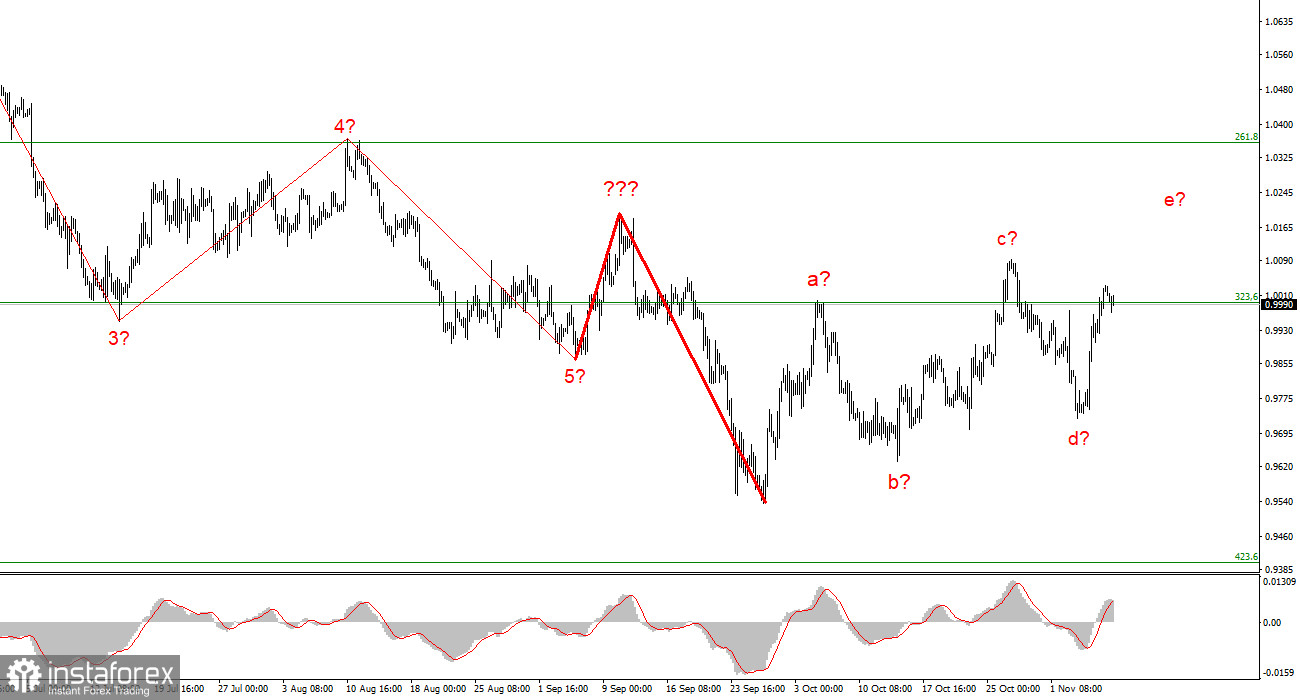

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes. The upward section of the trend continues its construction, but now it takes a pronounced corrective form. Initially, I thought that three waves up would be built, but now the tool is making a call to build the fifth wave e. Thus, we are likely to get a complex correction structure of waves a-b-c-d-e. There is also a possibility that the latest increase in quotes is the second wave as part of a new downward trend segment. An unsuccessful attempt to break through the 0.9993 mark, which corresponds to 323.6% Fibonacci, can confirm this assumption.

The most important thing now is that the wave markings of the pound and the euro coincide. If you remember, I have repeatedly warned about the low probability of a scenario in which the euro and the pound will trade in different directions. Theoretically, this is certainly possible, but in practice, it happens extremely rarely. Now both instruments are presumably building corrective trend sections. The European currency may rise this week beyond the peak of the expected wave c, but I don't think it is capable of going much higher than this mark.

The market may belatedly win back the speeches of FOMC members

The euro/dollar instrument fell by 30 basis points on Tuesday. The amplitude decreased noticeably compared to Monday, the news background was practically absent. Only in the European Union, a retail trade report for September was released in the morning, which announced an increase of 0.4% in monthly terms. However, this report in itself is not an important event for the market, and the reaction to it was extremely weak.

I would say that now a lot depends on the wave markup in the foreign exchange market. The tool is already building a pronounced five-wave structure, so I am waiting for a new increase in quotes, which may not converge at all with the news background. In fairness, it should be noted that there will be almost no important events this week. I can only mention a few speeches by FOMC members and the US inflation report. Moreover, I consider the speeches of the FOMC members more important, since they can clarify the situation with the rates for the next few months. Recently, there has been talk that the Fed's final rate may rise more than previously expected. Jerome Powell openly stated this last week, but Powell does not decide on the rate himself. If other FOMC members are against such a scenario, we may not see a tougher approach. That is why it is important to understand how many members of the Fed's PEPP committee support further policy tightening at the maximum pace. I would also note that the more votes in favor of this scenario we receive from the Fed, the higher the probability of a new increase in the US currency. At the same time, the market can first complete the correction set of waves, and only then take up the wagering of the statements of FOMC members and the inflation report in the United States.

General conclusions

Based on the analysis, I conclude that the construction of an upward trend section will become more complicated than a five-wave one. At this time, the instrument could start building the fifth wave of this section, so I advise buying with targets located above the peak of wave c, according to the MACD reversals "up." The entire trend segment originating after September 28 takes the form a-b-c-d-e, but after its completion, a new downward trend segment can begin to build.

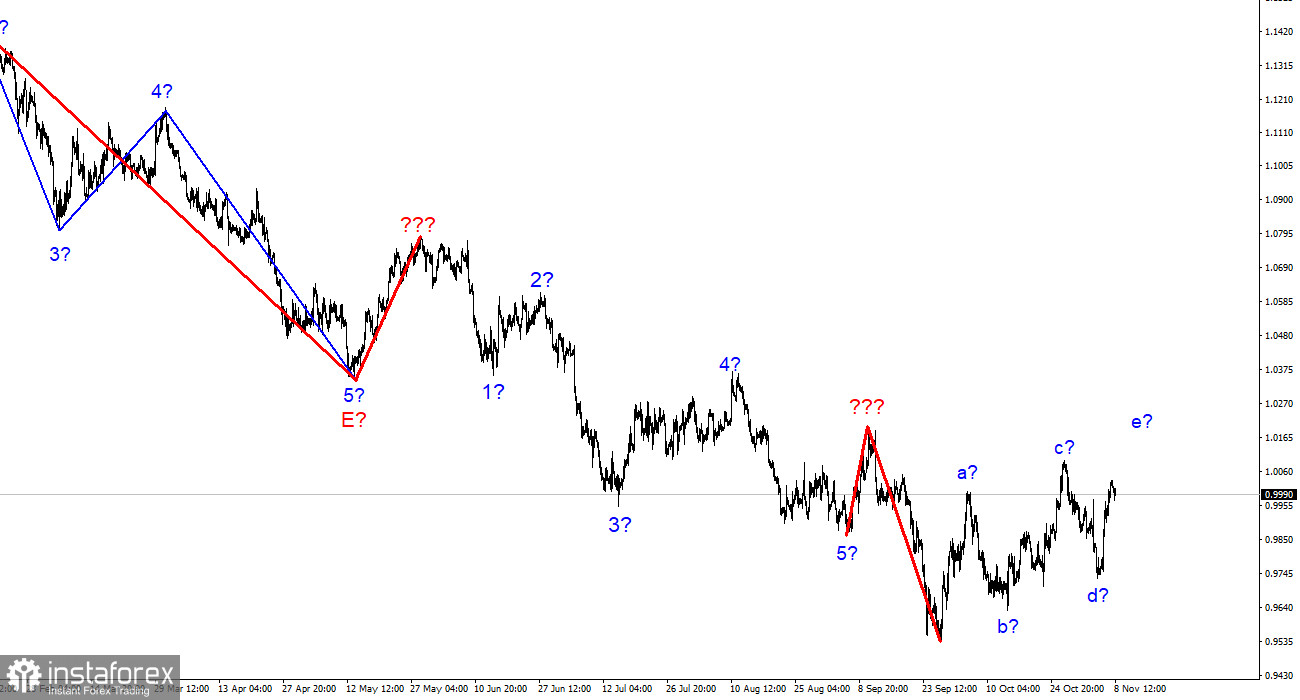

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. We saw three waves up, which are most likely the a-b-c structure, but probably two more waves will be built in the same structure. The construction of a downward trend section may resume after the completion of the construction of this section.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română