dollar. The low probability of a recession in the US economy is a plus for the dollar. And what advantages does the euro or the pound have now? The probability of a recession in both the EU and the Kingdom is high. The Bank of England promised to reduce its balance sheet, and instead bought more treasury bonds to stabilize financial markets after the "Liz Truss initiatives." The ECB is not even thinking about selling bonds. The rates of the Bank of England and the ECB are likely to rise weaker than the Fed rate, and slower. Therefore, local growth of European currencies is possible, but in the long term.

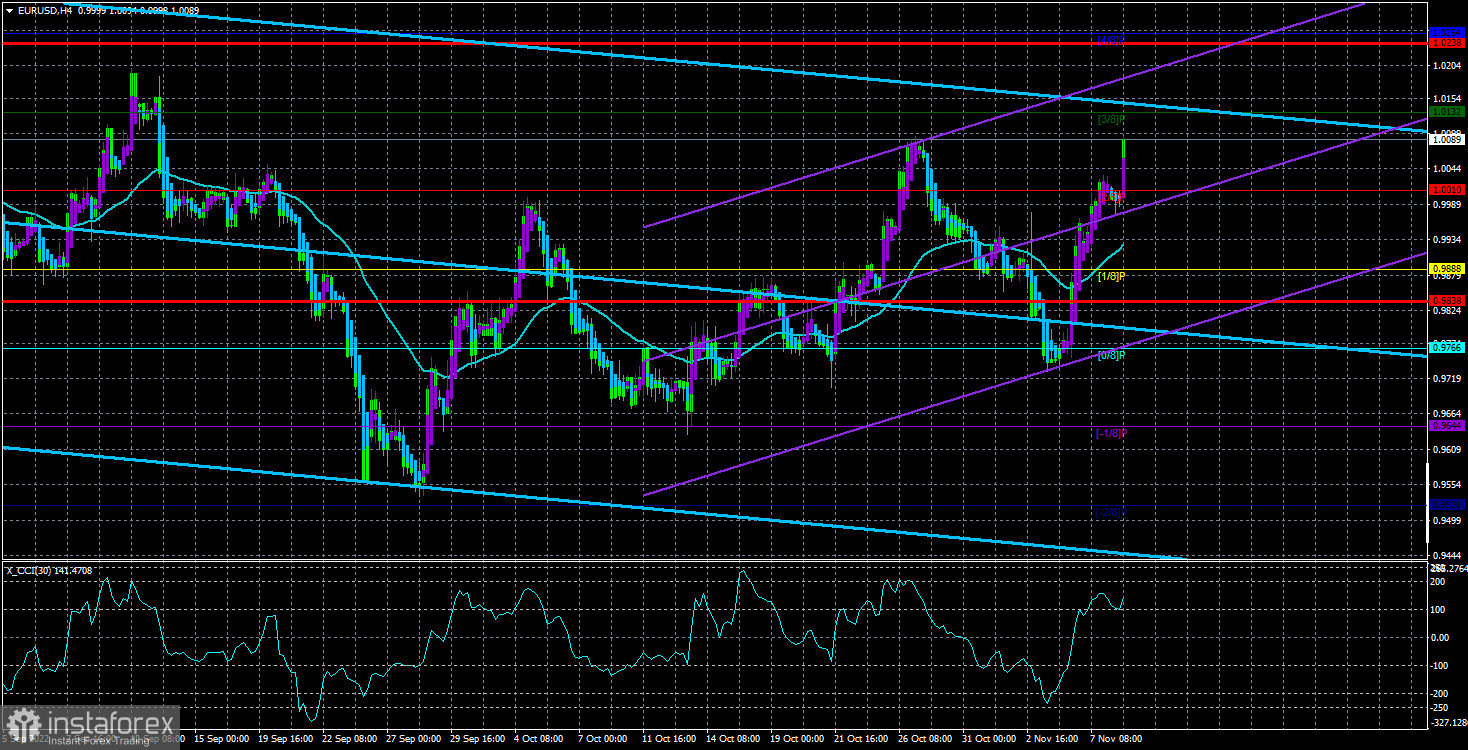

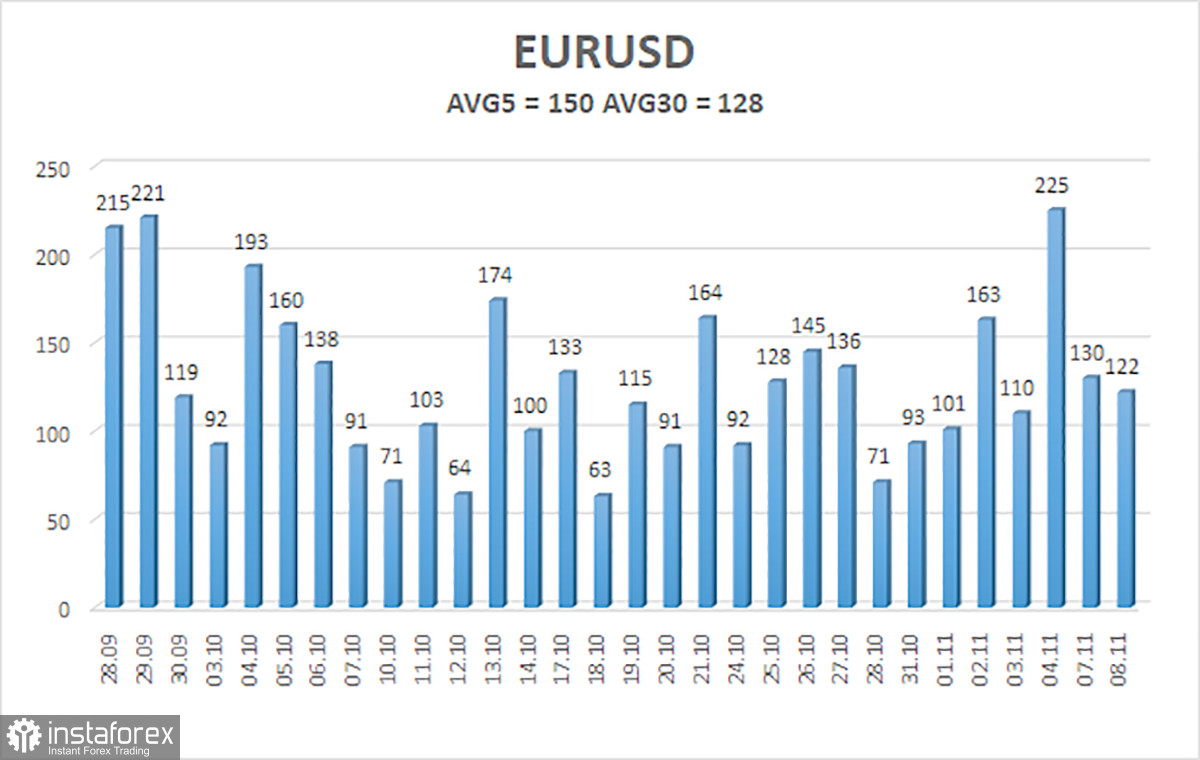

The average volatility of the euro/dollar currency pair over the last 5 trading days as of November 9 is 150 points and is characterized as "high." Thus, we expect the pair to move between 0.9838 and 1.0238 levels on Wednesday. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.0010

S2 – 0.9888

S3 – 0.9766

Nearest resistance levels:

R1 – 1.0132

R2 – 1.0254

R3 – 1.0376

Trading Recommendations:

The EUR/USD pair continues to be located above the moving average. Thus, now you should stay in long positions with targets of 1.0132 and 1.0238 until the Heiken Ashi indicator turns down. Sales will become relevant again no earlier than fixing the price below the moving average line with targets of 0.9838 and 0.9766.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română