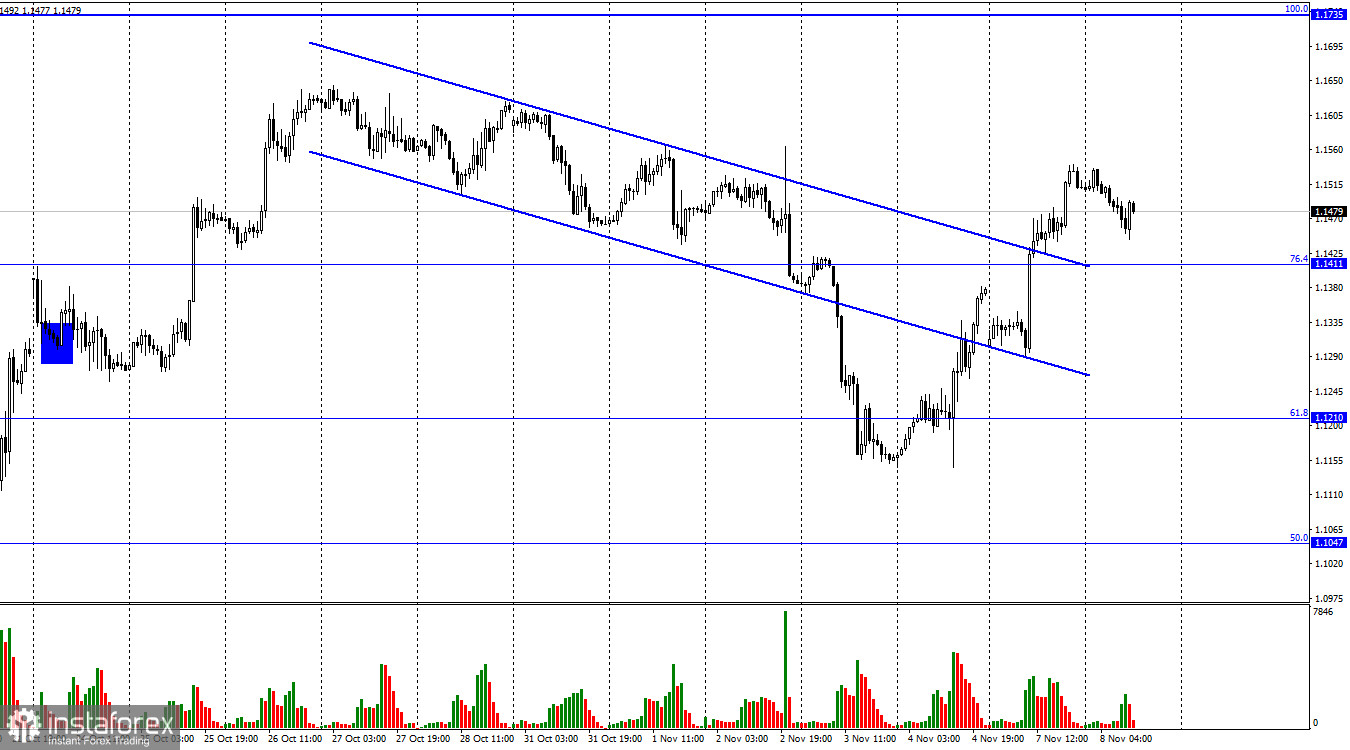

On Monday, GBP/USD continued to move higher on the 1-hour chart and settled above the Fibonacci level of 76.4% at 1.1411. So, the pound may continue its uptrend in the near term and test the retracement level of 100.0% at 1.1735. However, bulls still need to pass the level of 1.1496 on the 4-hour chart in order to extend the upward cycle. A rebound from this level will support the US currency.

On Monday, there were no important events either in the US or the UK. Therefore, a strong upward momentum in GBP was not caused by the news. However, both the pound and the euro advanced yesterday. The technical layout may change at any moment. This week, there is only one report to watch for - the inflation data in the US. Analysts wonder what the CPI report will reveal and how it will affect the forex market. I think that the report will be neutral. Currently, traders expect inflation to slow down to 8.0-8.1% year-on-year and these expectations are likely to come in line with the actual reading. Even in this case, traders may react to the report although the expected CPI reading is unlikely to cause sharp fluctuations.

At a recent press conference, Fed Chair Jerome Powell said nothing certain about the interest rates. It is still not clear whether the regulator is going to steadily slow down the pace of rate hikes or whether it will maintain the current pace if inflation accelerates. As far as I see it, the second scenario is more likely. Powell has repeatedly stated that the Fed will consider inflation when deciding on its future policy. Therefore, if the CPI rises slightly, the Fed may increase the rate by another 75 basis points in December. Stronger-than-expected inflation may spur a new round of growth in the US dollar.

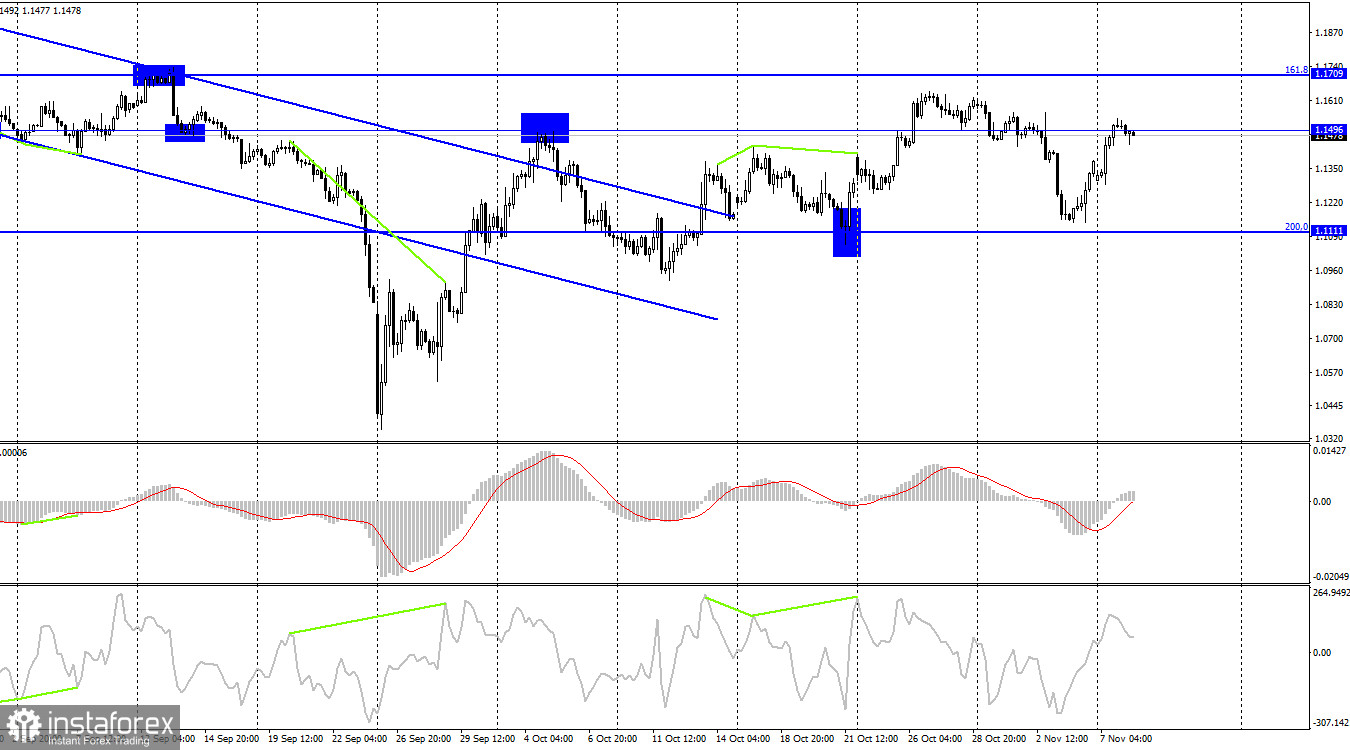

The pair reversed in favor of the British pound on the 4-hour chart and started to rise towards 1.1496. A firm hold above this level will open the way further to the upside to 1.1709 and 1.2008. Although the pound has not developed a strong upward movement yet, it is still rising to the joy of the bulls who have been idle for quite some time.

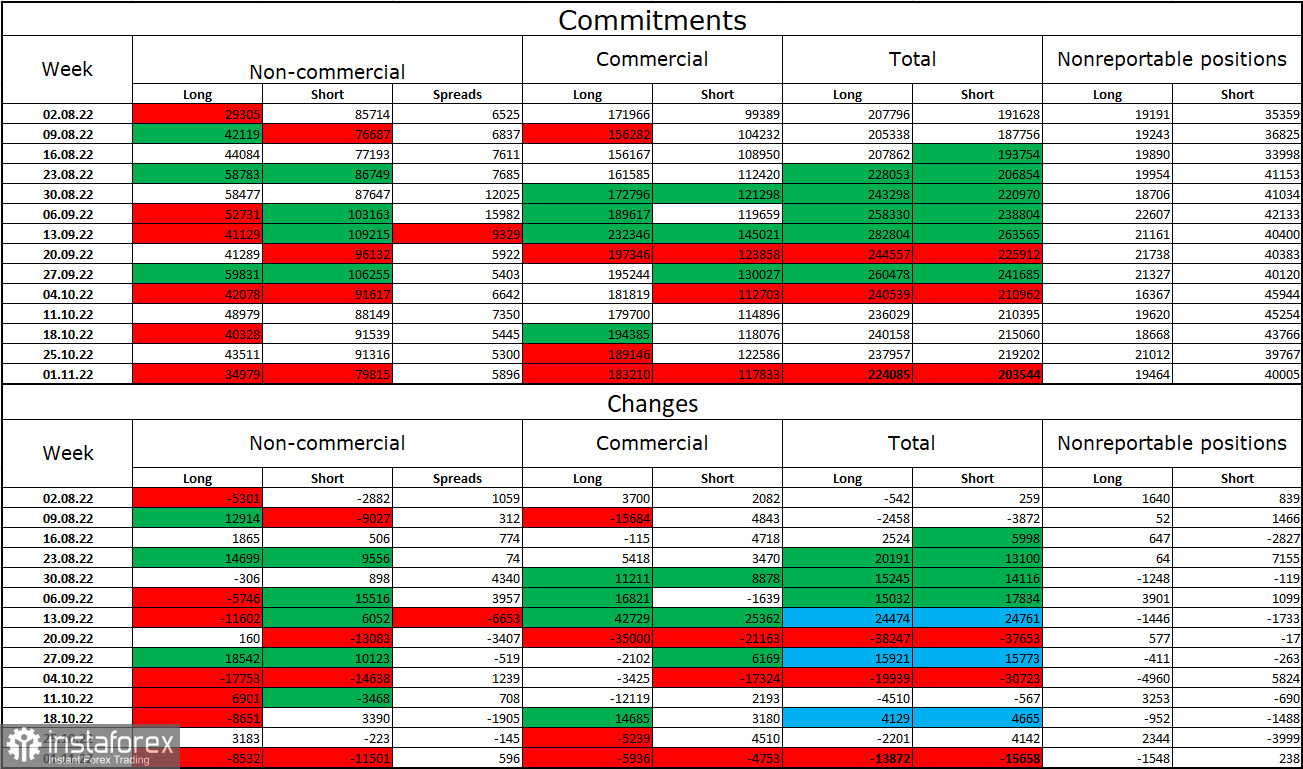

Commitments of Traders (COT) report:

Over the past week, the non-commercial group of traders became a bit less bearish on the pair than the week earlier. Traders closed 8,532 long contracts and 11,501 short contracts. However, the overall sentiment of large market players remains bearish as short positions still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound may continue its uptrend only if supported by strong fundamental data which has not been so favorable lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still depreciating against the US dollar. As for the pound, even COT reports do not favor buying the pair.

Economic calendar for US and UK:

There are no important events in the US and the UK on Tuesday. So, the impact of the information background on the market sentiment will be zero today.

GBP/USD forecast and trading tips:

I would recommend selling the pound when the price rebounds from the level of 1.1496 on the 4-hour chart. In this case, the target should be the level of 1.1210. Buying the pound will be possible when the quote closes above the descending channel on H1 with the target at 1.1709. The trade can be left open until the pair closes below 1.1411.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română