Markets are anticipating the preliminary results of the midterm elections in the US, which are expected to have a significant impact on government financial policy, on inflation and, of course, the actions of the Fed. Many believe that a change will be seen if Republicans take control of both houses of Congress. This means that many decisions may be changed, especially in taxes, spending and support for the Ukrainian regime, which largely caused the high inflation in the country as demand increased amid significantly low supply, primarily in goods for everyday life. Such a scenario may cause a cautious rally in the stock markets and the weakening of the dollar. And if the data on consumer inflation, which will be presented on Thursday, show at least a slight downward correction, positive sentiment will grow,

So far, about half of the Fed members are in favor of raising the rate not by 0.75%, but by 0.50% at the December meeting. This in itself may serve as a signal that the bank may start easing the rate hike, moreso if US inflation does not show a sharp increase.

Forecasts for today:

EUR/USD

The pair is demonstrating a local downward reversal on the wave of a possible downward rollback on the stock markets today ahead of the results of the US Congress elections. But it found support at 0.9990, so a rise above this level may lead to a growth, albeit short-lived. Meanwhile, the pair's decline below 0.9990 may lead a local fall to 0.9895.

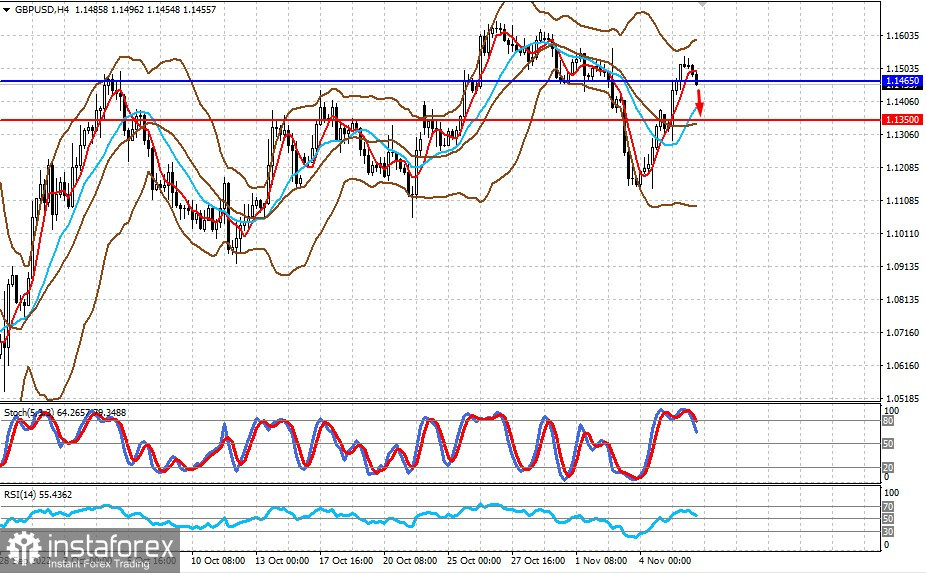

GBP/USD

The pair broke through 1.1465 amid lower risk appetite ahead of the midterm elections in the US. A further decline below this level will lead to a fall to 1.1350.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română